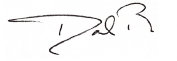

Treatment Adoption is 40% Faster with Targeted Scientific Outreach

Engaging digitally savvy, early-career HCPs amplifies impact

Challenging disease states, innovative new medicines, and increasingly complex clinical trials have raised the stakes for

new product launches. Breaking through to healthcare professionals (HCP) with new scientific evidence is a core

challenge, as they contend with huge volumes of information across disparate channels. How biopharmas

communicate scientific evidence is key to maximizing launch success.

Pulse data has shown that pre-launch field medical education improves treatment adoption by 50%. Now, our latest

analysis shows that pre-launch investment in scientific outreach beyond field medical, in forums like congresses, has a

material impact. In an analysis of U.S. oncology drugs, higher levels of pre-launch scientific activity accelerated

treatment adoption by 40%. These findings underscore the quantifiable impact that targeted medical affairs strategies

have on launch success.

Read our analysis to learn how pre-launch investment in scientific outreach sets the stage for faster treatment adoption

and, ultimately, commercial success at launch and beyond.

Thank you,

Dan Rizzo

Global Head of Veeva Business Consulting

Pre-launch scientific outreach accelerates treatment adoption by 40%

In a study of oncology drugs in the U.S., biopharmas that invested more in pre-launch scientific

activities, e.g., congresses, clinical trials, and publications, saw 40% faster treatment adoption than

biopharmas that invested less. A robust pre-launch scientific communications strategy optimizes

launch success by meeting HCPs and other experts where they are, on their terms.

Pre-launch field medical education improves treatment adoption by 50%. By connecting medical

affairs HQ and field medical activity and measuring impact during this critical window,

biopharmas can create the best opportunity to influence treatment adoption.

Defining scientific activity:

Non-promotional medical or scientific initiatives, including congresses, social media activity, publications,

guidelines, and clinical trials

Impact of Pre-Launch Scientific Outreach

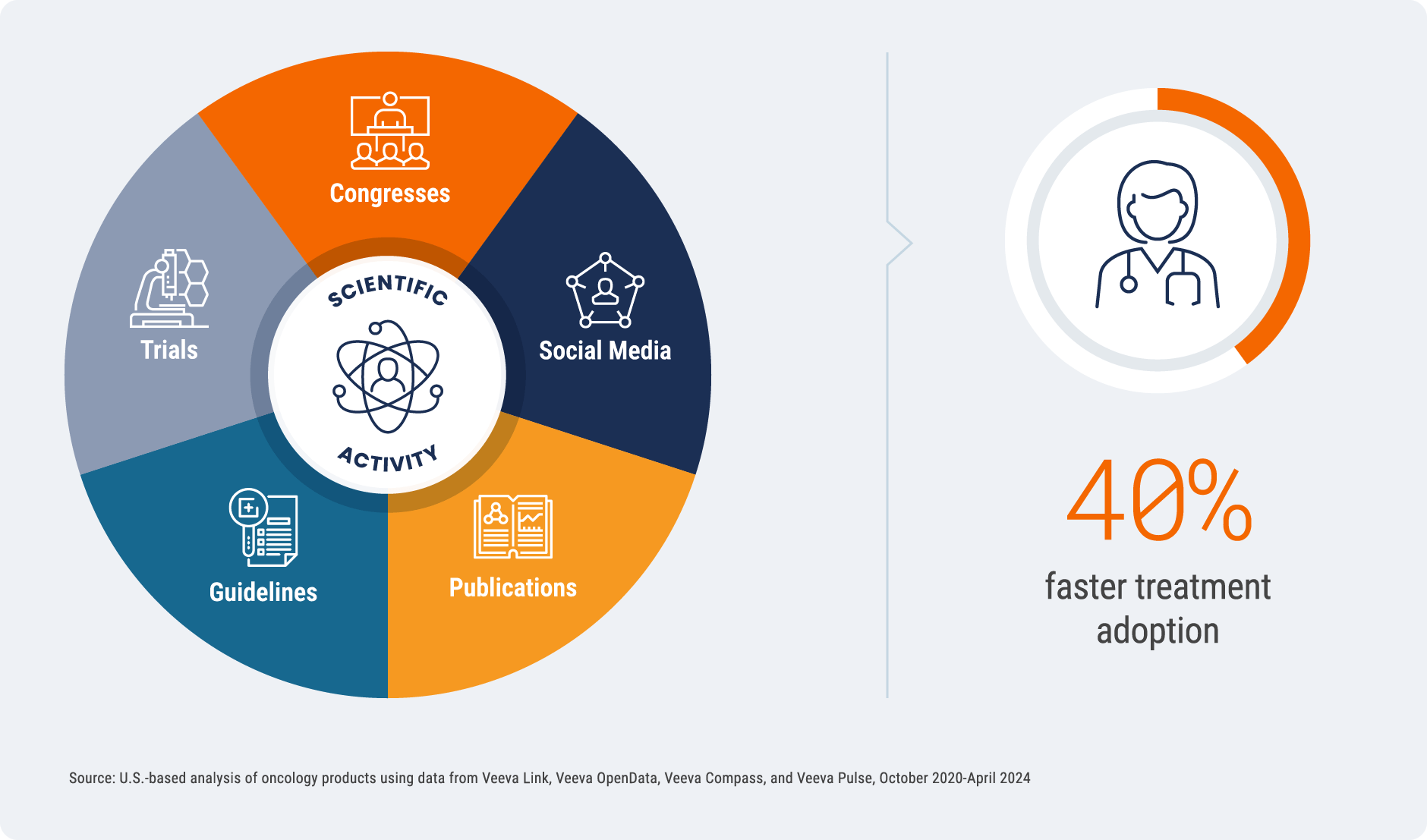

Congress activity has the strongest influence on speed of adoption

Not all channels of scientific activity are created equal — how biopharmas reach experts can have

a measurable impact on success. Across the oncology drugs studied, higher investment in

congress activities pre-launch most strongly influenced speed to treatment adoption post-approval.

While clinical trials and publications are important foundational elements of scientific

communication, the analysis found a much lower correlation between these activities and

treatment adoption. Congresses and the digital discussions kicked off by those events (e.g.,

discussions on social media) create a halo effect that amplifies scientific information. Deep data

on KOLs and other experts can help medical affairs understand which congresses present the

best opportunity to drive scientific engagement.

