Closing the Gap: New Science, New HCP Expectations

R&D 파이프라인의 혁신은 기존의 커머셜 인게이지먼트 모델에 새로운 변화의 챌린지를 더하고 있습니다. 치료의 복잡성과 경쟁이 증가하고, 제품 론칭 성공의 기회가 감소하며, 그리고 심층적인 의학 정보에 대한 HCP의 니즈가 증대함에 따라, 잘 짜여진 커머셜 전략으로 새로운 치료법을 HCP에게 효과적으로 전달하는 것이 중요해지고 있습니다.

그러나 영업 및 마케팅 팀은 기능적 사일로에 갇혀 기존의 의약품을 위한 인게이지먼트 모델에 의존하고 있습니다. 아이러니하게도 기술과 데이터에 대한 투자가 문제를 더욱 어렵게 만들었습니다. 서로 단절된 시스템과 이질적인 데이터들로 인해 협업이 제한되고 고객 경험이 단절되며, 결국 새로운 치료법의 도입을 더디게 하고 있습니다.

위와 같은 기존의 사일로를 혁신하려는 민첩한 바이오파마 기업들은 이러한 역학 관계를 변화시키고 있습니다. 연결된 도구와 데이터로 강화된 영업 및 마케팅 팀은 HCP의 요구를 빠르게 충족하고 새로운 치료법의 도입을 촉진하는 고객 경험을 조율하고 있습니다.

“의사들은 한정된 일정을 가지고 있고, 따라서 반복적인 정보를 필요로 하지 않습니다. 정보 전달은 효율적이어야 하며, 올바른 채널을 통해 과학적으로 신뢰할 수 있는 정보를 제공해야 합니다. 모든 상호 작용은 다음 커뮤니케이션을 위한 기반 정보가 되어야 합니다.”

— Dr. Vital Hevia, 비뇨기과 의사 및 로봇 수술 전문의, ROC Clinic and HM Hospitals

더 자세한 내용은 전체 리포트를 통해 확인하시기 바랍니다.

Dan Rizzo

Global Head of Veeva Business Consulting

Disconnected models don’t meet evolving HCP needs

Therapeutic complexity continues to rise, and the volume of medical knowledge doubles every 73 days, according to some estimates. At the same time, it’s also harder to reach HCPs via traditional methods. They are highly selective, and even for biopharmas with access, in-person meetings per HCP are down 7% since last year.

But biopharmas struggle to close the gap between HCPs’ needs and their decreasing share of time and attention. Sales and marketing teams often use disconnected tech, purchase different data sets, and track different KPIs. In many cases, they have a different understanding of target HCPs and what success looks like.

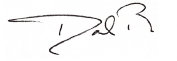

As a result, 65% of HCP engagements are not synchronized, despite the proven effectiveness.

Connected sales and marketing improves outcomes

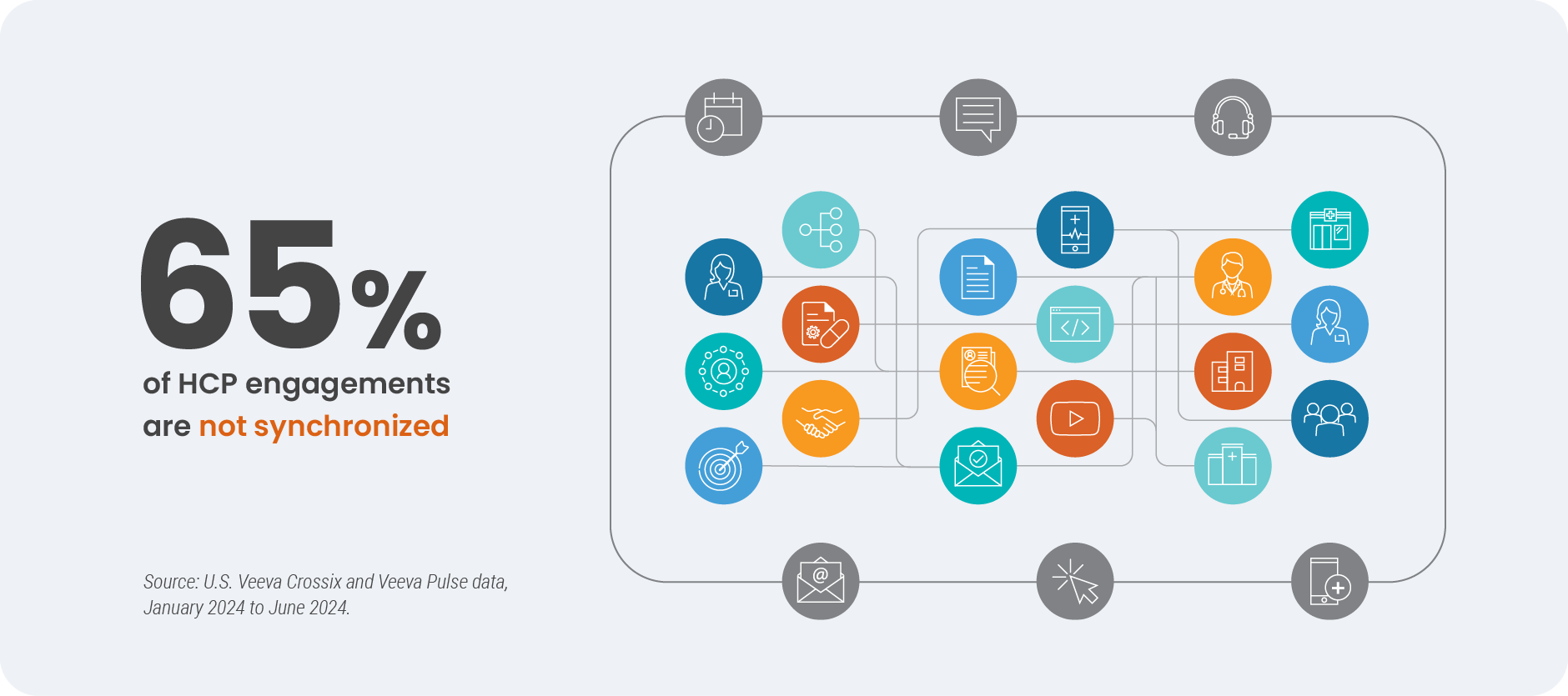

In the past, sales and marketing teams tried to boost HCP engagement by each turning up the dial on their own strategies, optimizing within the function. But in this complex environment, simply adding more interactions isn’t effective or practical. Instead, data shows that a connected, coordinated omnichannel strategy blending in-person and promotional touchpoints drives results.

This approach results in:

- More efficient outcomes for the brand

- A better customer experience for the HCP

- Improved treatment adoption for the patient

The figure below illustrates key customer touchpoints where coordinated, timely action between sales and marketing increases scientific understanding.

Early movers are disrupting old engagement models

Innovations in technology and data are removing the traditional barriers to connected and coordinated engagement. Early movers are coordinating sales and marketing and building agility into their commercial model to deliver on the needs of HCPs.

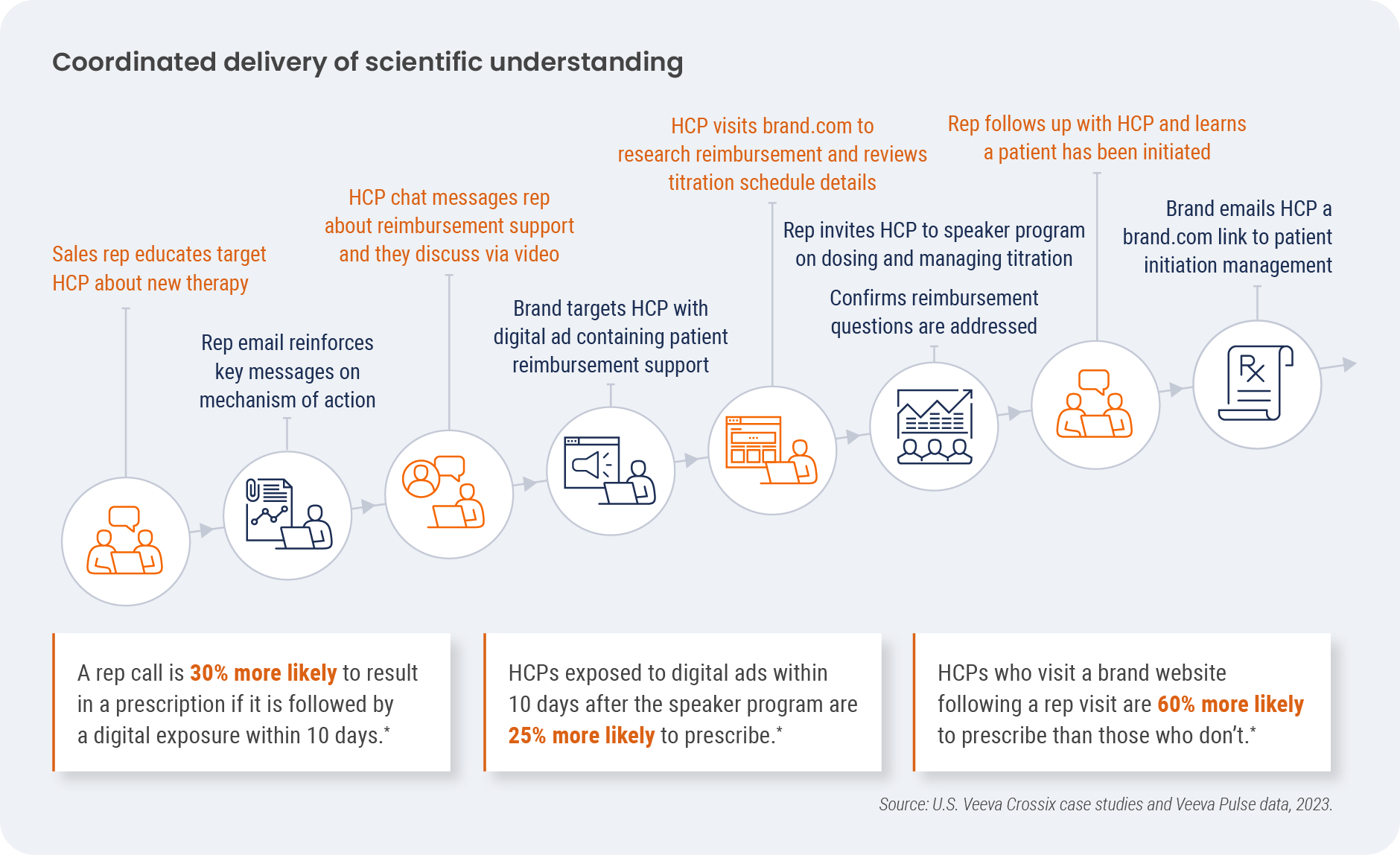

This emerging sales and marketing model will include:

While the fundamental capabilities may be similar, organizations will come to this model differently:

- Smaller, scrappier biotechs will make these investments out of necessity to compete with larger, better-resourced companies.

- Large global biopharmas will confront disconnected engagement models and functional silos to create a competitive advantage and differentiate on customer experience.

Companies that bring sales and marketing together with medical and service teams will be best positioned to meet HCPs’ growing scientific needs and increasing expectations.

Reach out to Veeva Business Consulting to learn how connected sales and marketing deliver a better customer experience.

Global and Regional Trends

This report highlights global and regional field engagement trends from Veeva Pulse data gathered between July 2023

and September 2024. Veeva Pulse data is sourced from Veeva’s aggregated CRM activity, including field engagement

stats from all instances of Veeva CRM globally. In this report, all comparisons are year-over-year, Q3 2023 to Q3

2024, unless otherwise noted.