Not All Channels Are Created Equal

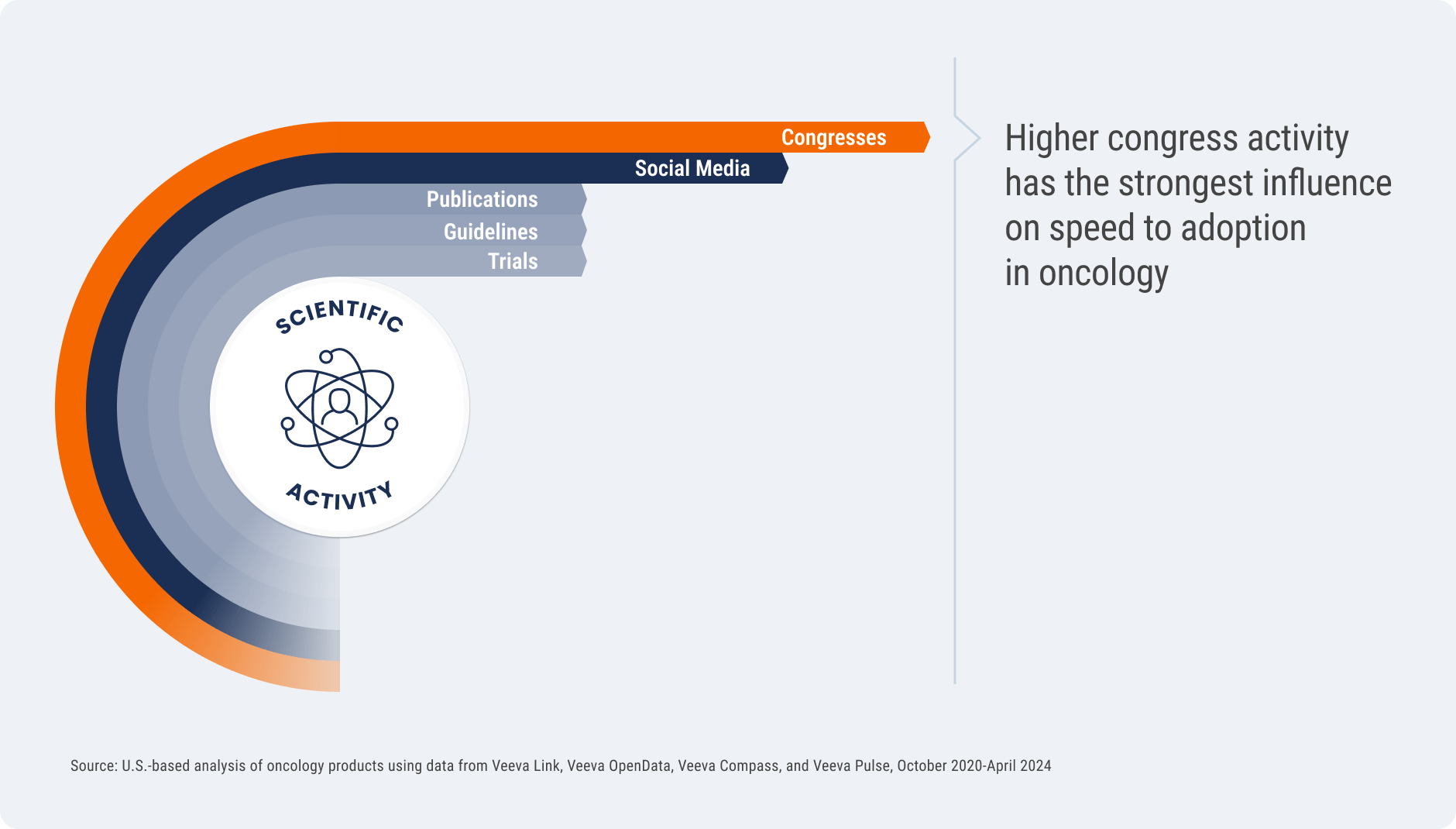

Digitally savvy, early-career HCPs are four times more likely to adopt

a new treatment

There is significant untapped potential in early-career HCPs, who are 15 years younger, digitally

savvy, and more scientifically active than their peers. The analysis found that these emerging

experts are four times more likely to adopt a new treatment.

“Gone are the days when medical could just focus on the top-tier scientific thought leaders.

The range of stakeholders has broadened, and it’s imperative to expand our engagement

strategies beyond traditional experts.”

Angela Smart, Director of Global Medical Excellence and Operations at ADVANZ PHARMA

Deep data on activities like congresses, social media posts, and publications can help identify,

prioritize, and engage these experts. Understanding this demographic’s digital and scientific

behaviors, in addition to investing in the right scientific channels, can maximize treatment

adoption.

Untapped Potential of Digitally Savvy, Early-Career HCPs

Biopharmas have an opportunity to maximize launch success by:

- Coordinating the efforts of medical affairs and field medical, including sharing medical insights that improve commercial and clinical decision-making

- Benchmarking investments in scientific outreach, ensuring appropriate resources to support launch strategy, and measuring the ROI of outreach for each disease area

- Using deep data to identify, prioritize, and engage experts with targeted scientific outreach

Reach out to Veeva Business Consulting to learn how you can use Veeva Pulse data to achieve data-driven launch

excellence.

Global and Regional Trends

This report highlights global and regional field engagement trends from Veeva Pulse data gathered between April 2023

and June 2024. Veeva Pulse data is sourced from Veeva’s aggregated CRM activity, including field engagement stats

from all instances of Veeva CRM globally. In this report, all comparisons are year-over-year, Q2 2023 to Q2 2024,

unless otherwise noted.