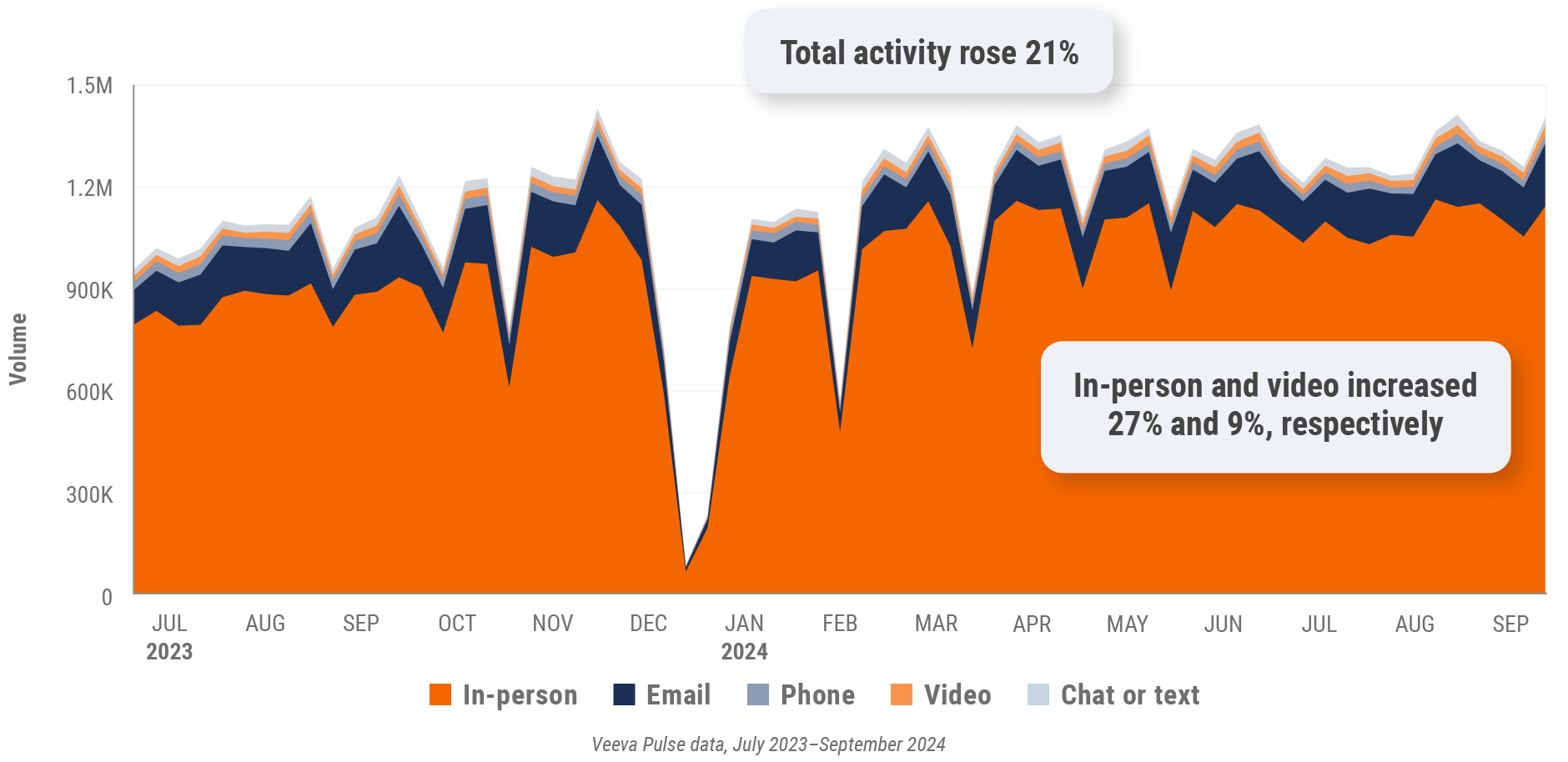

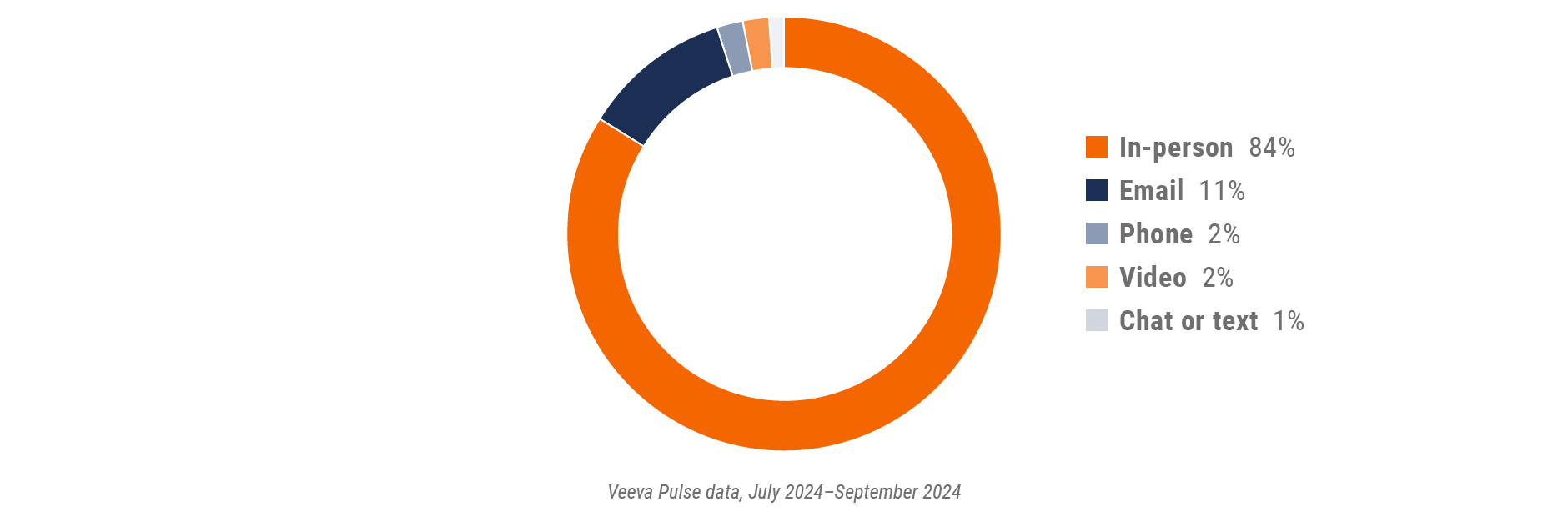

Global trends*

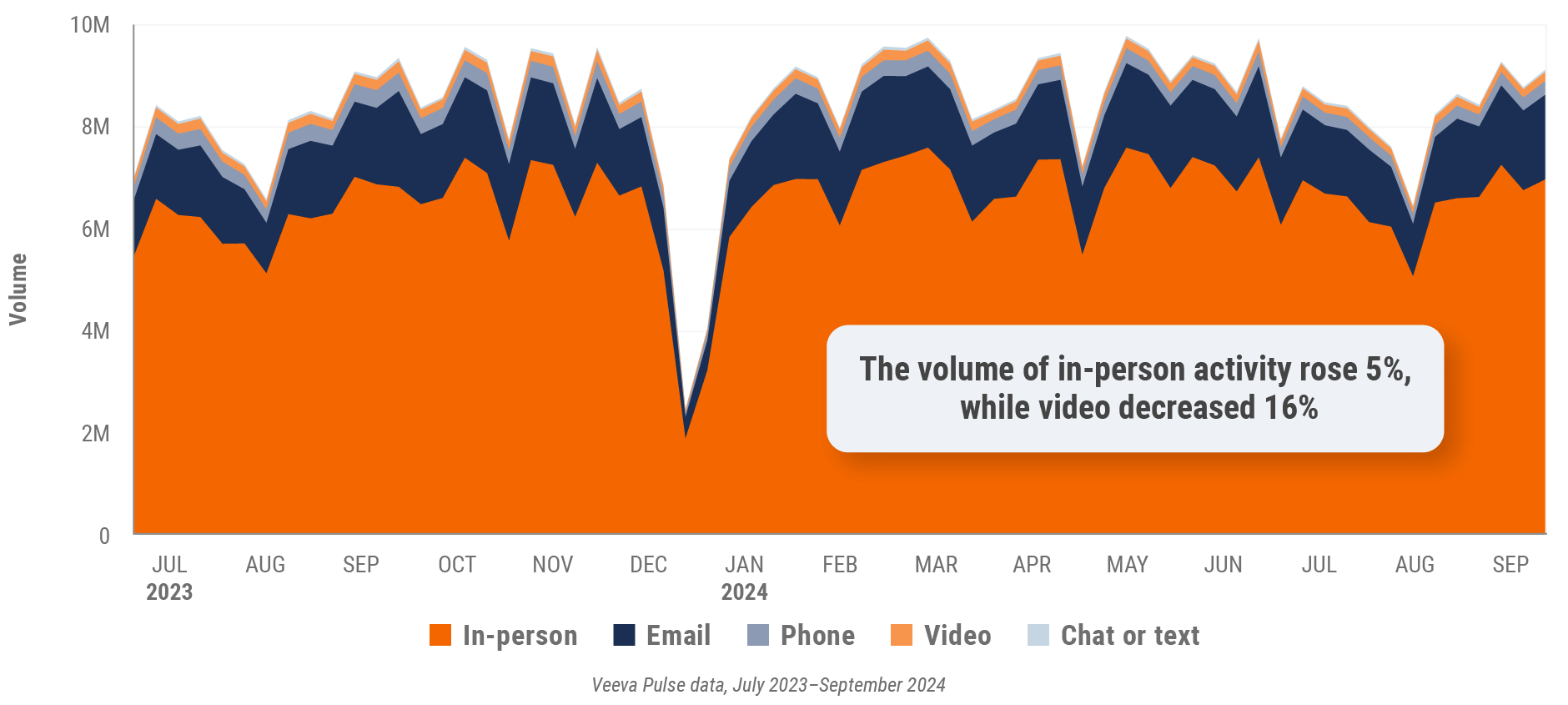

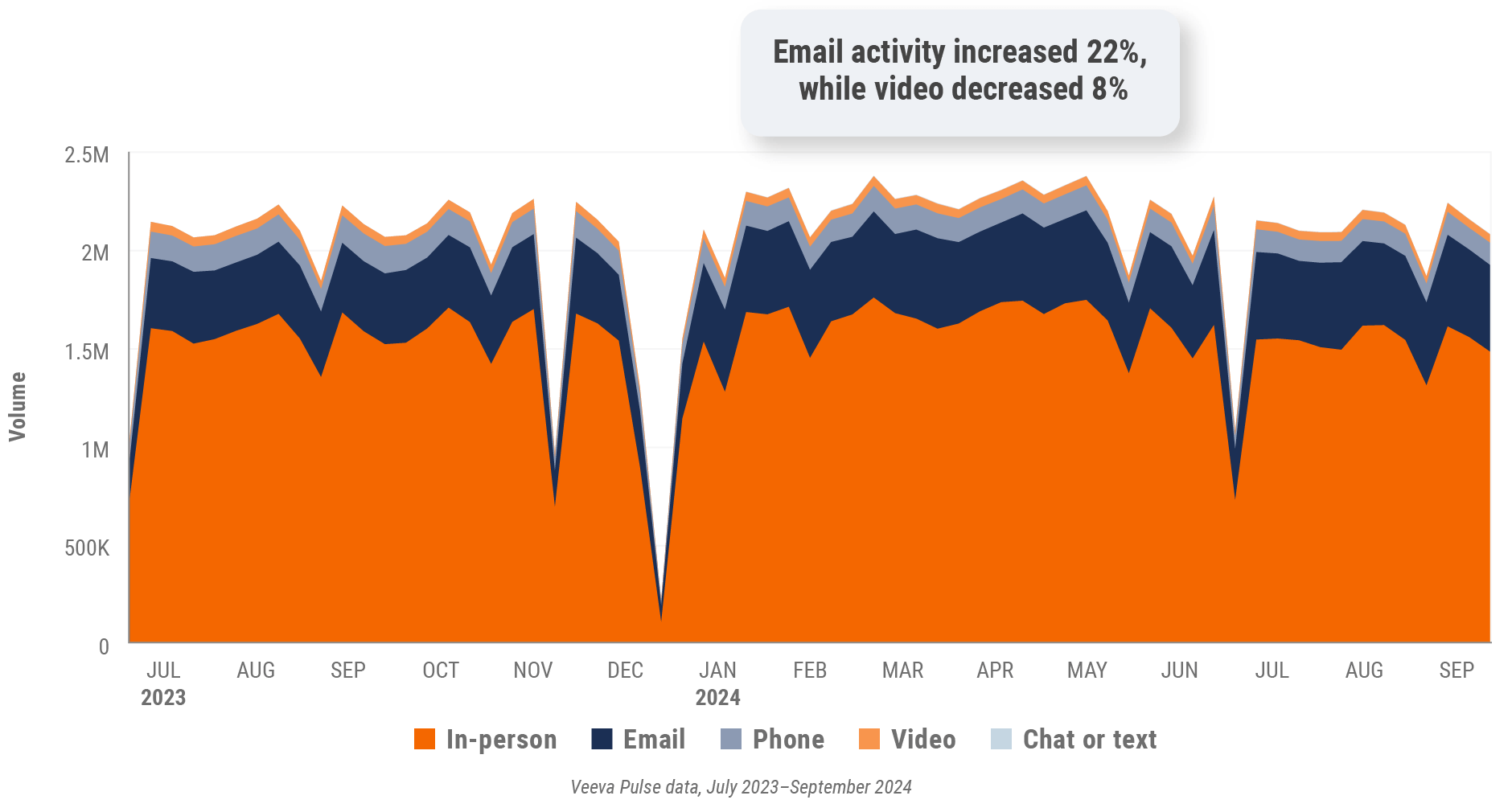

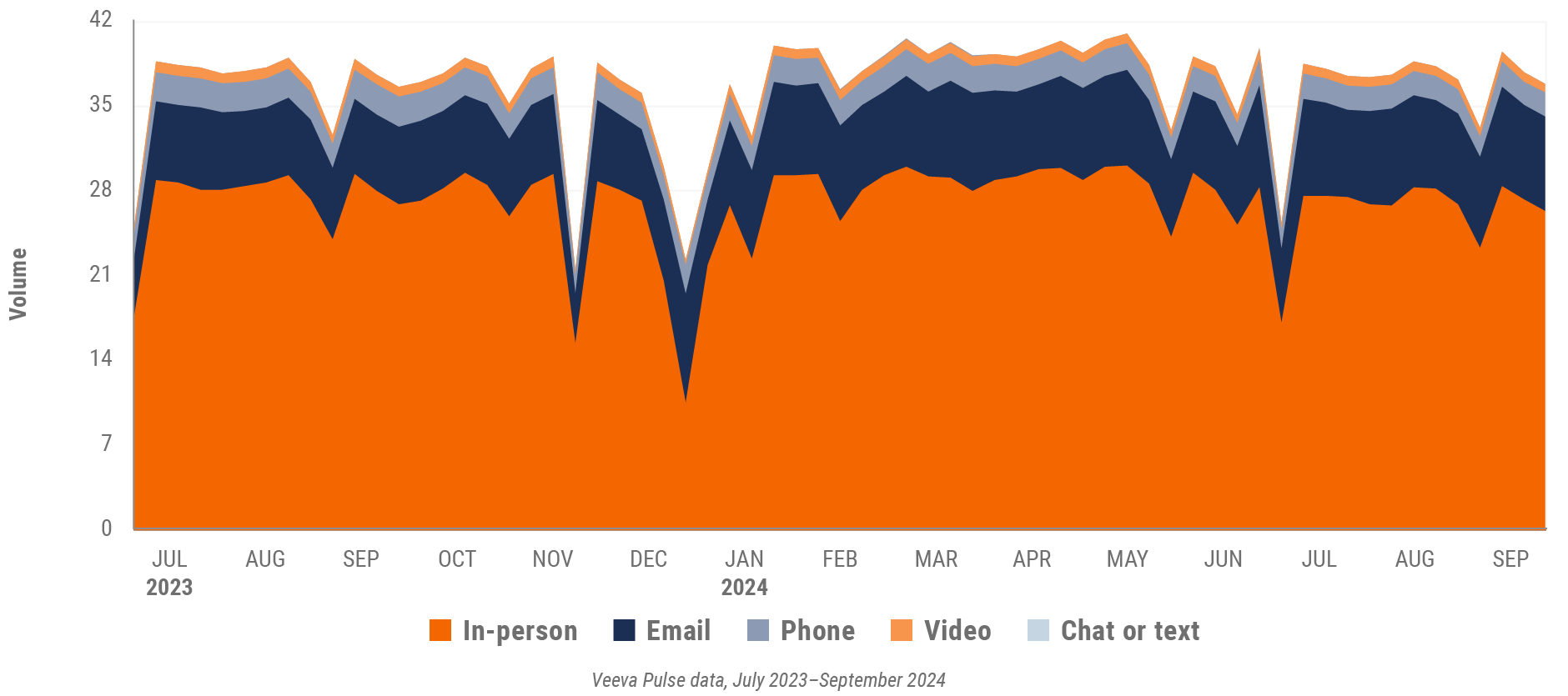

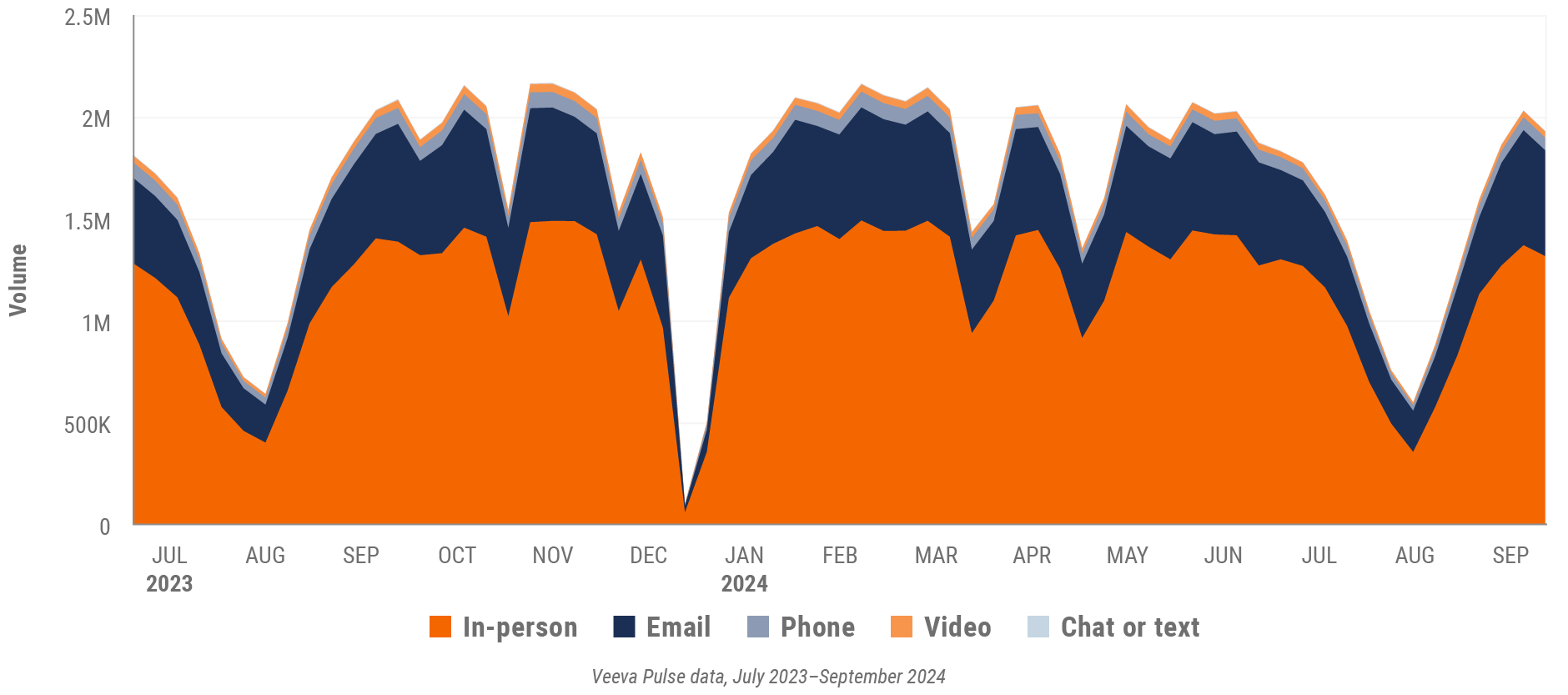

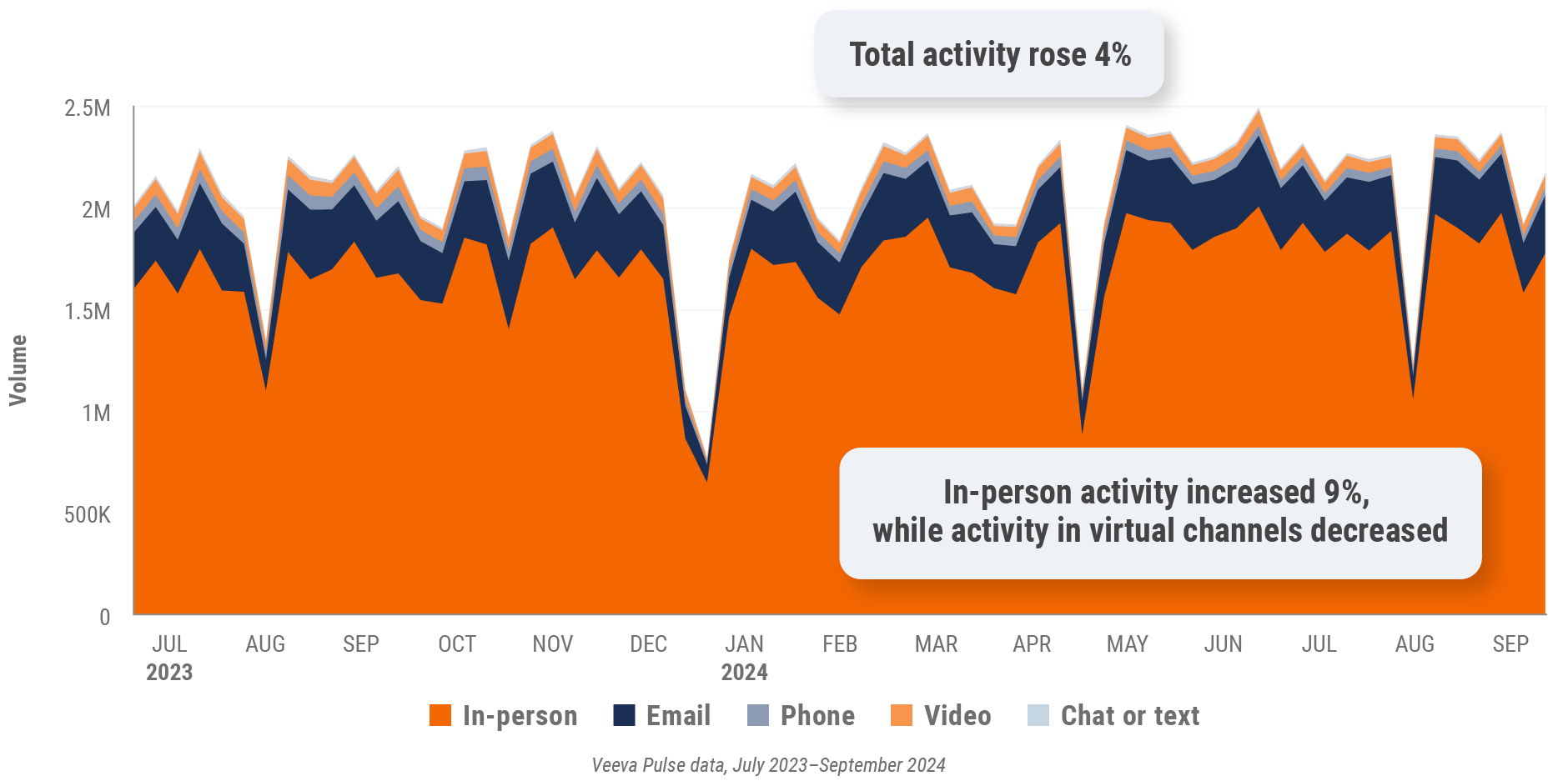

Figure 1: Channel mix evolution, global

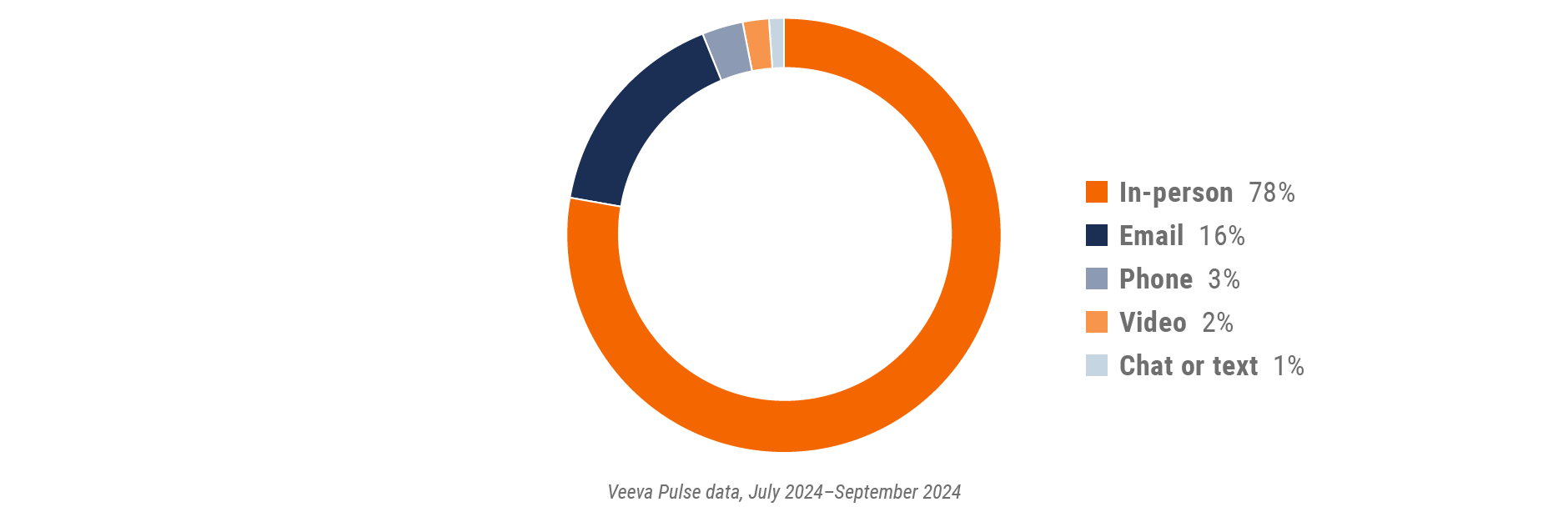

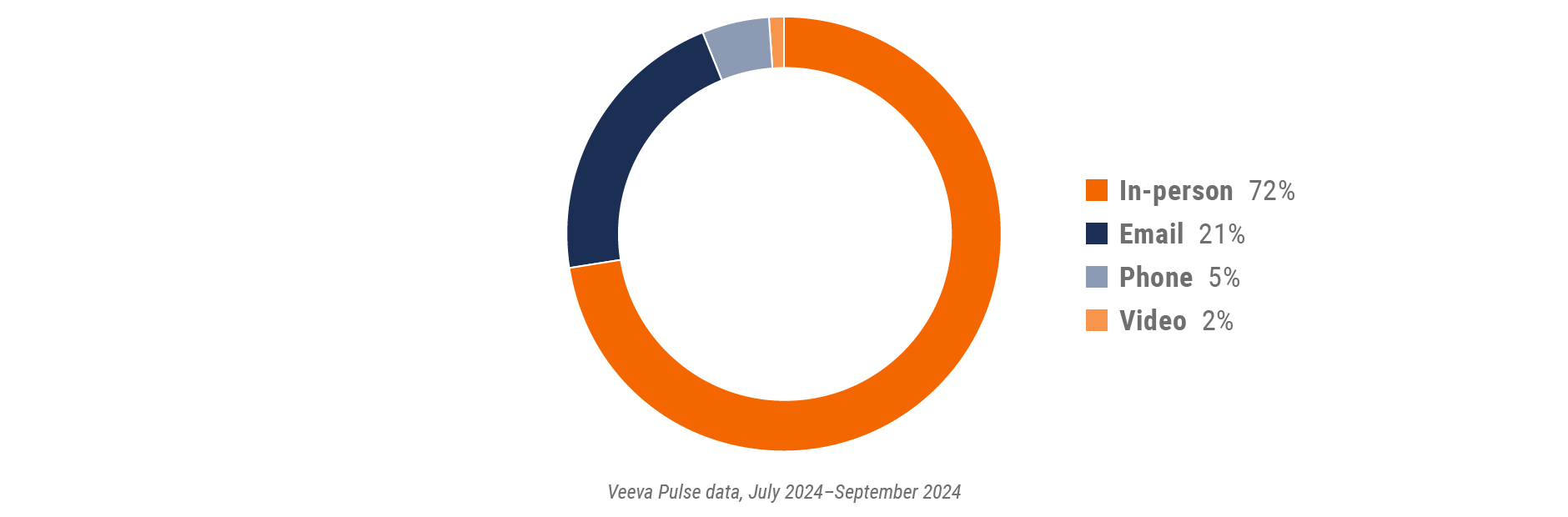