Global trends*

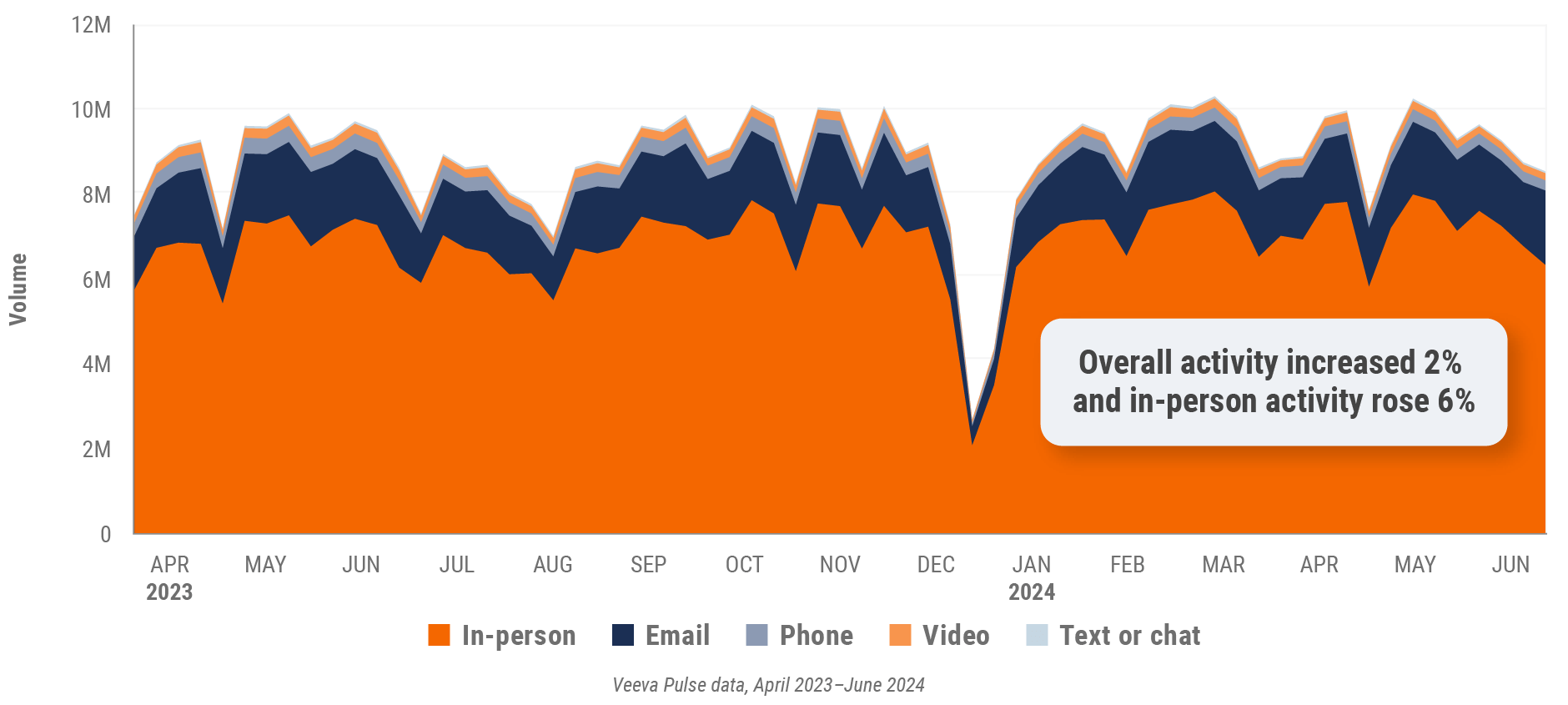

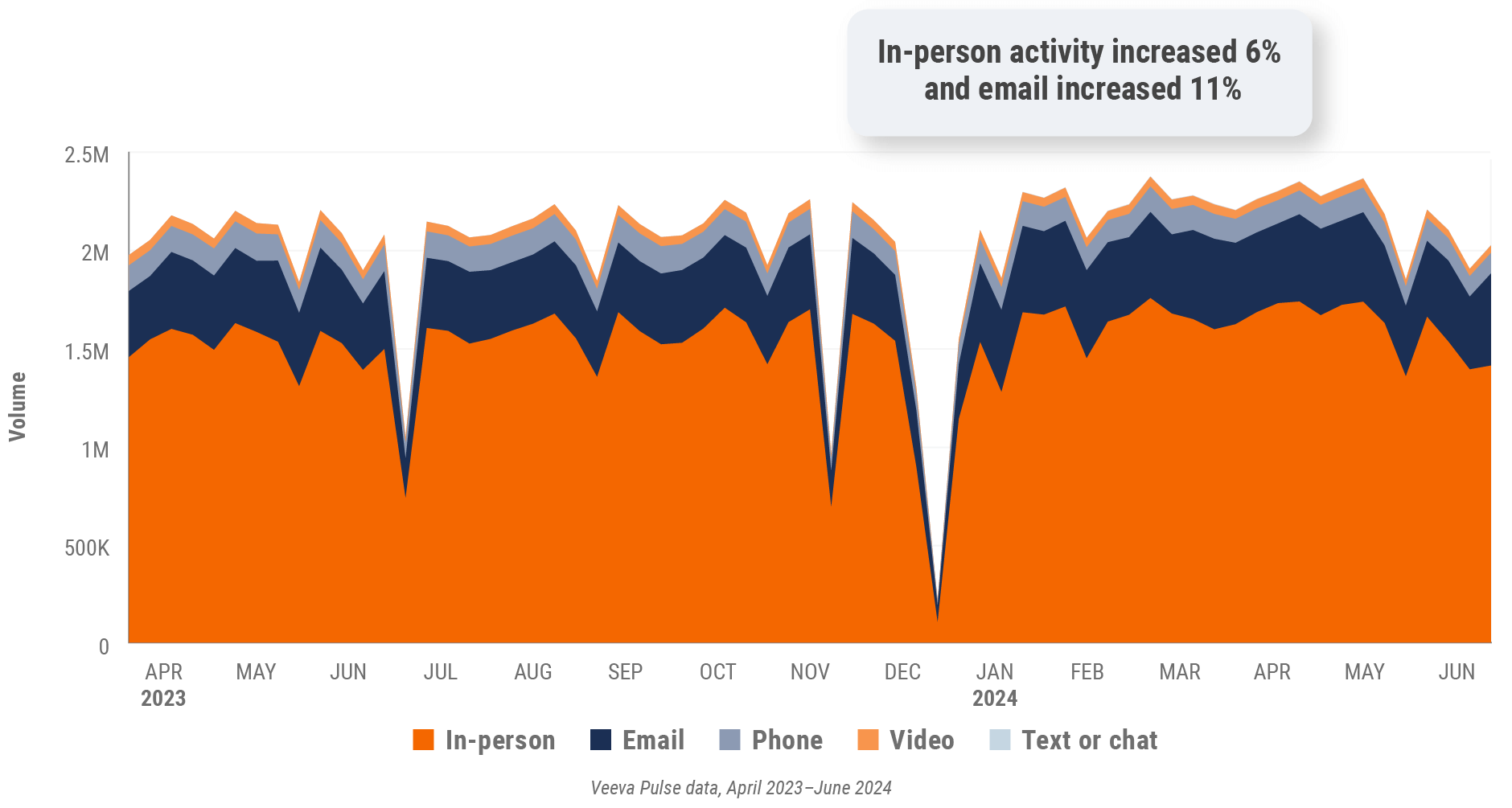

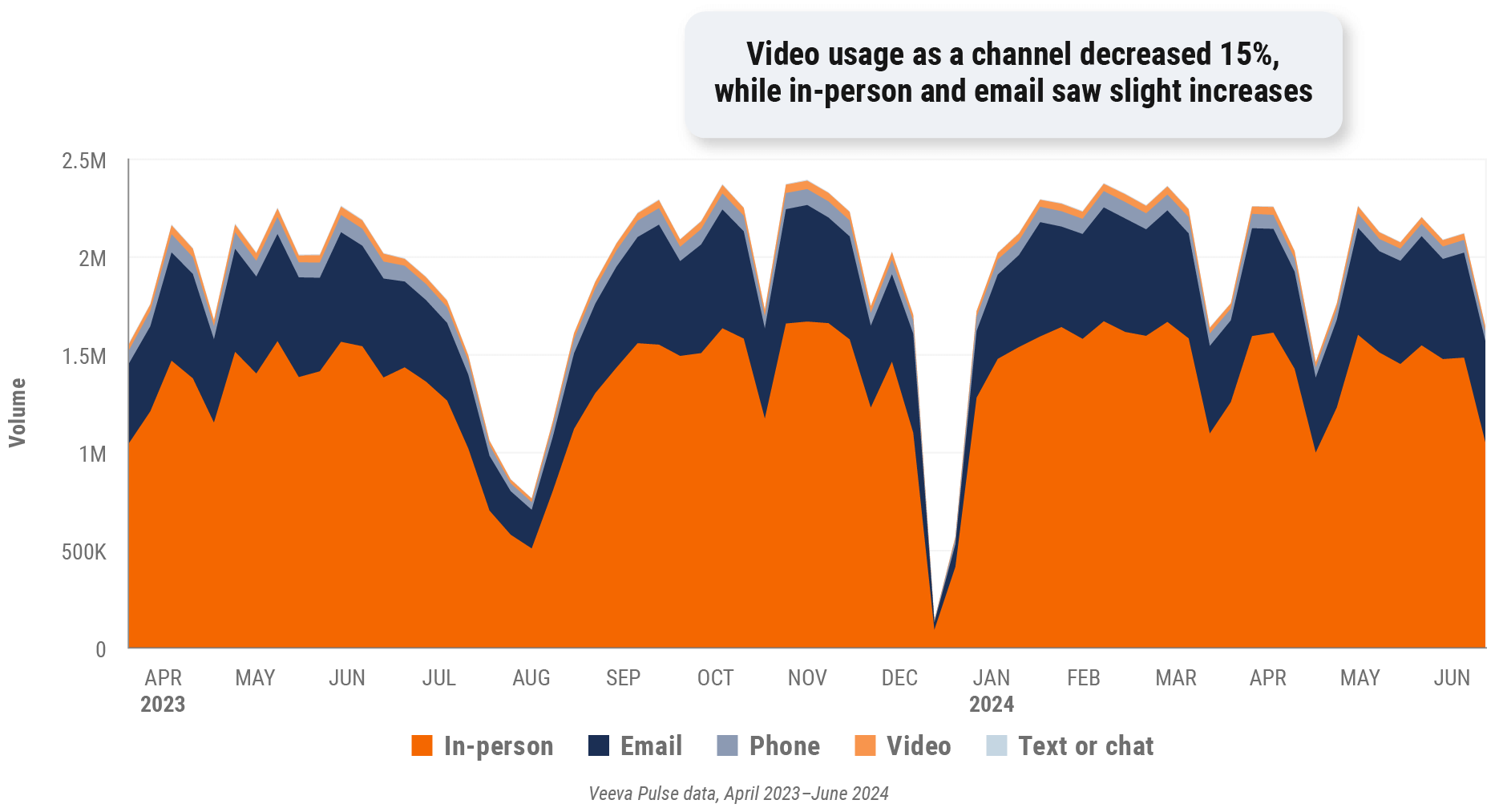