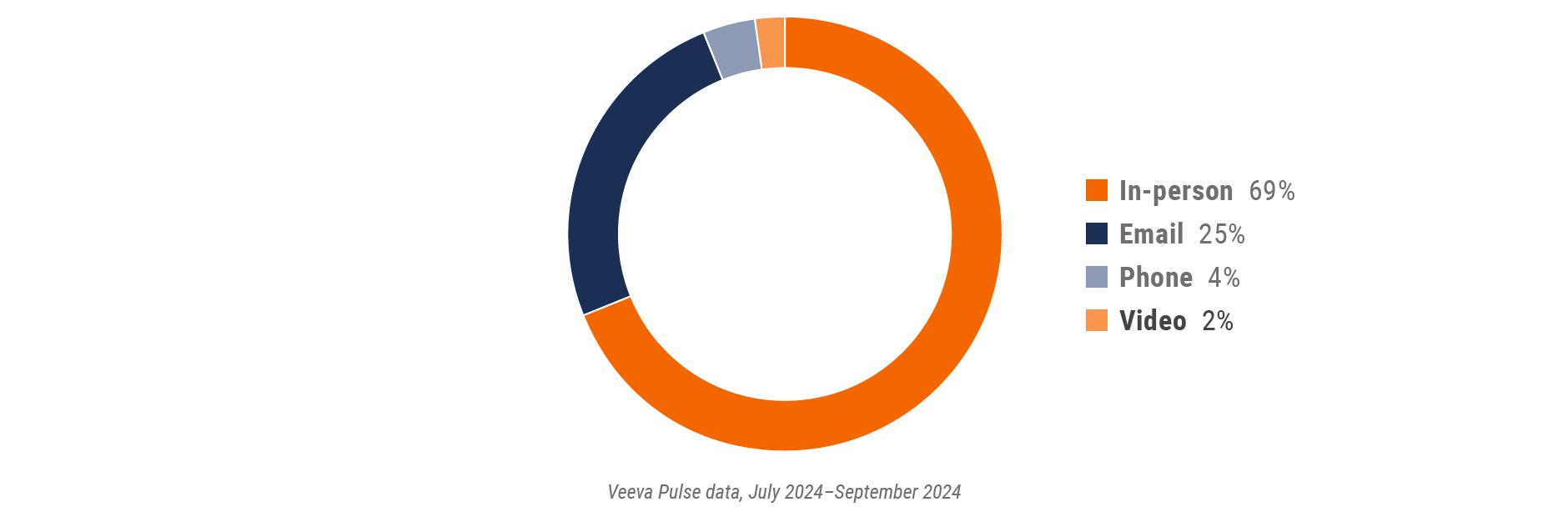

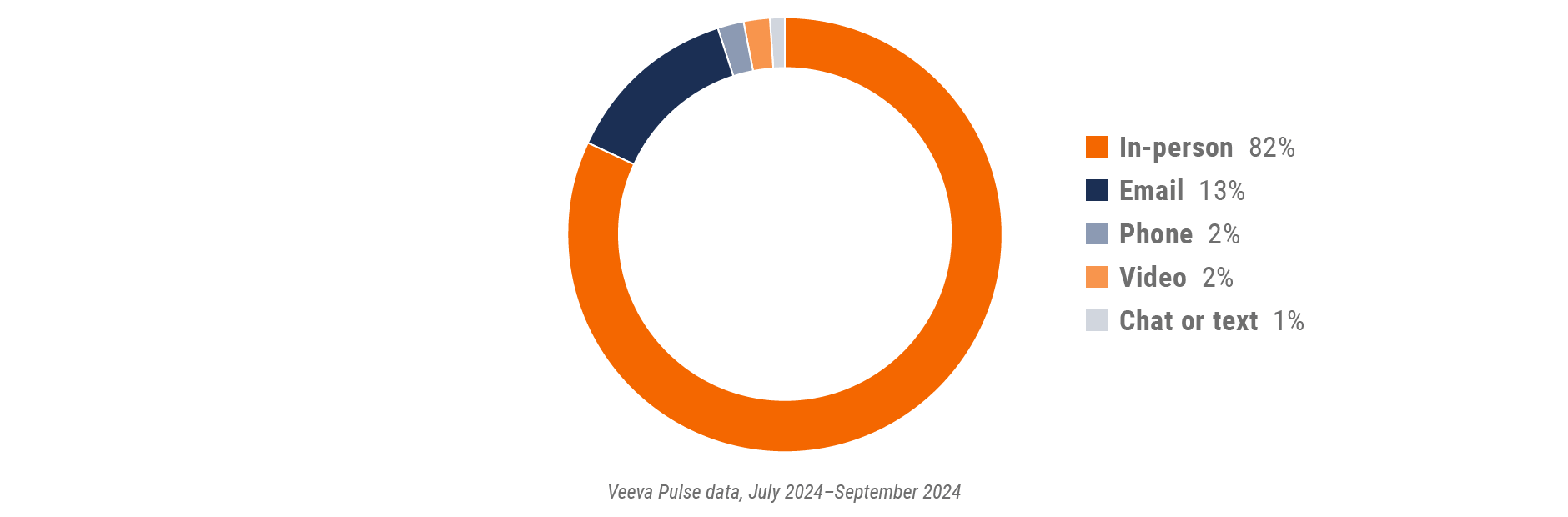

Figure 2: Channel mix, global

Global field team activity

Weekly activity per user by engagement channel

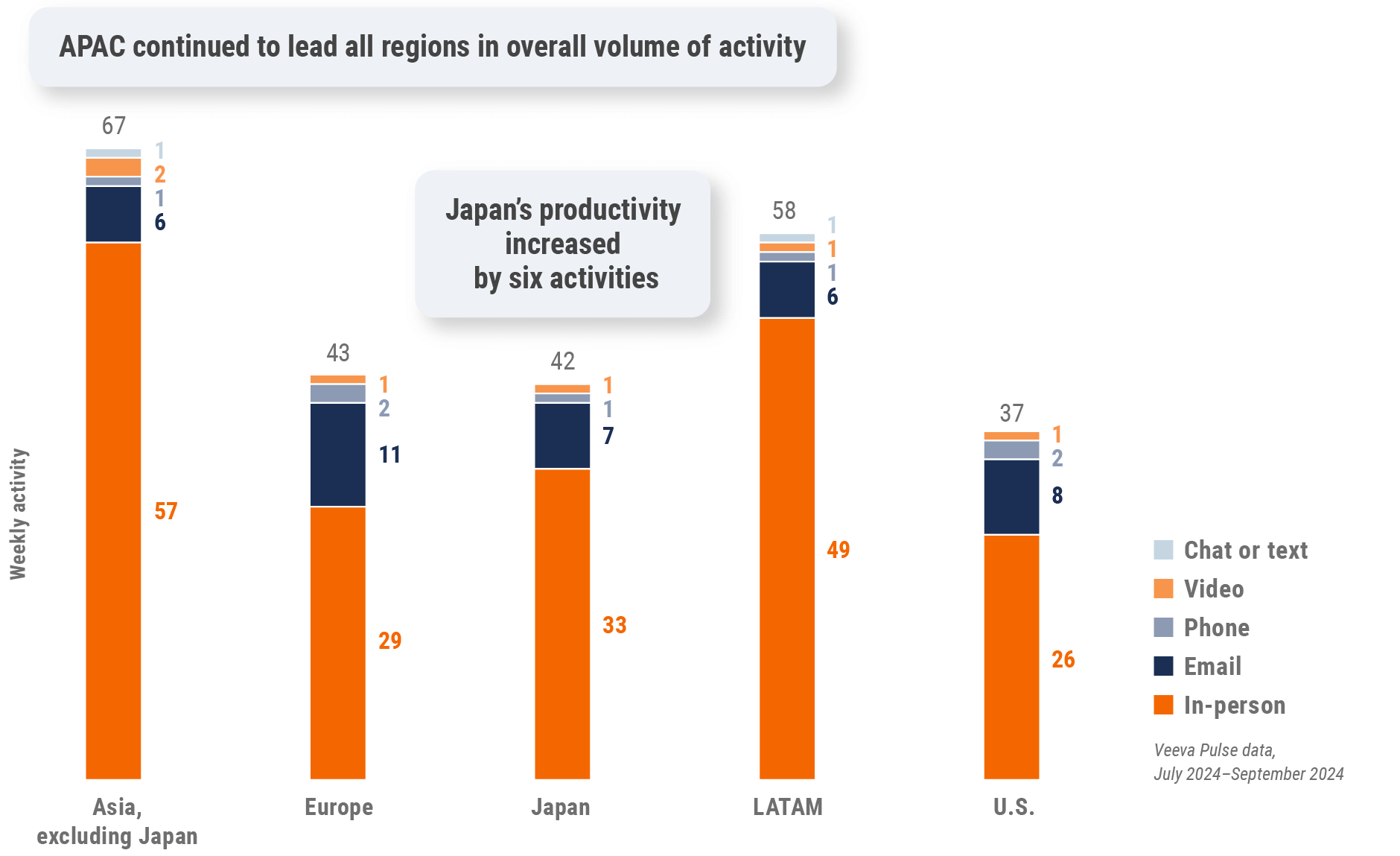

Figure 3: Activity by region, global

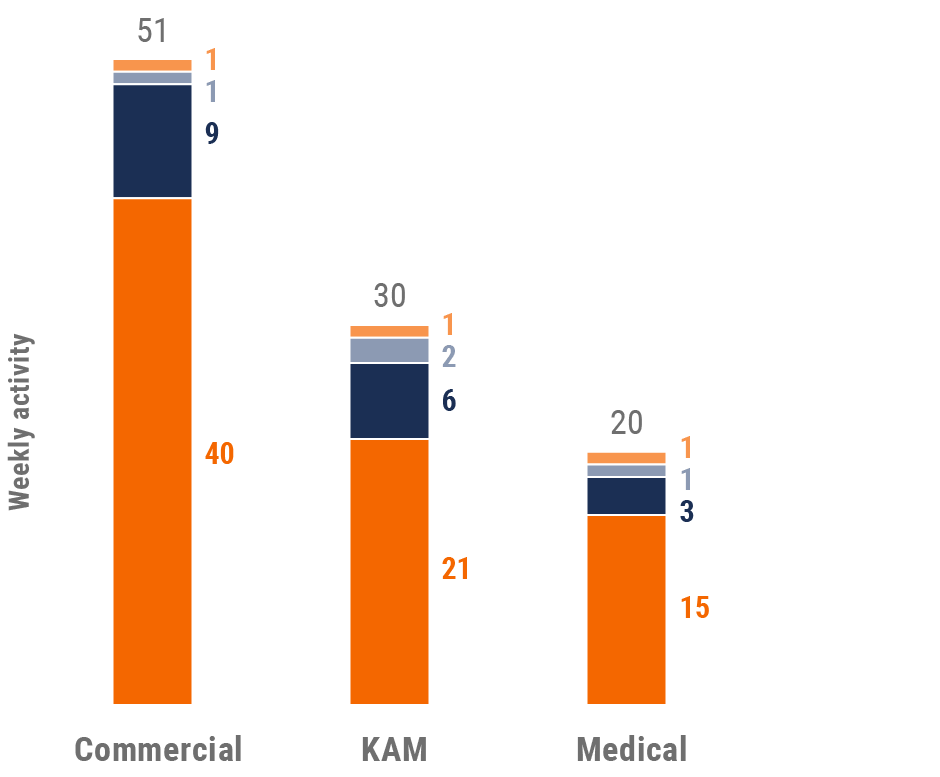

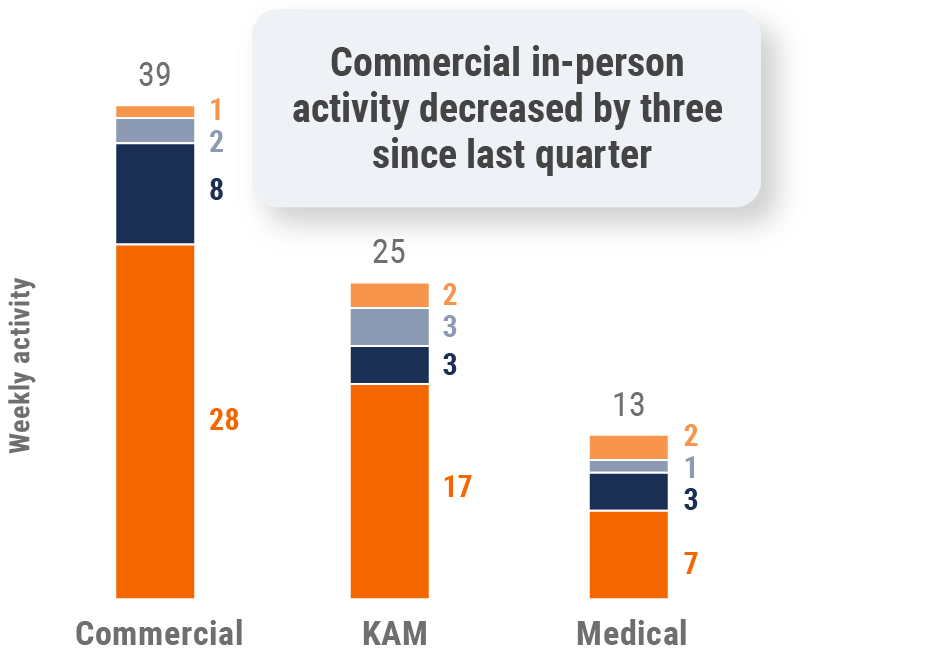

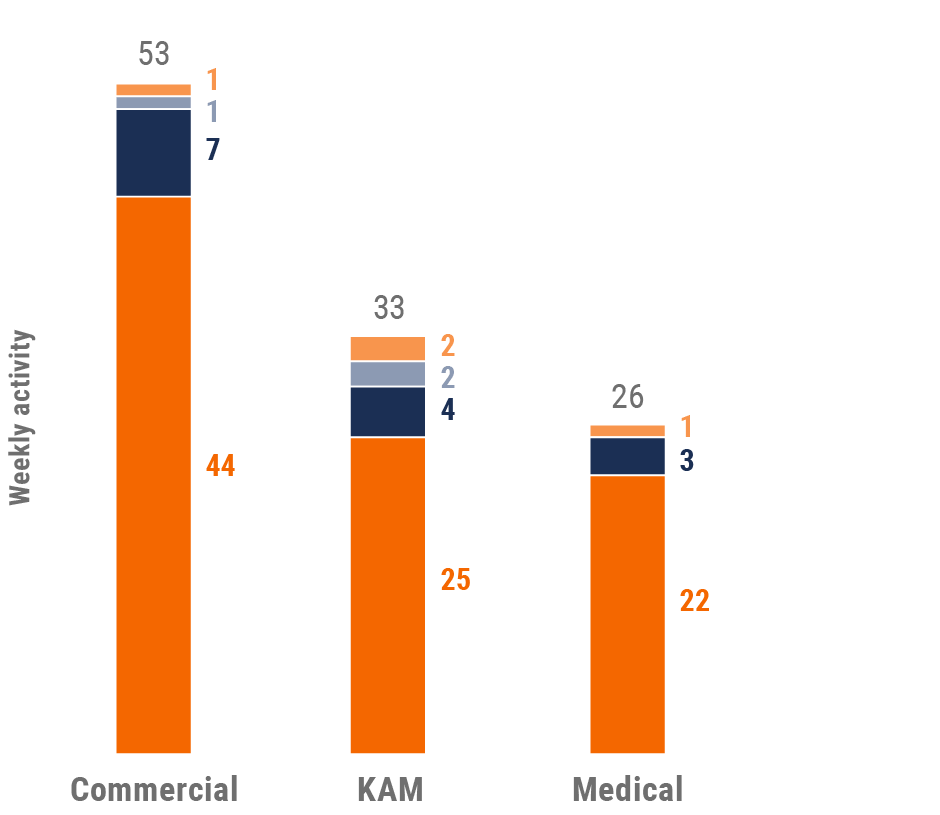

Figure 4: Activity by user type, global