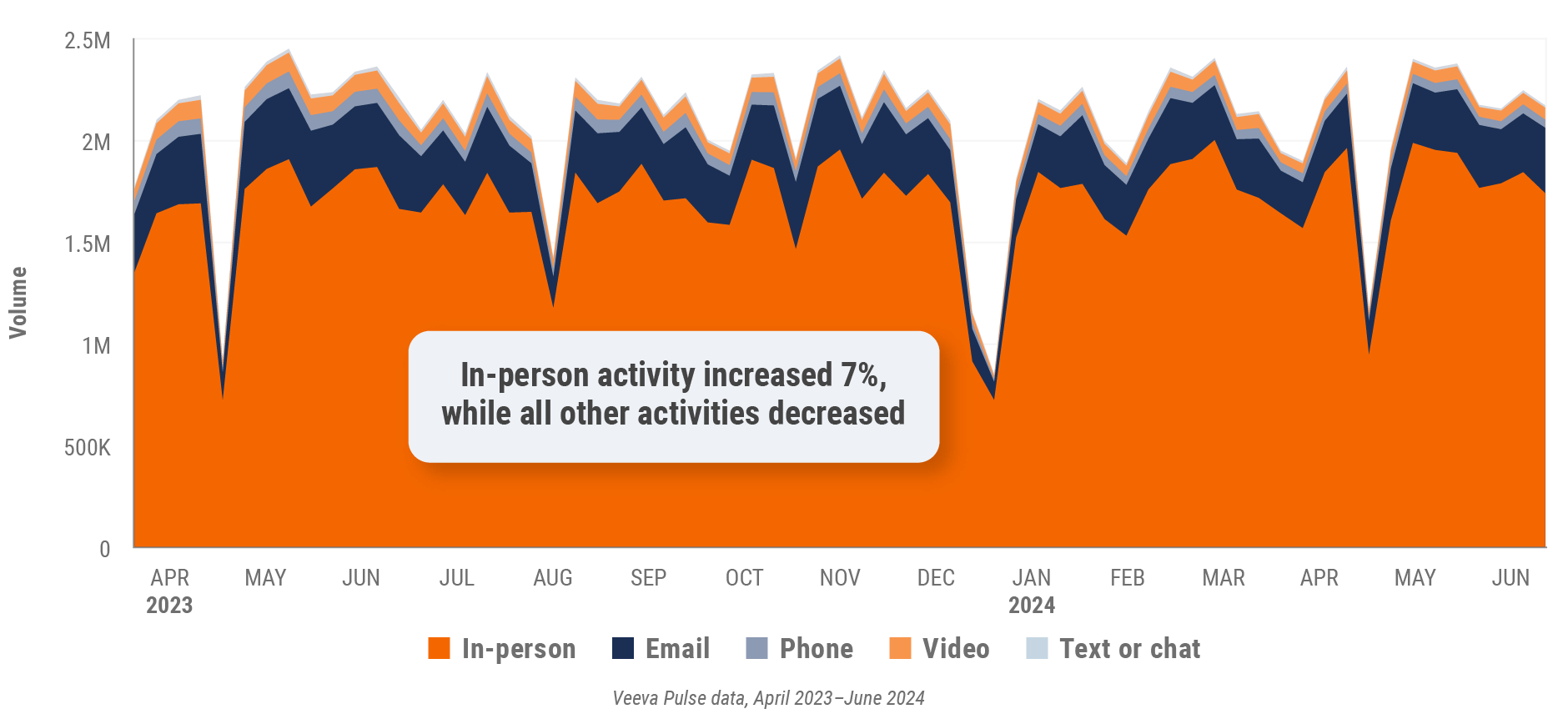

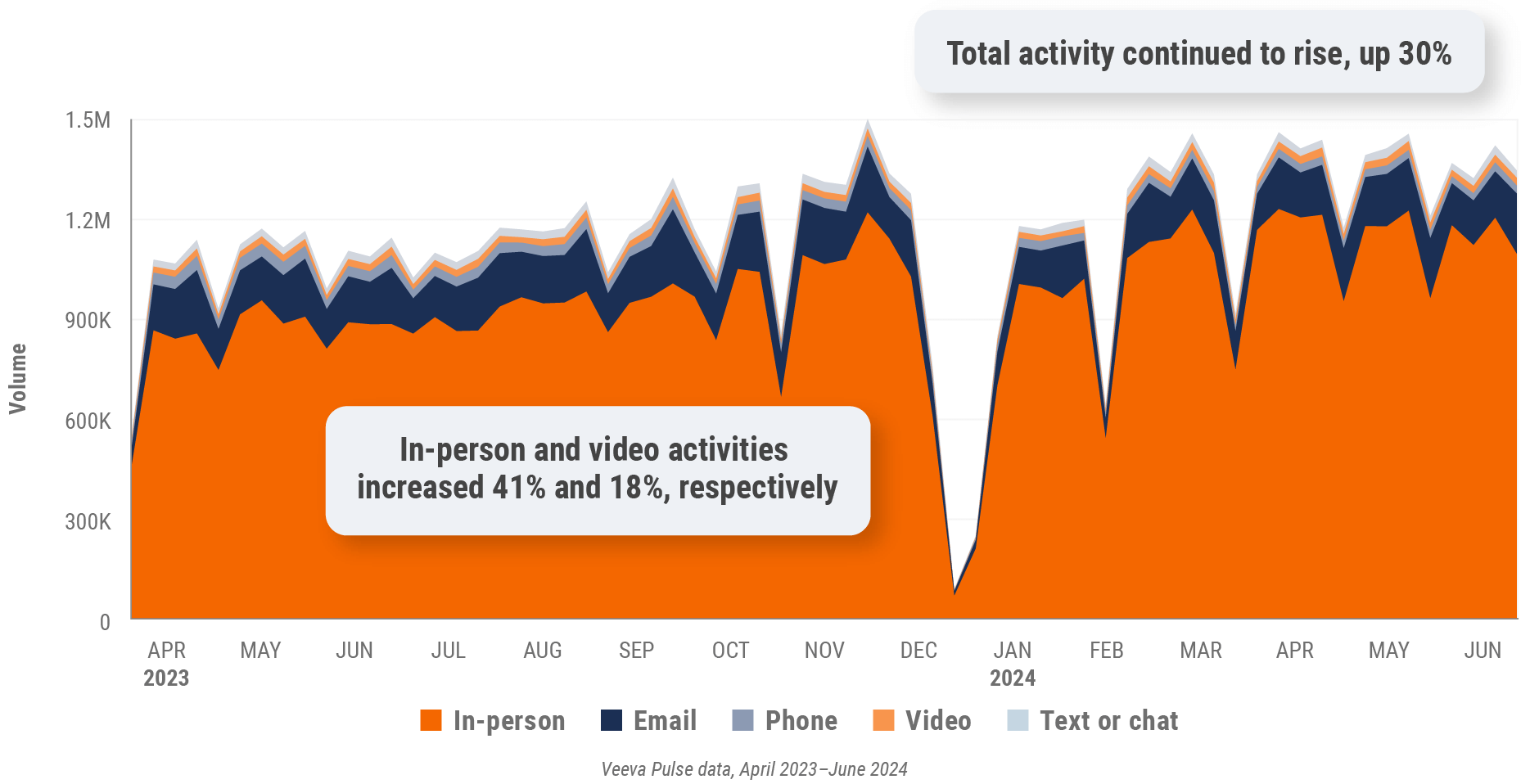

Figure 1: Channel mix evolution, global

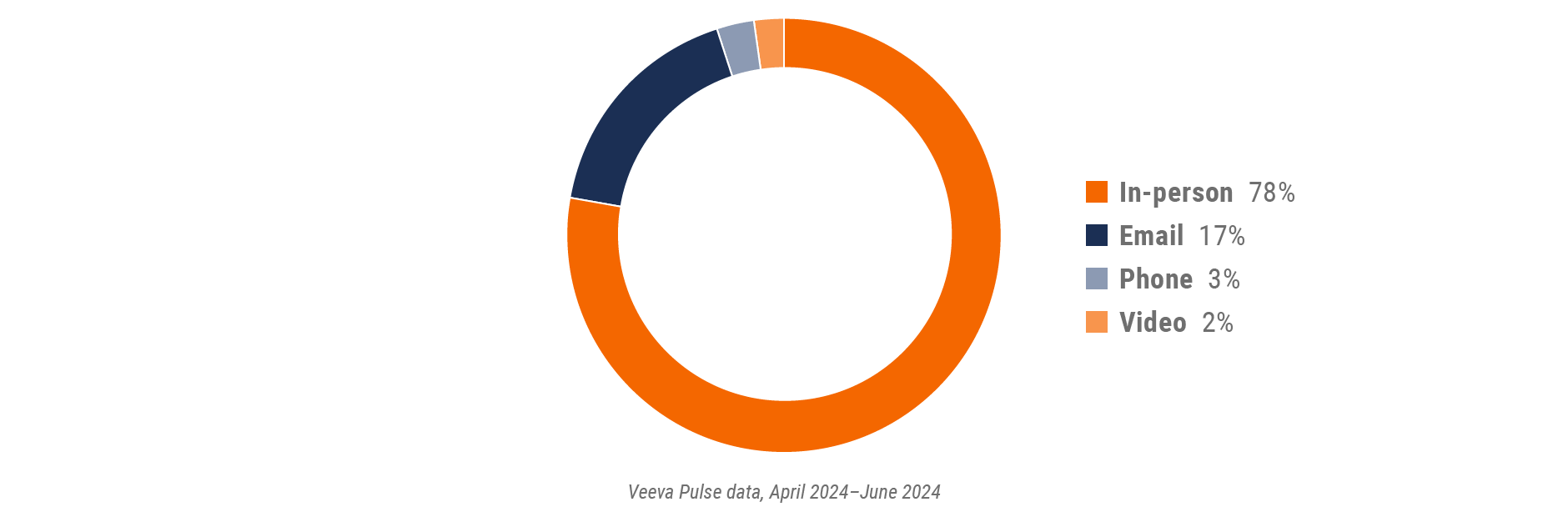

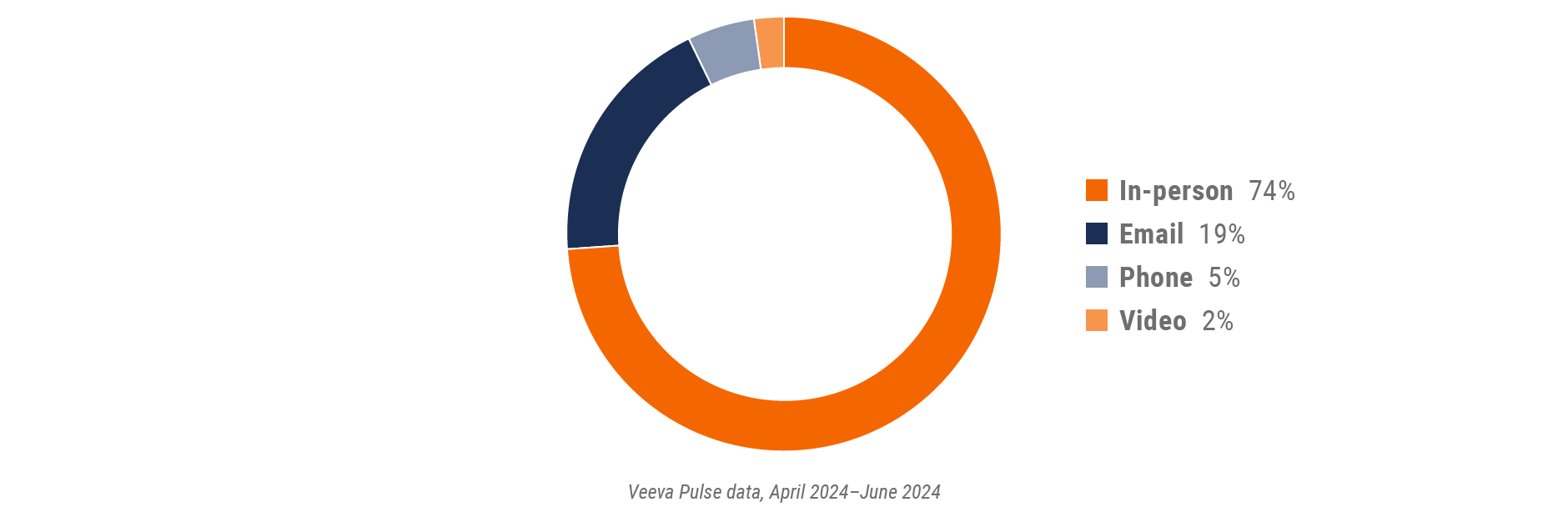

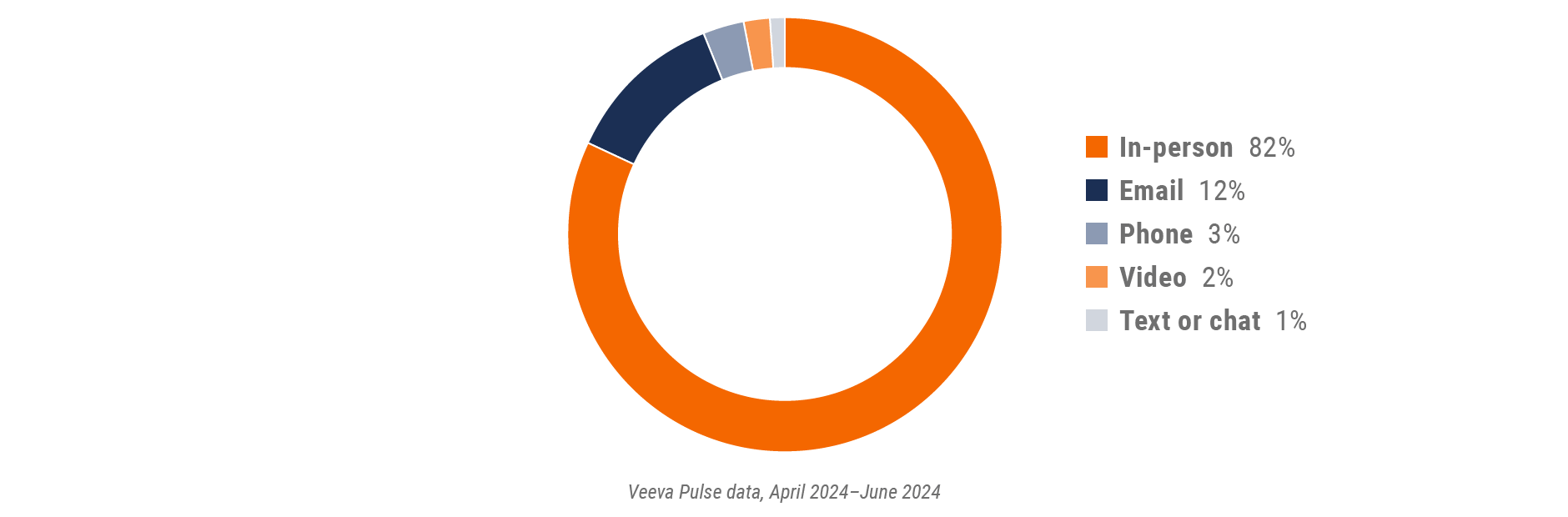

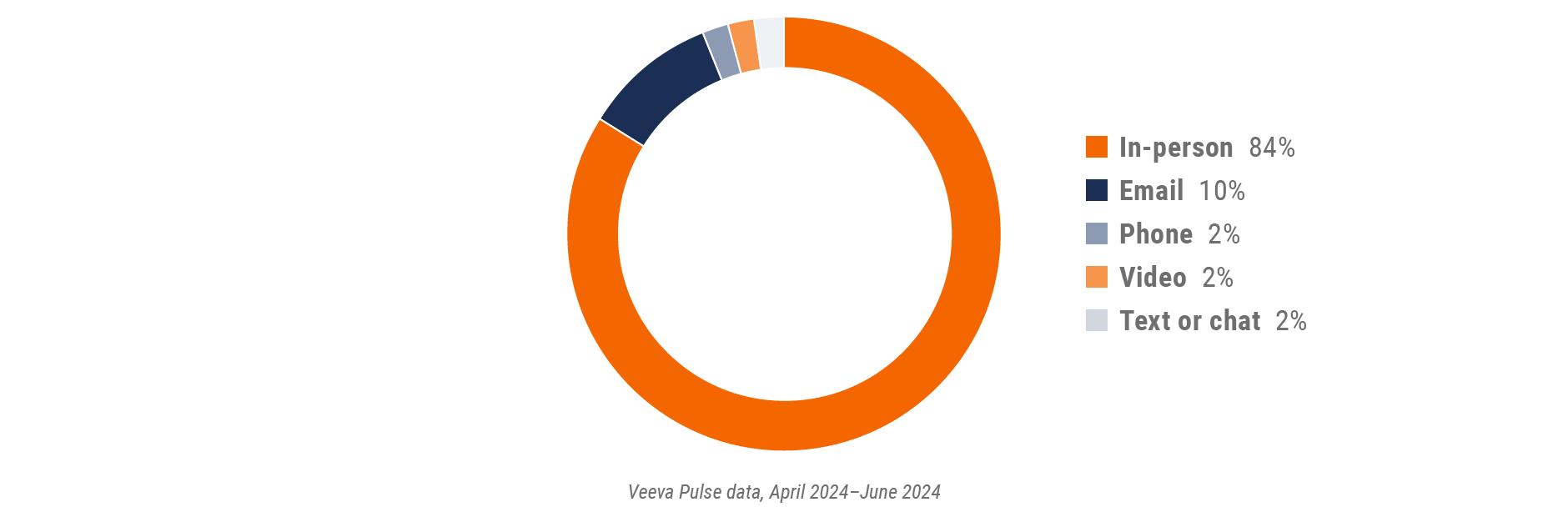