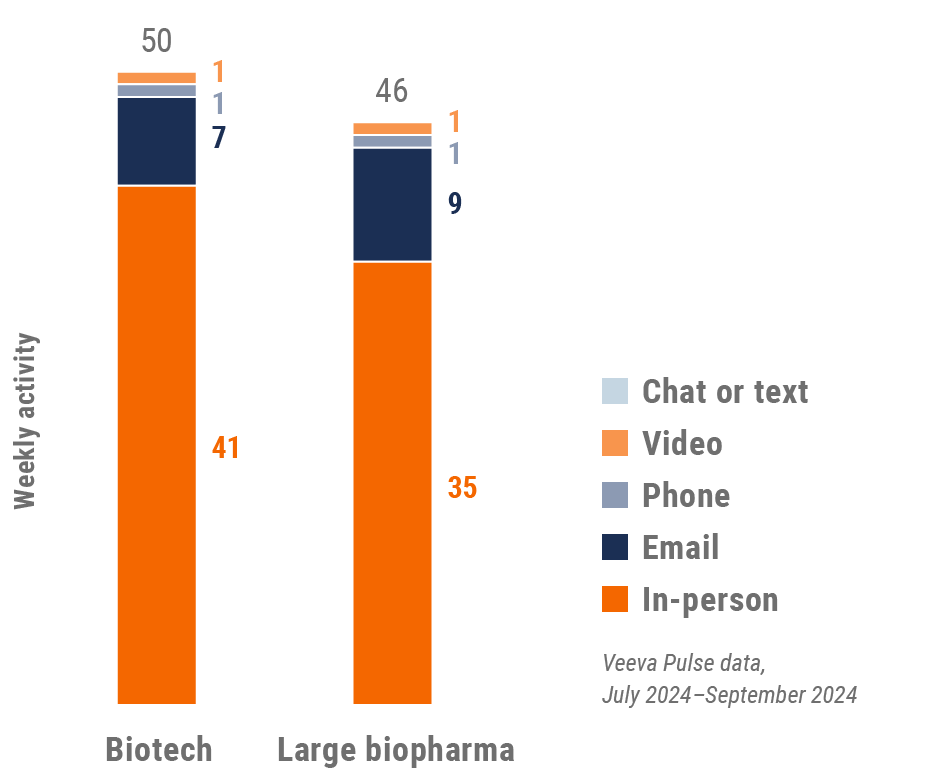

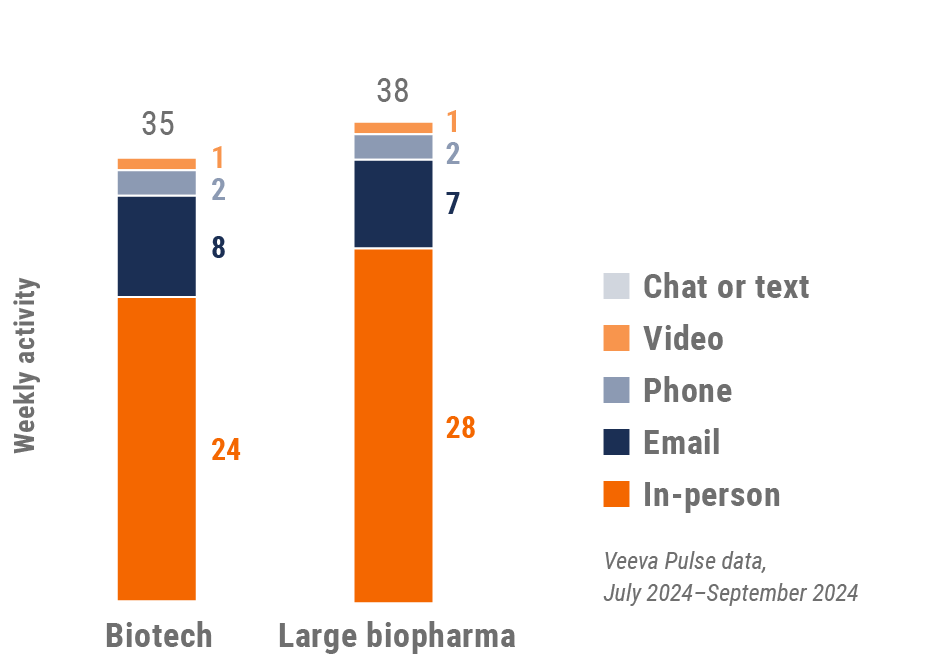

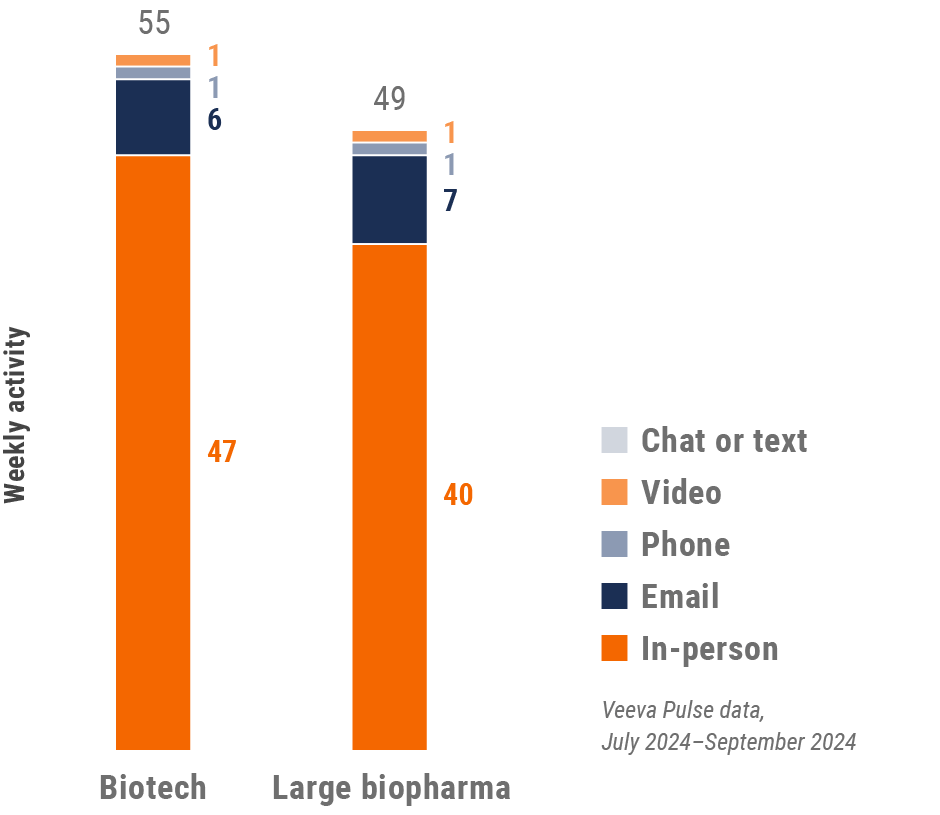

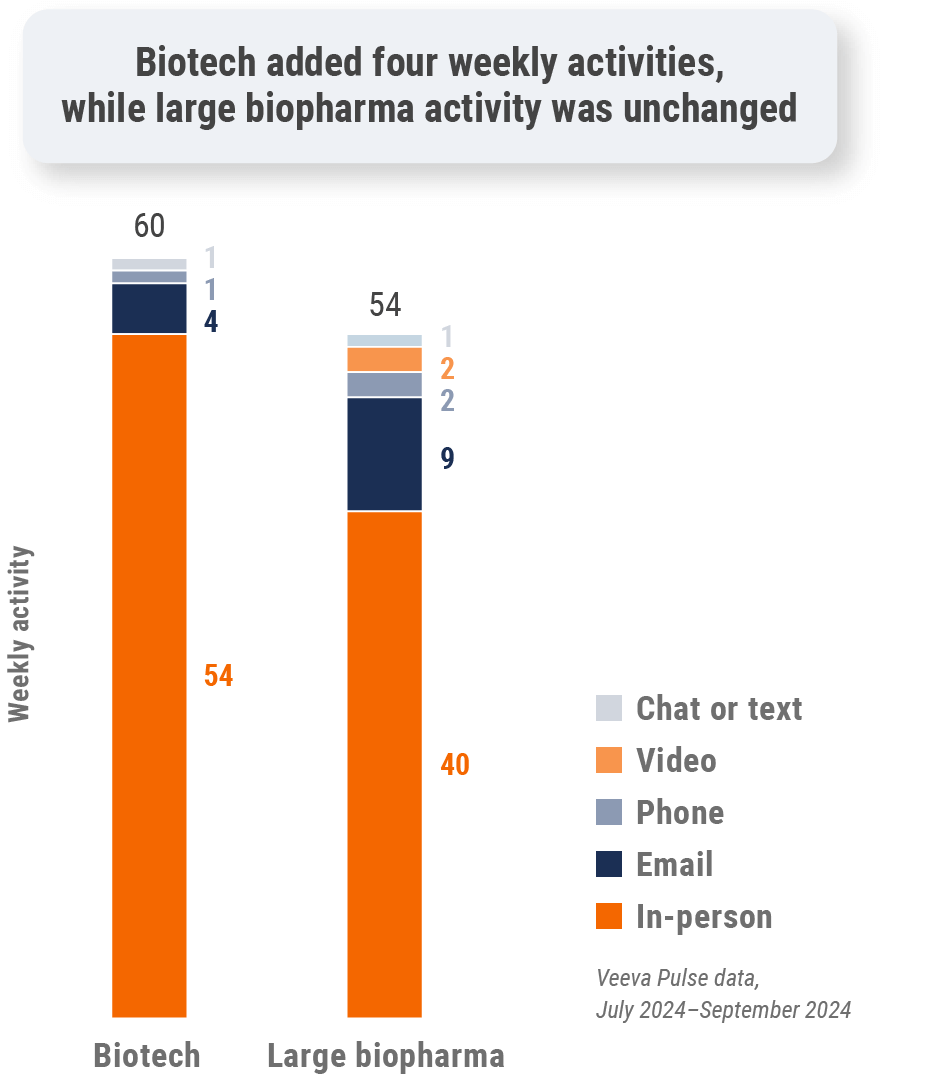

Figure 5: Activity by company size, global

Global engagement quality

Consolidation of key quality metrics

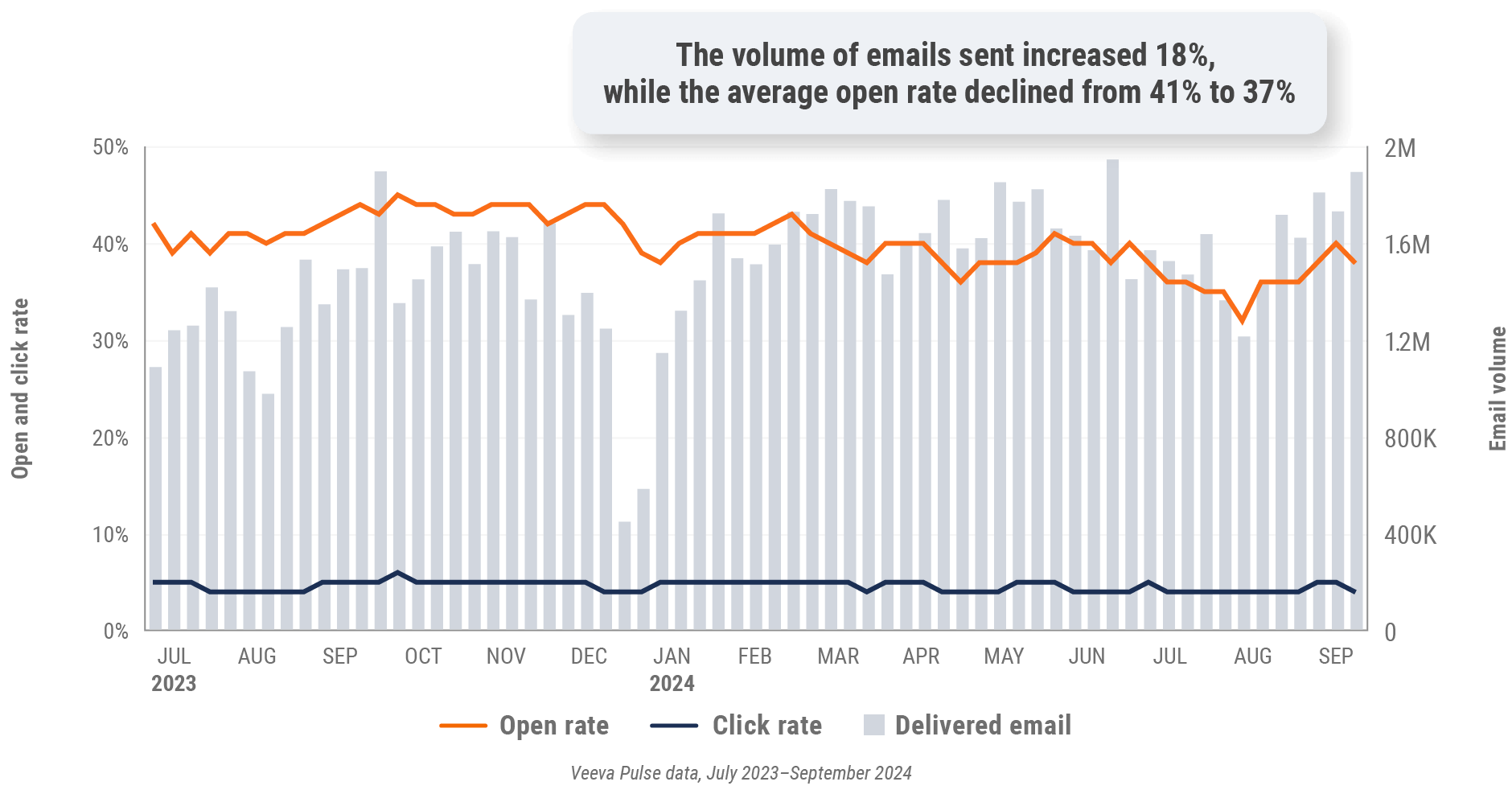

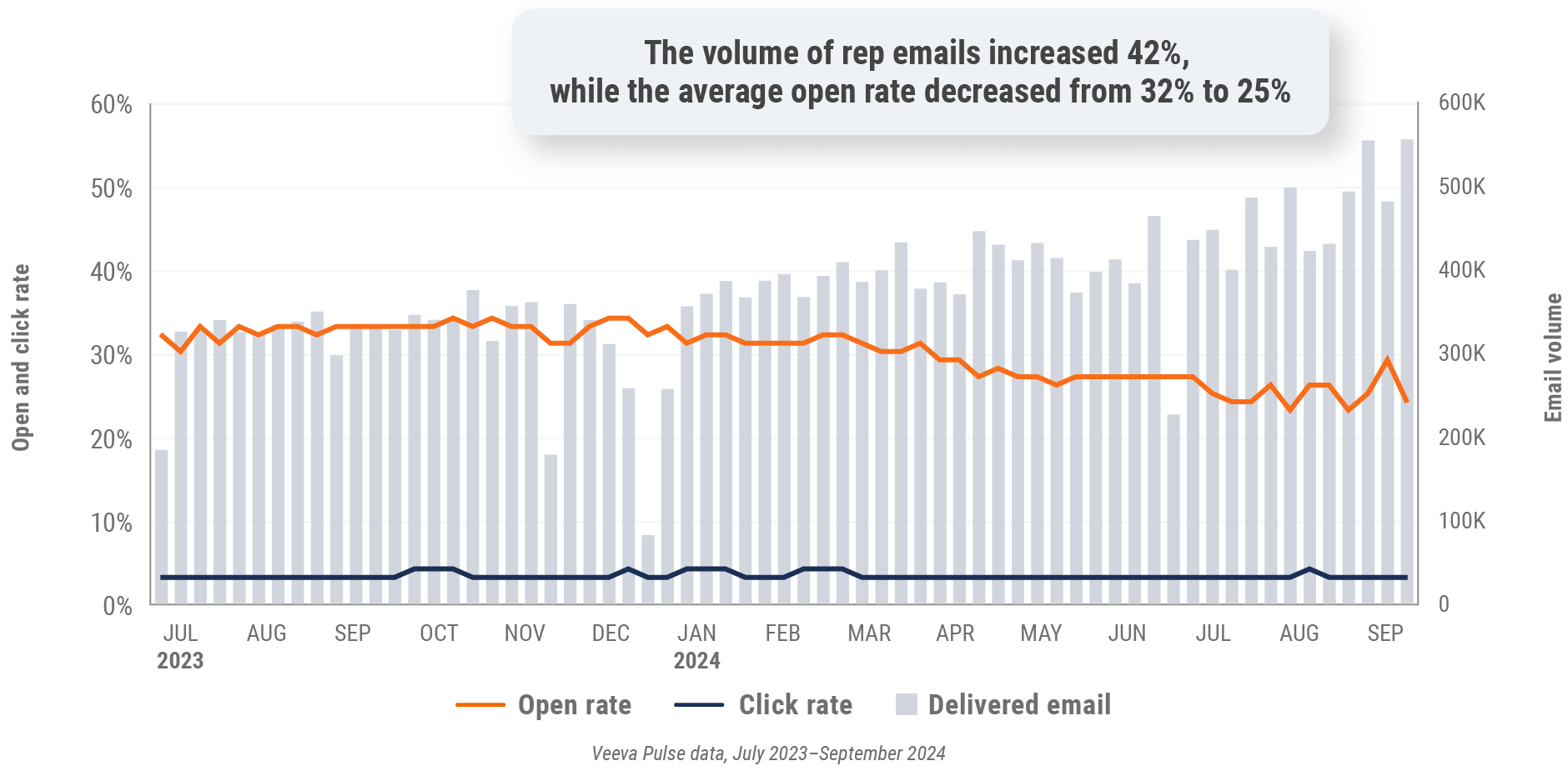

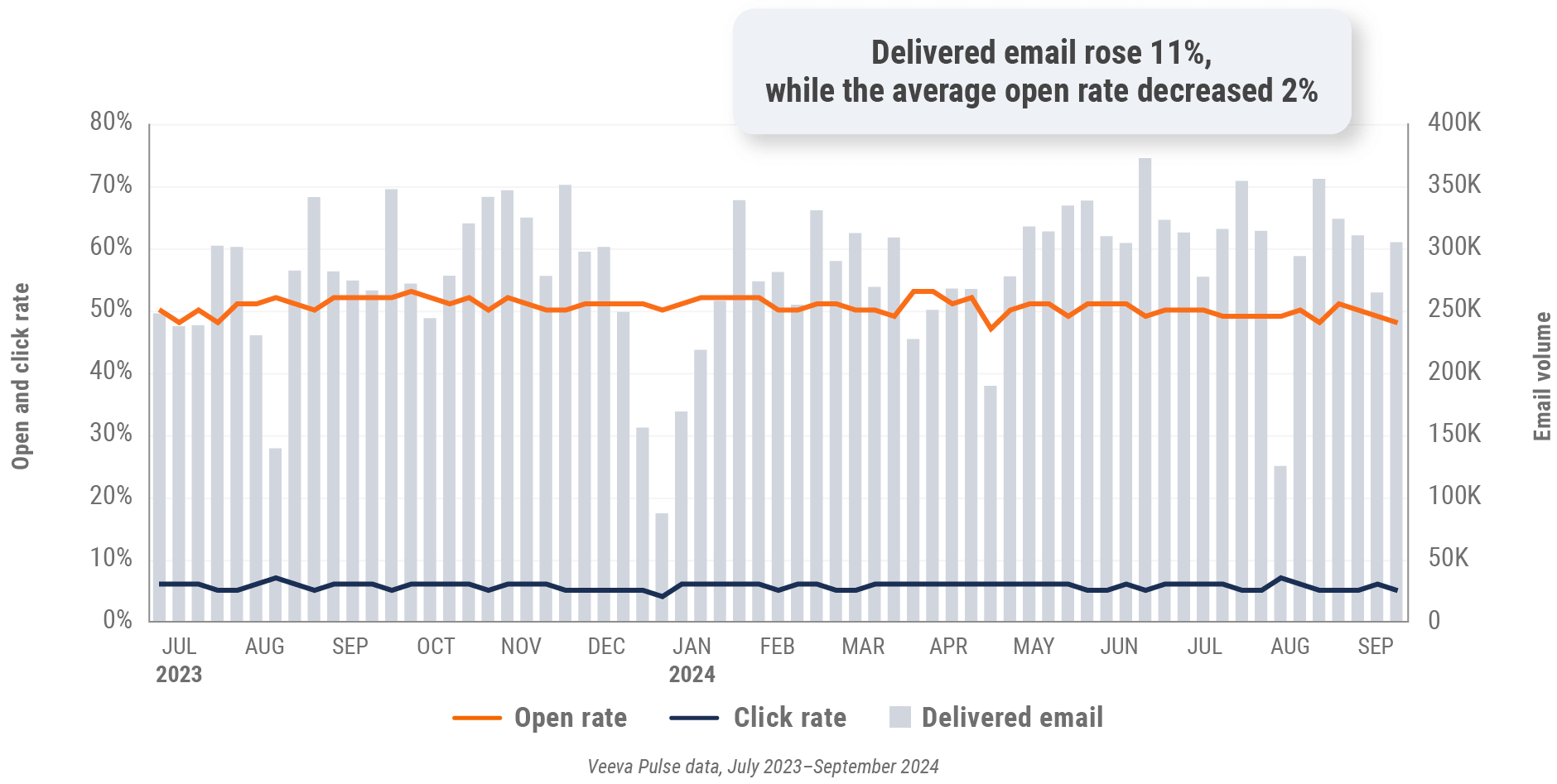

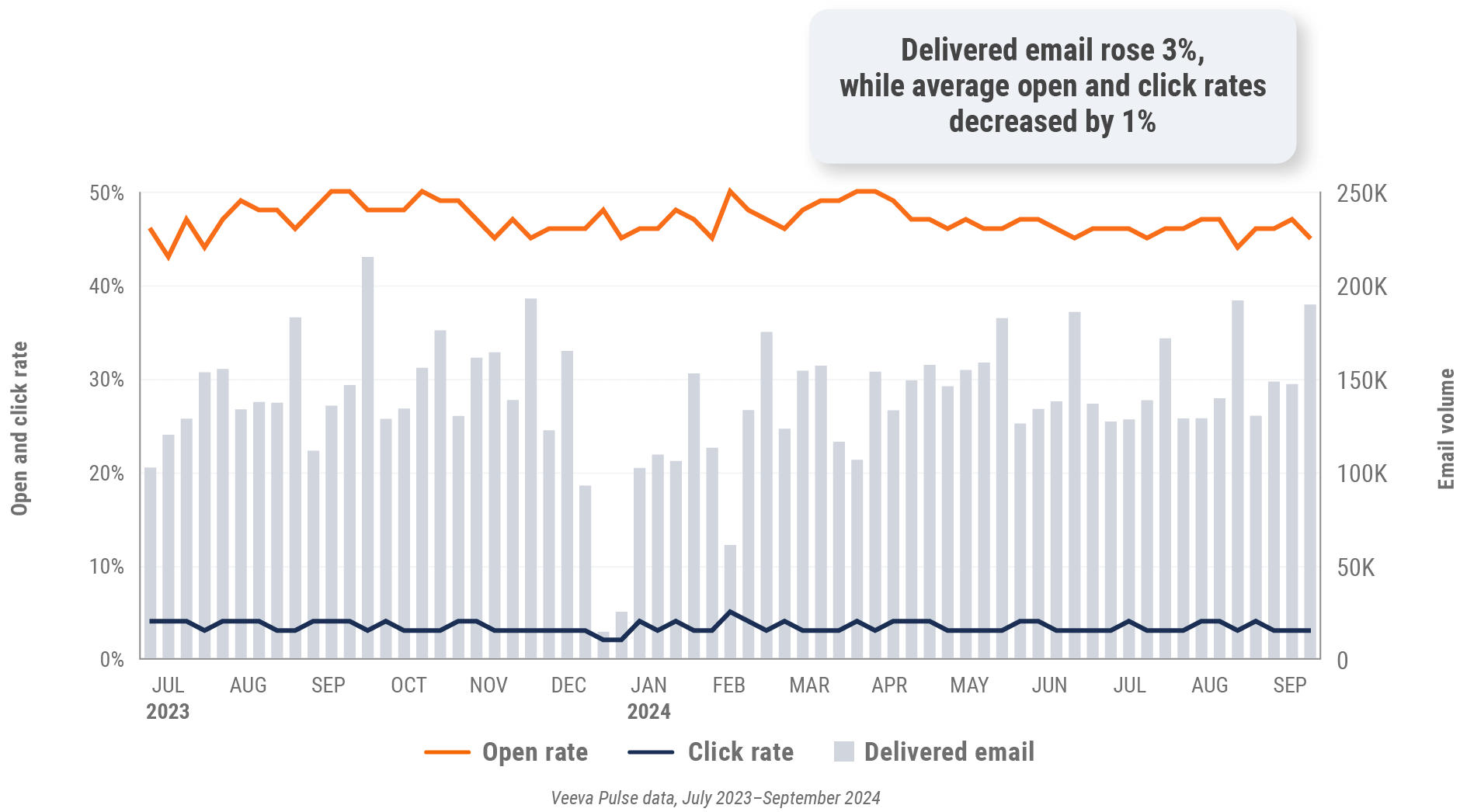

Figure 6: Approved email volume, global

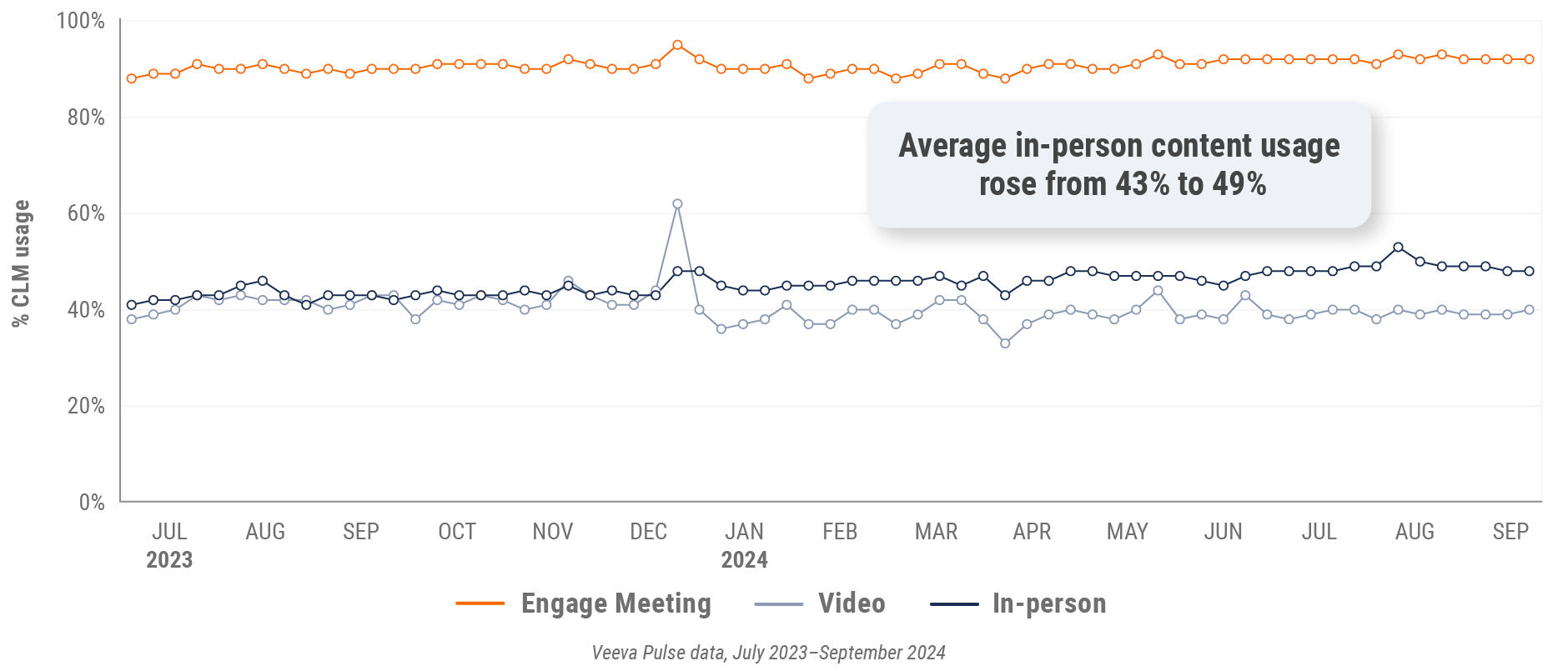

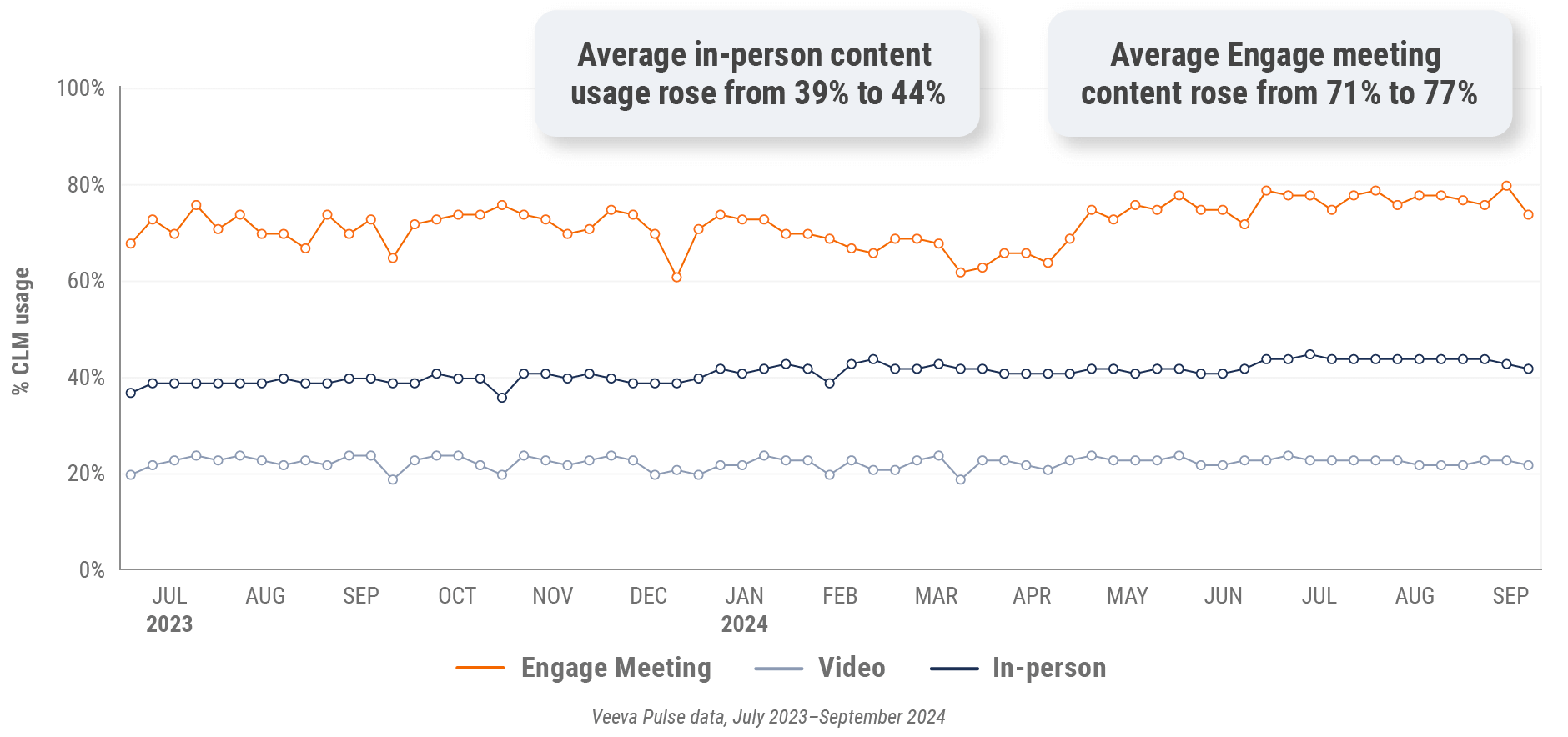

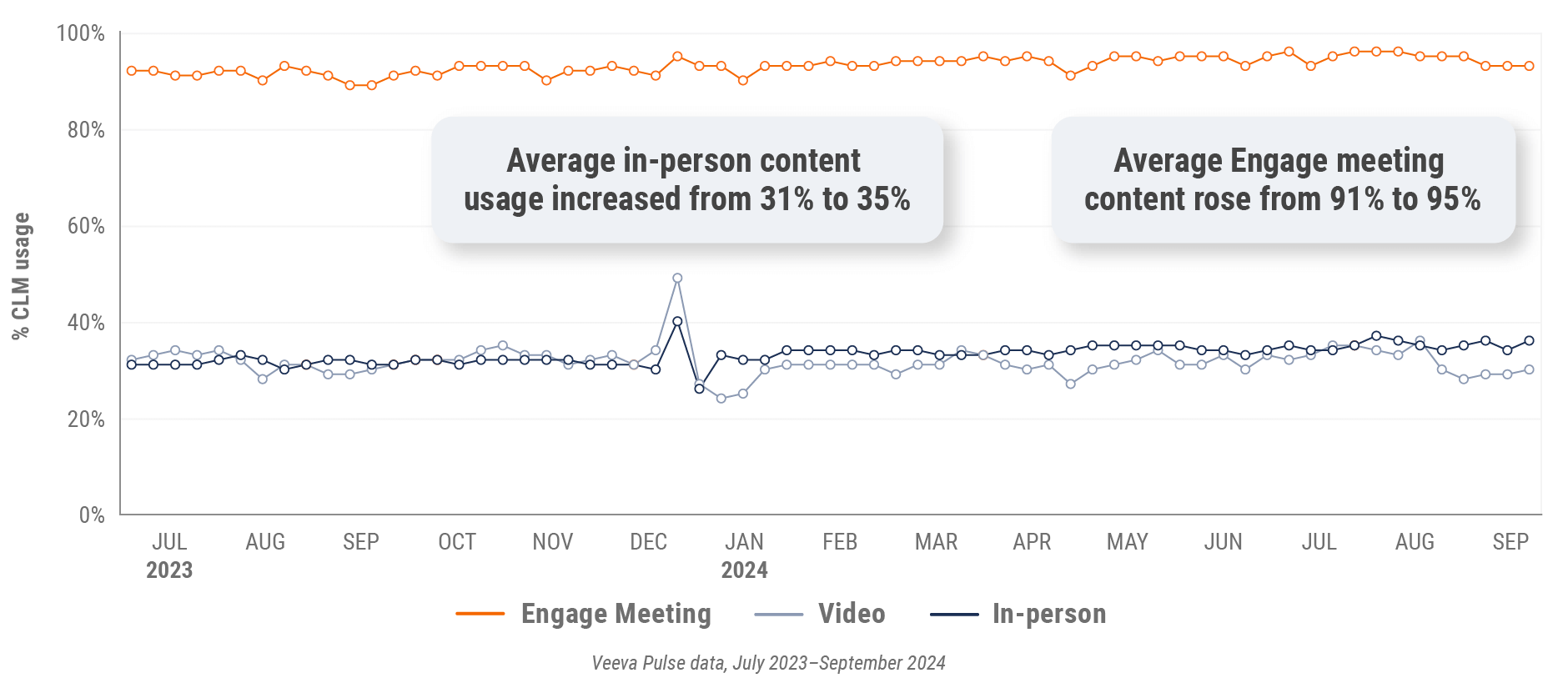

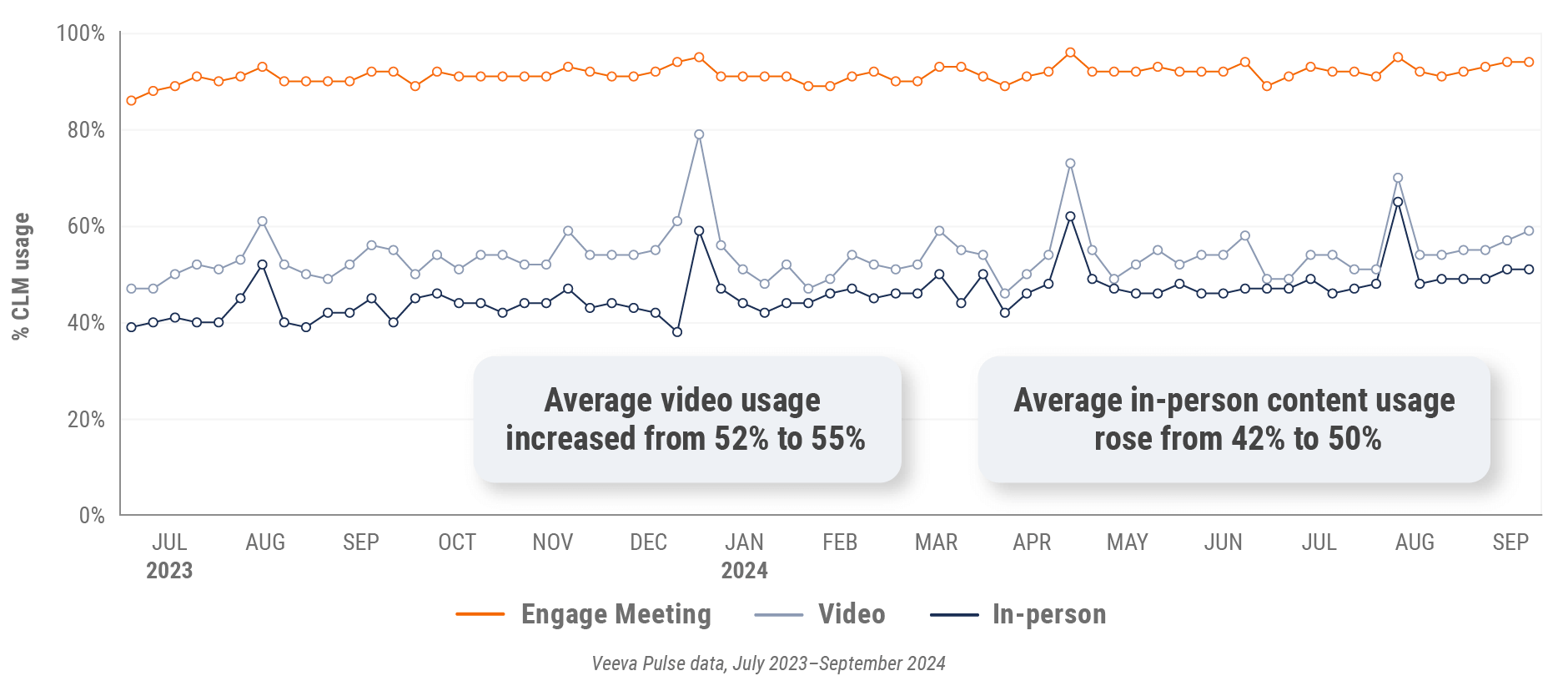

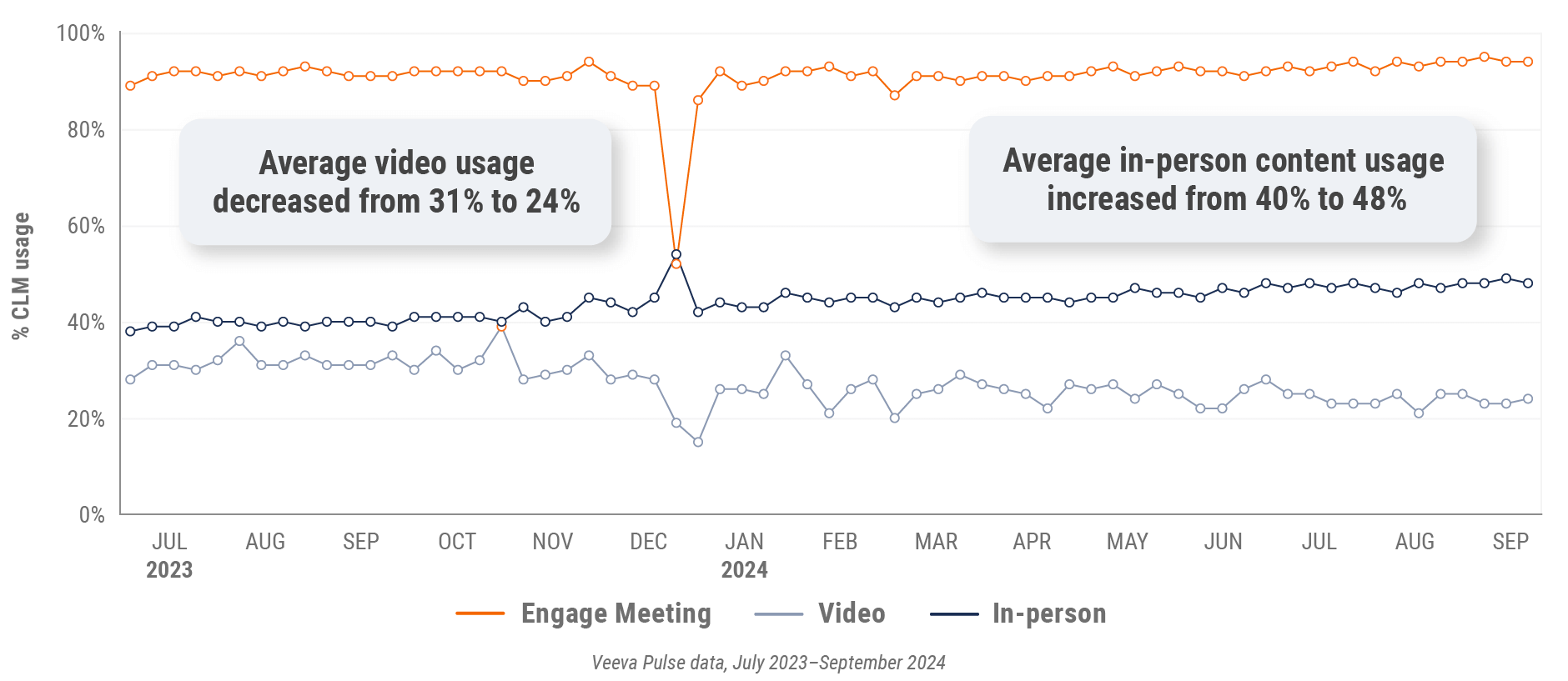

Figure 7: Content usage by channel, global

Figure 8: Veeva CRM Engage meeting duration, global

*This quarter’s global trends report omits data from China.

U.S. market trends

Figure 9: Channel mix evolution, U.S.

Figure 10: Channel mix, U.S.

U.S. field team activity

Weekly activity per user by engagement channel

Figure 11: Activity, U.S.

Figure 12: Activity by user type, U.S.

Figure 13: Activity by company size, U.S.

U.S. engagement quality

Consolidation of key quality metrics

Figure 14: Approved email volume, U.S.

Figure 15: Content usage by channel, U.S.

Figure 16: Veeva CRM Engage meeting duration, U.S.