Figure 2: Channel mix, global

Global field team activity

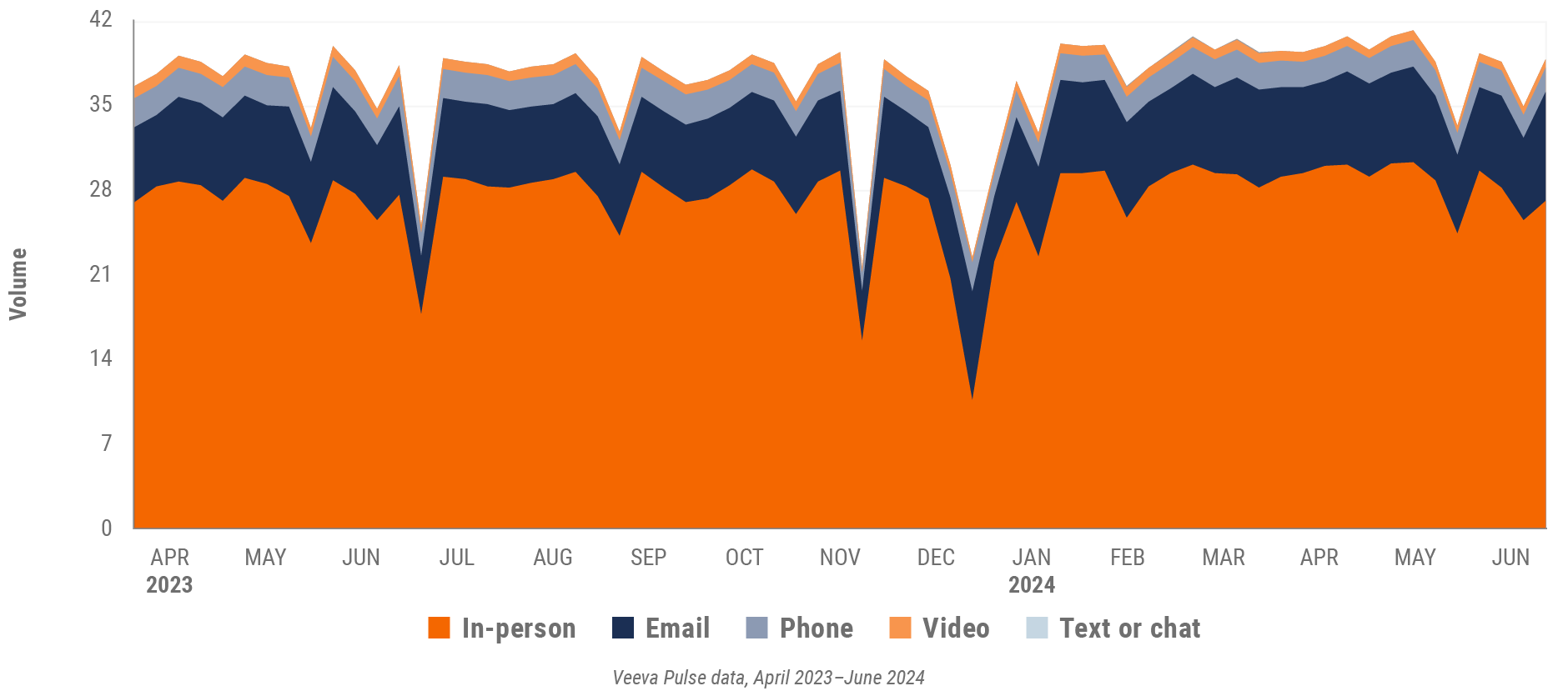

Weekly activity per user by engagement channel

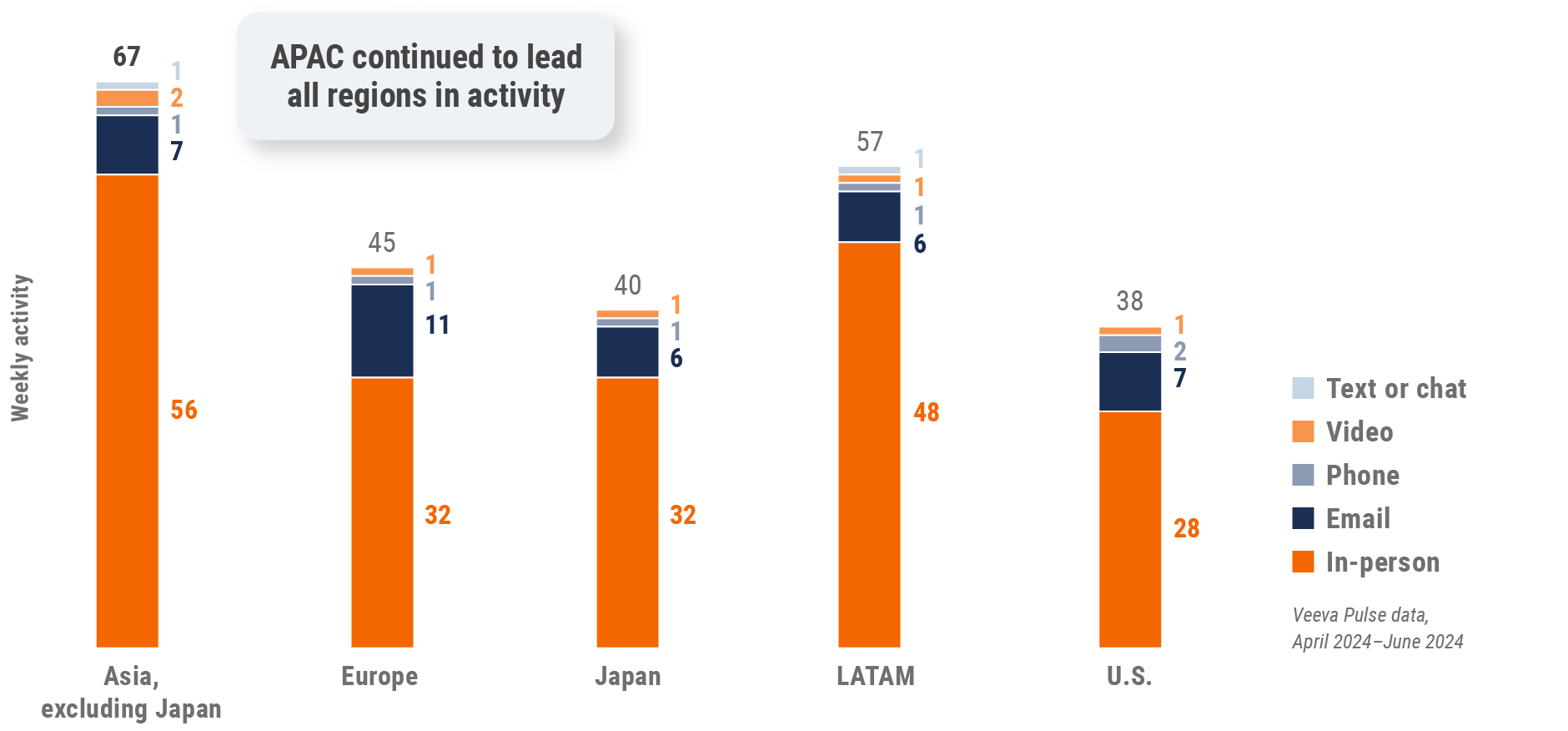

Figure 3: Activity by region, global

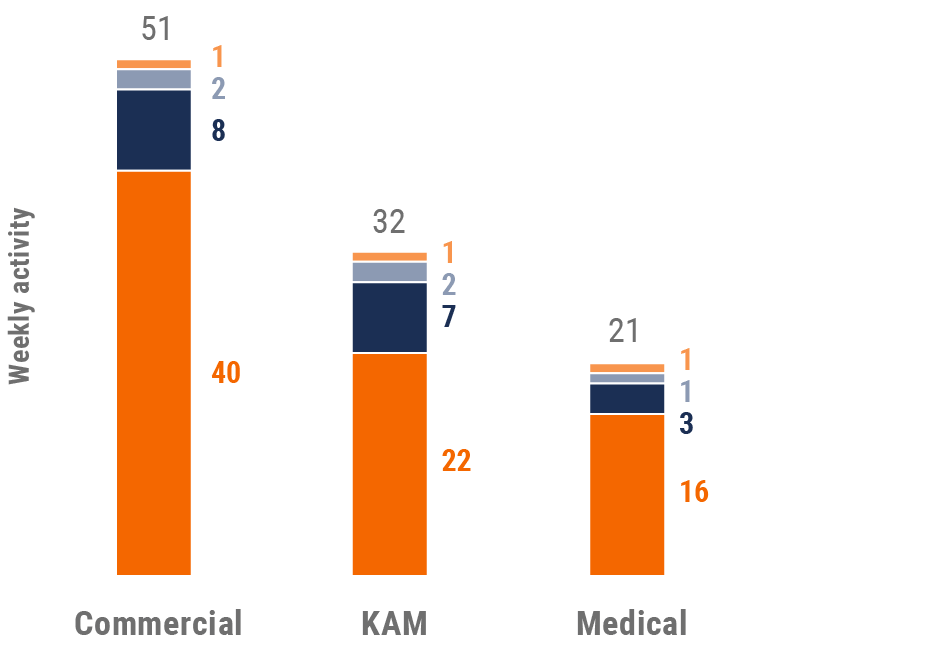

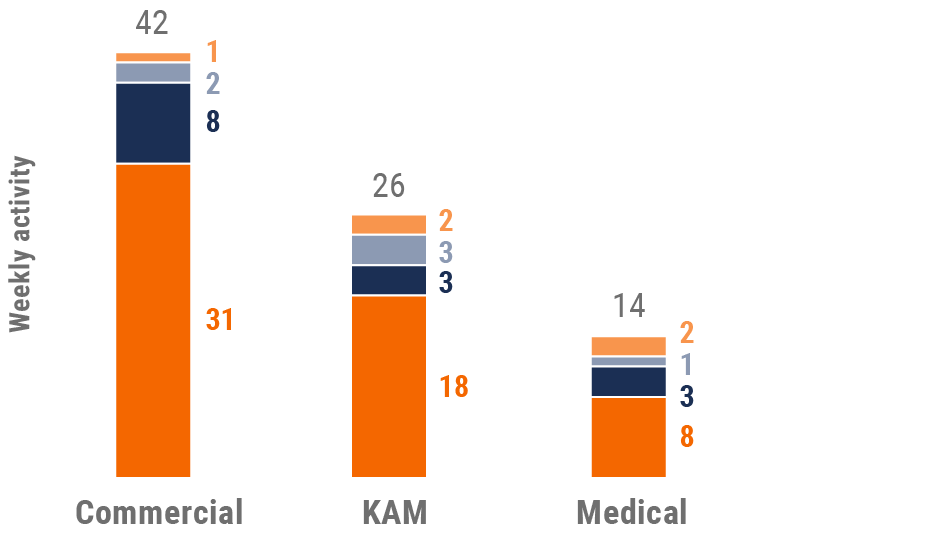