Europe market trends

Figure 17: Channel mix evolution, Europe

Figure 18: Channel mix, Europe

Europe field team activity

Weekly activity per user by engagement channel

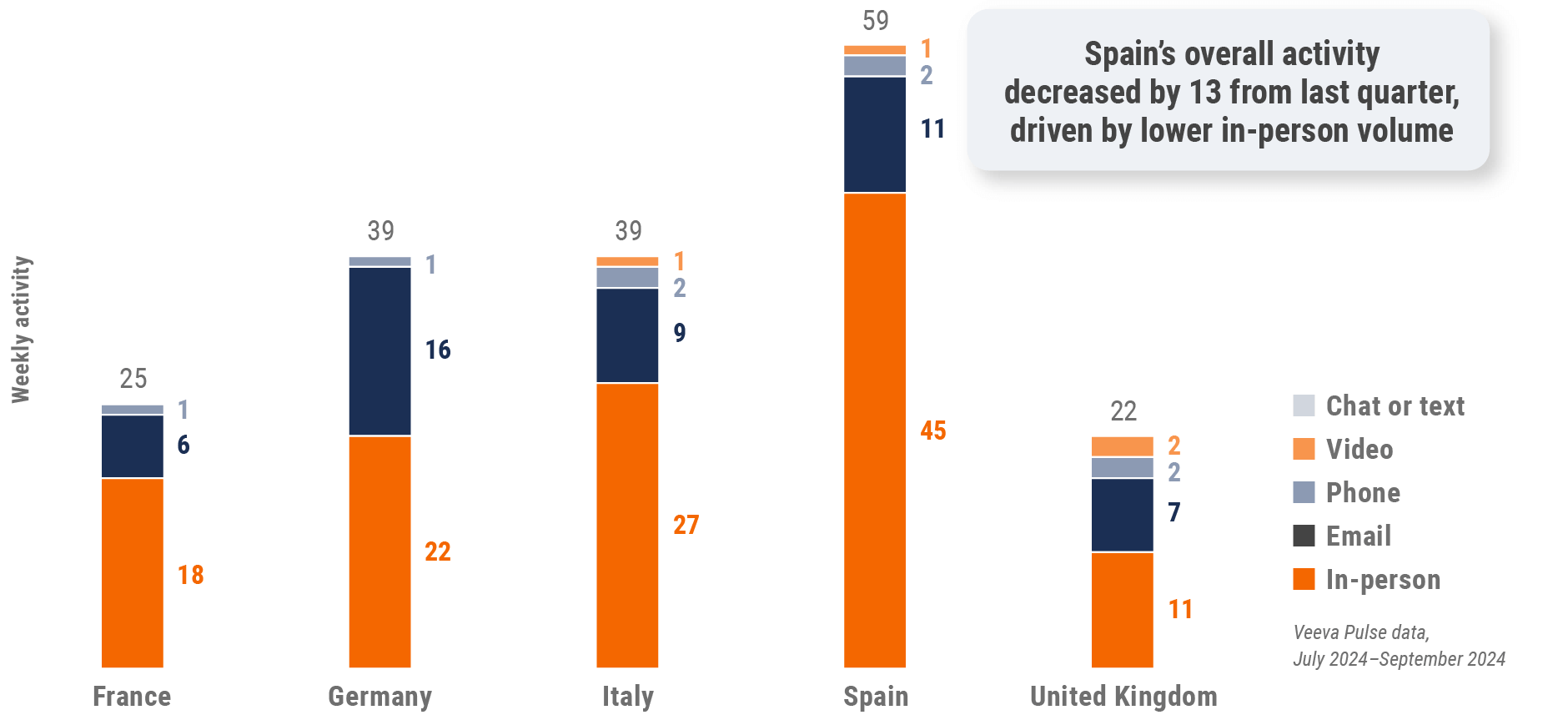

Figure 19: Activity by country, EU5

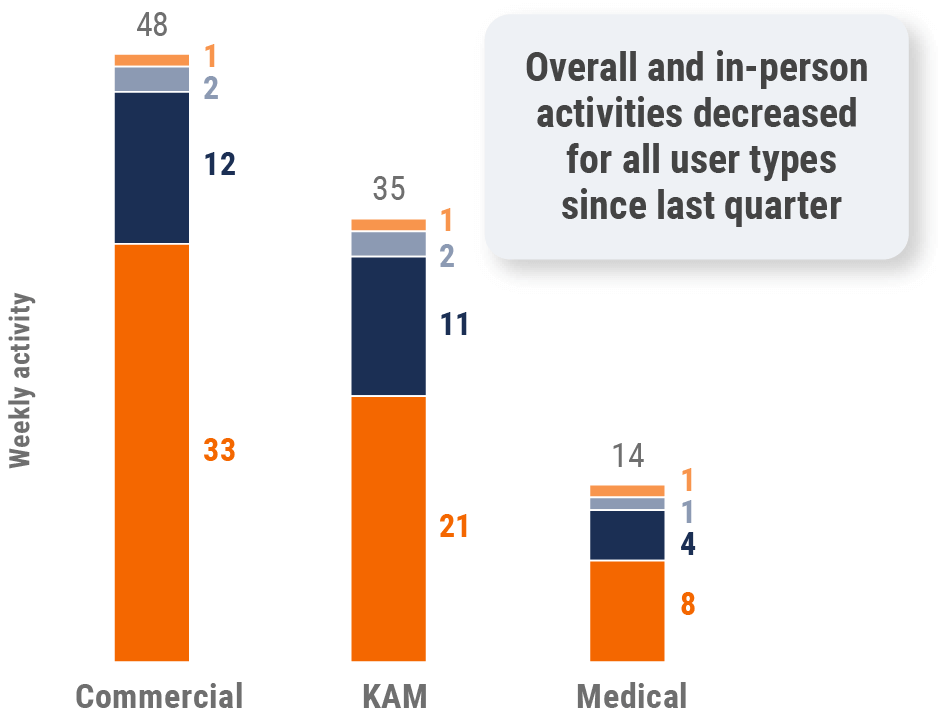

Figure 20: Activity by user type, Europe

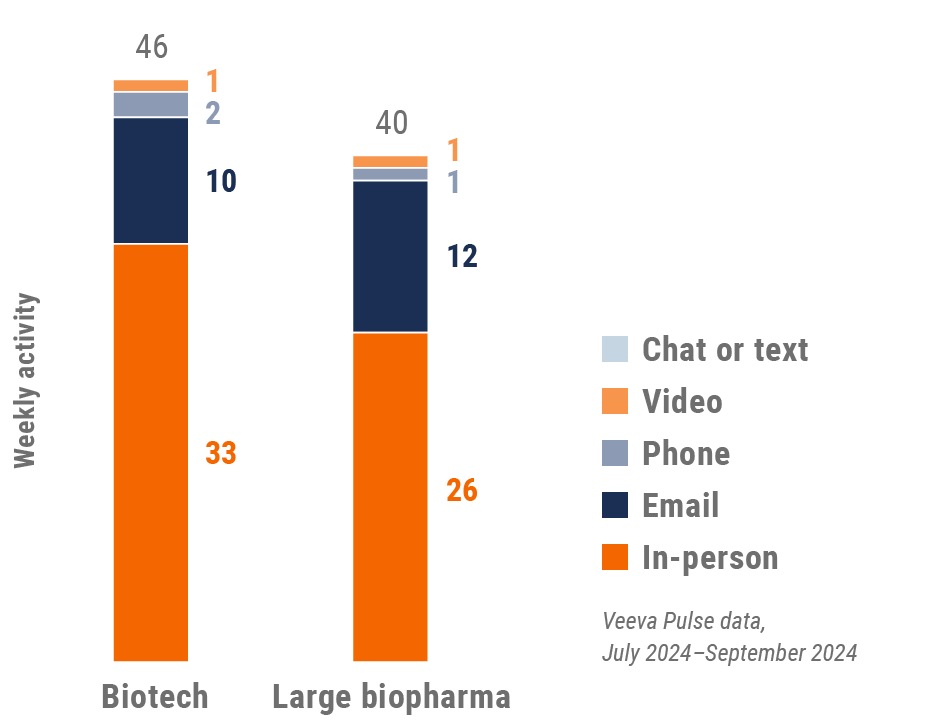

Figure 21: Activity by company size, Europe

Europe engagement quality

Consolidation of key quality metrics

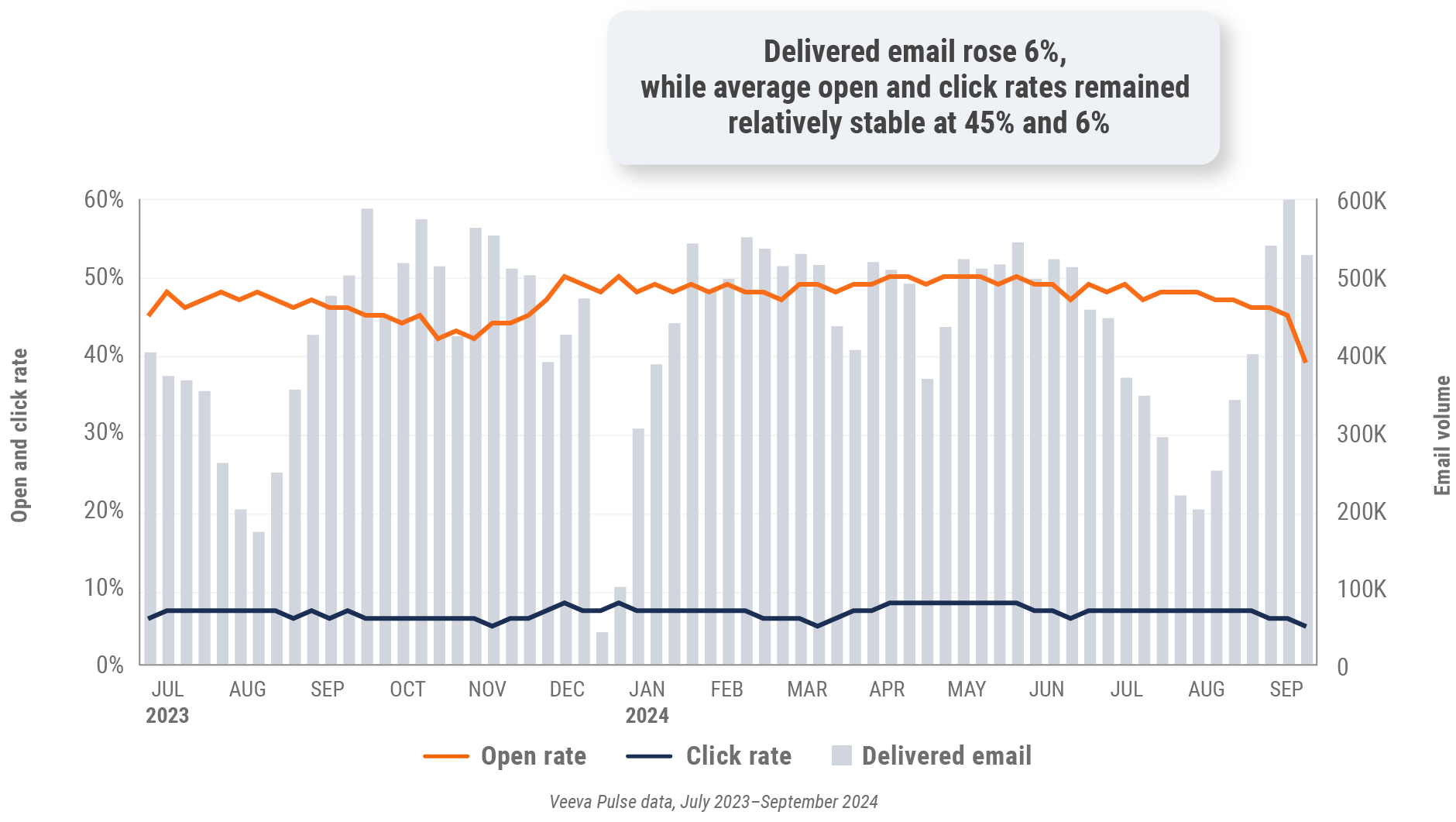

Figure 22: Approved email volume, Europe

Figure 23: Content usage by channel, Europe

Figure 24: Veeva CRM Engage meeting duration, Europe

Asia market trends

Figure 25: Channel mix evolution, Asia

Figure 26: Channel mix, Asia

Asia field team activity

Weekly activity per user by engagement channel

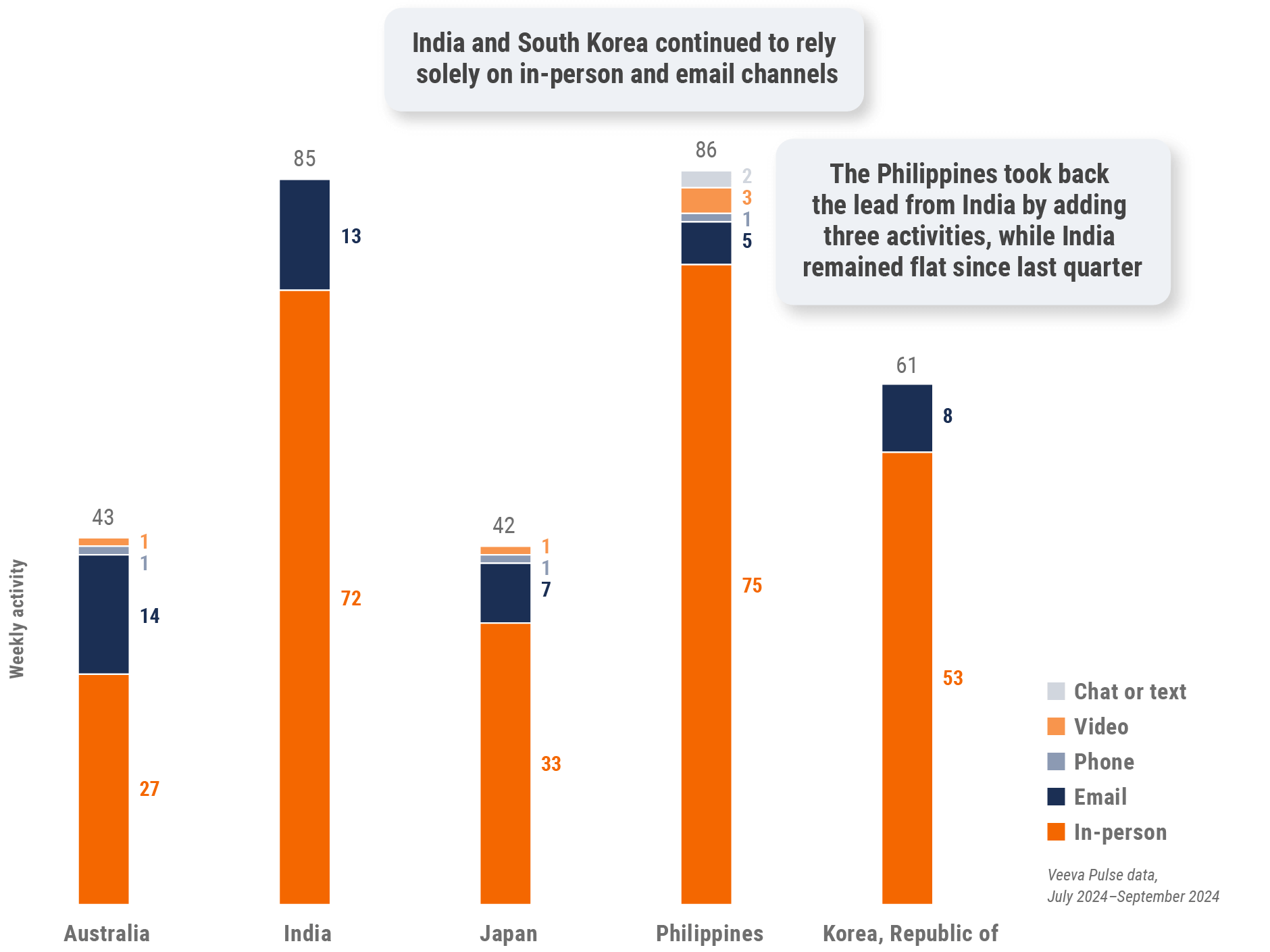

Figure 27: Activity by country, Asia

Figure 28: Activity by user type, Asia

Figure 29: Activity by company size, Asia

Asia engagement quality

Consolidation of key quality metrics

Figure 30: Approved email volume, Asia

Figure 31: Content usage by channel, Asia

Figure 32: Veeva CRM Engage meeting duration, Asia

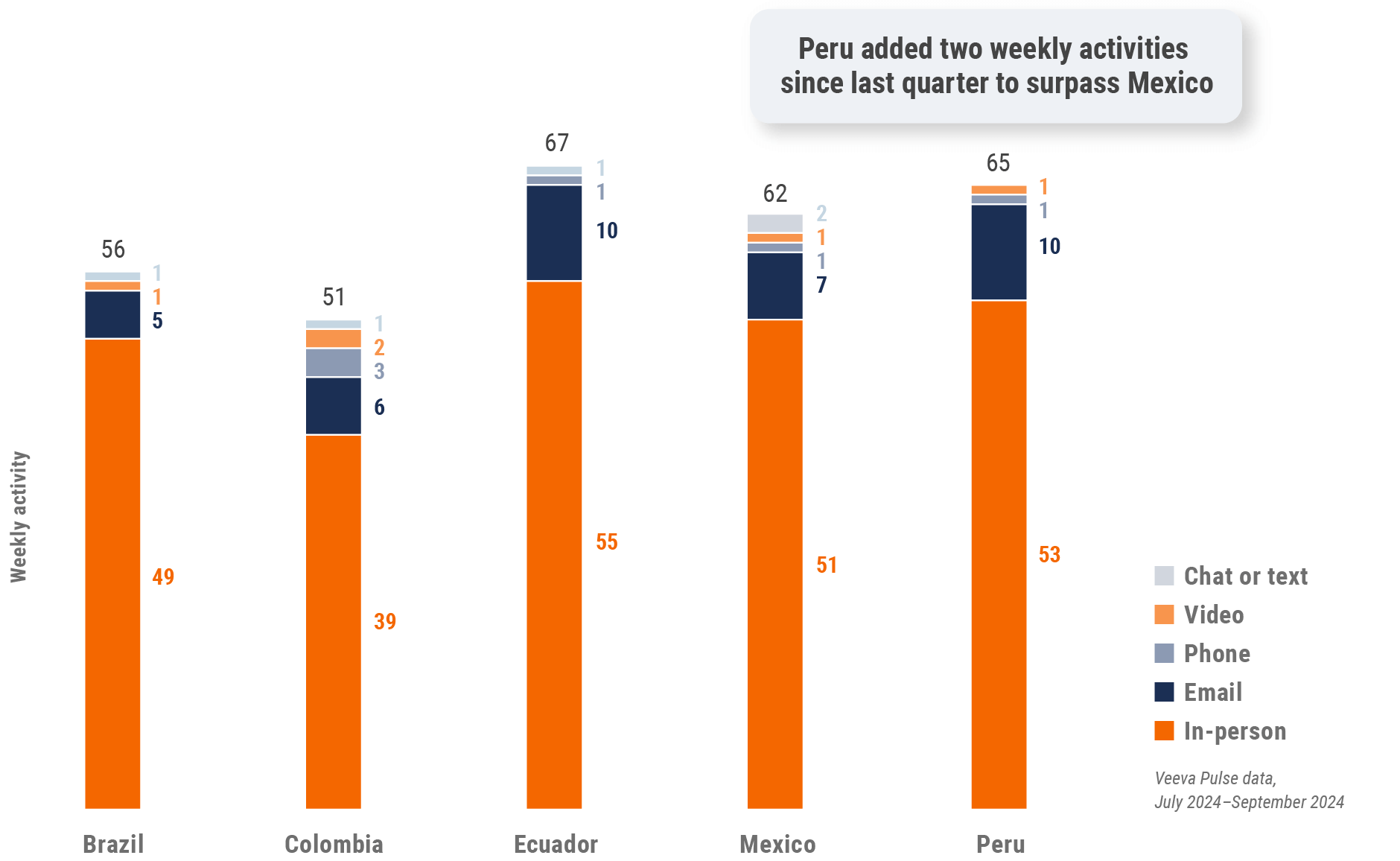

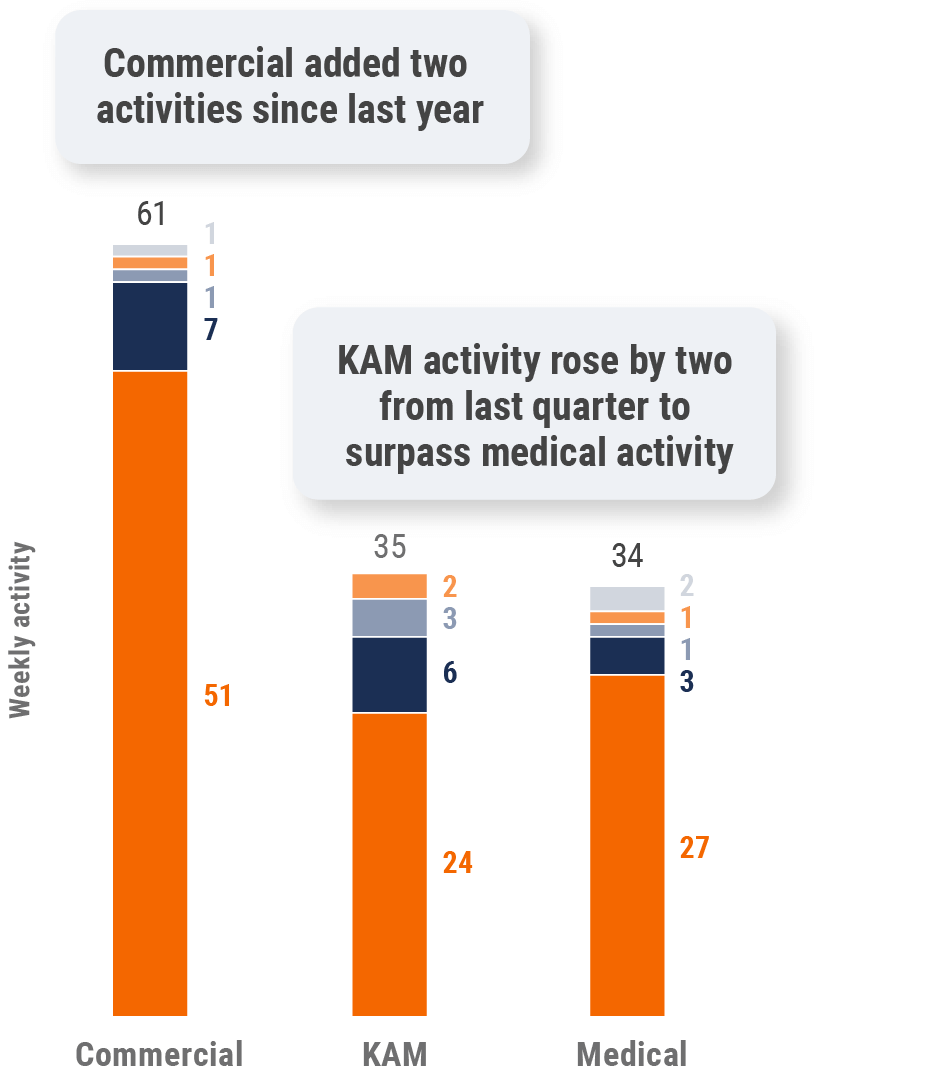

Latin America market trends

Figure 33: Channel mix evolution, Latin America

Figure 34: Channel mix, Latin America

Latin America field team activity

Weekly activity per user by engagement channel

Figure 35: Activity by country, Latin America

Figure 36: Activity by user type, Latin America

Figure 37: Activity by company size, Latin America

Latin America engagement quality

Consolidation of key quality metrics

Figure 38: Approved email volume, Latin America

Figure 39: Content usage by channel, Latin America

Figure 40: Veeva CRM Engage meeting duration, Latin America

Appendix: Data dictionary

Metric definitions

- Channel mix evolution over time: Weekly Veeva CRM activity volume broken down by the channel of engagement (in-person, phone, video, email, chat or text)

- Channel mix: Total Veeva CRM activity volume broken down by engagement channel percentage

- Weekly activities per user: The average weekly number of Veeva CRM activities submitted per number of users active in Veeva CRM

- Approved email volume: Volume of approved emails sent via Veeva CRM

- Email open rate: Percentage of approved emails opened at least once out of all approved emails sent via Veeva CRM

- Email click rate: Percentage of approved emails clicked at least once out of all approved emails sent via Veeva CRM

- In-person % CLM usage: Percentage of in-person engagements that leveraged content in Veeva CRM

- Video % CLM usage: Percentage of video engagements that leveraged content in Veeva CRM

- Veeva CRM Engage meeting % CLM usage: Percentage of Veeva CRM Engage meetings that leveraged content in Veeva CRM

- Veeva CRM Engage meeting duration: The average duration of Veeva CRM Engage meetings in minutes

Engagement channel definitions

- In-person: Submitted calls with a CRM Standard Metrics call channel value of ‘in-person’

- Phone: Submitted calls with a CRM Standard Metrics call channel value of ‘phone’

- Video: Veeva CRM Engage calls and video calls via other platforms that are then recorded as calls in Veeva CRM with a Standard Metrics call channel value of ‘video’

- Email: Approved emails and emails sent via other platforms that are then recorded as calls in Veeva CRM with a Standard Metrics call channel value of ‘email’

- Chat or text: Submitted calls with a CRM Standard Metrics call channel value of ‘chat or text’

User type definitions

- Sales: Users that have been classified with the ‘sales’ value in the CRM Standard Metrics user type field

- Key account manager: Users that have been classified with the ‘key account manager’ value in the CRM Standard Metrics user type field

- Medical: Users that have been classified with the ‘medical’ value in the CRM Standard Metrics user type field

- Top global biopharma: Top 17 global biopharma companies by revenue

- Rest of industry: All other biopharmas

Region definitions

- Global: All markets globally. This quarter’s global trends report omits data from China.

- Europe: Albania, Andorra, Armenia, Aruba, Austria, Azerbaijan, Belarus, Belgium, Bermuda, Bosnia and Herzegovina,

Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, French Polynesia, Georgia, Germany,

Greece, Greenland, Guadeloupe, Guernsey, Hungary, Ireland, Italy, Jersey, Latvia, Lithuania, Luxembourg, Macedonia,

Malta, Martinique, Republic of Moldova, Monaco, Montenegro, Netherlands, New Caledonia, Norway, Poland, Portugal,

Romania, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Ukraine, United Kingdom - Asia: Australia, Bangladesh, Bhutan, Brunei Darussalam, Cambodia, Cocos (Keeling) Islands, Indonesia, Japan,

Kazakhstan, Republic of Korea, Kyrgyzstan, Malaysia, Mongolia, Myanmar, Nauru, Nepal, New Zealand, Philippines,

Samoa, Singapore, Solomon Islands, Sri Lanka, Taiwan, Tajikistan, Thailand, Turkmenistan, Uzbekistan, Vietnam - Latin America: Antigua and Barbuda, Argentina, Bahamas, Barbados, Belize, Bolivia, Brazil, Chile, Colombia, Costa

Rica, Cuba, Dominican Republic, Ecuador, El Salvador, Guatemala, Guyana, Haiti, Honduras, Jamaica, Mexico,

Nicaragua, Panama, Paraguay, Peru, Trinidad and Tobago, Uruguay, Venezuela

Methodology

The Veeva Pulse Field Trends Report is a quarterly industry benchmark for global and regional healthcare professional

(HCP) engagement across the life sciences industry. The report is based on approximately 600 million annual global

field activities captured in Veeva CRM and Veeva CRM Engage. In addition, this study used marketing effectiveness

data from Veeva Crossix. Crossix connects anonymized health data on 300+ million

patients to media data to measure the impact of direct-to-consumer and HCP marketing investments in the U.S.

The Veeva Pulse Field Trends Report delivers insights that inform the industry and help field teams align their strategy to

key market trends for improved commercial success. The global Veeva Business Consulting team also helps customers

inform their strategies using industry benchmarking with Veeva Pulse data.

Yearly share of channel mix and delivered email volume are calculated using average weekly percent changes during the specified period unless otherwise noted.