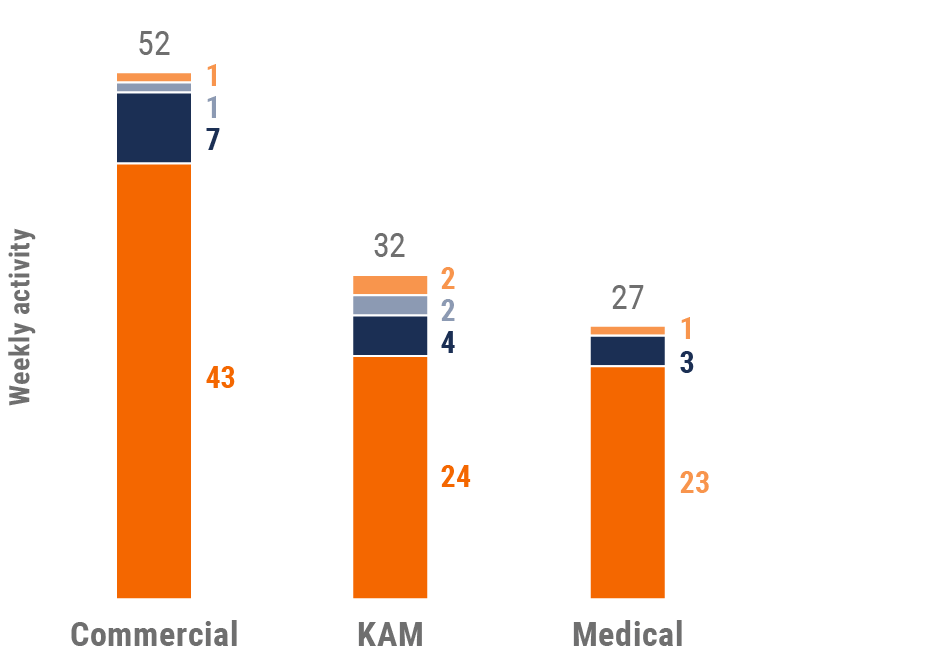

Figure 4: Activity by user type, global

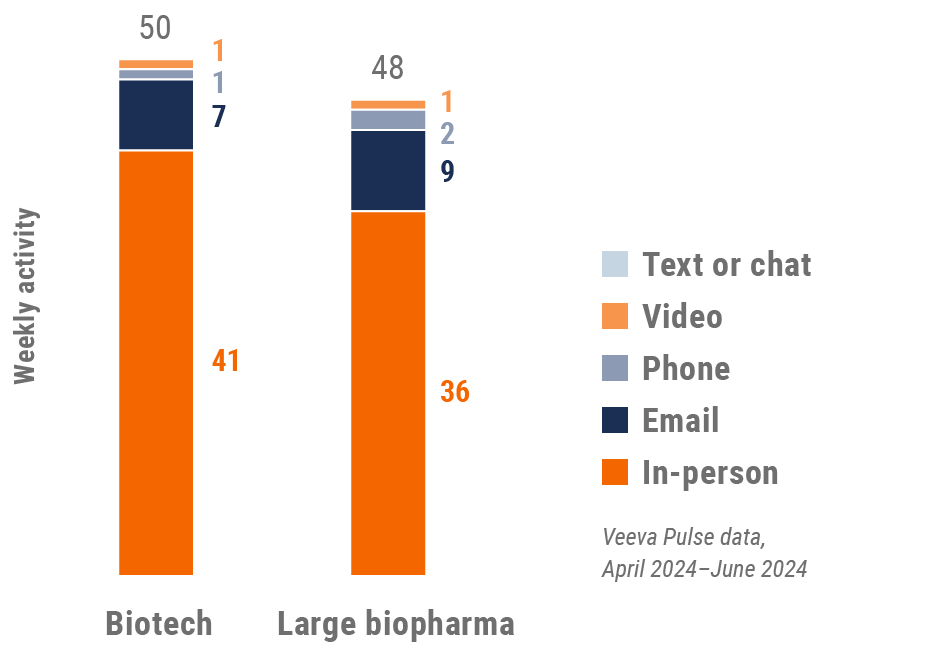

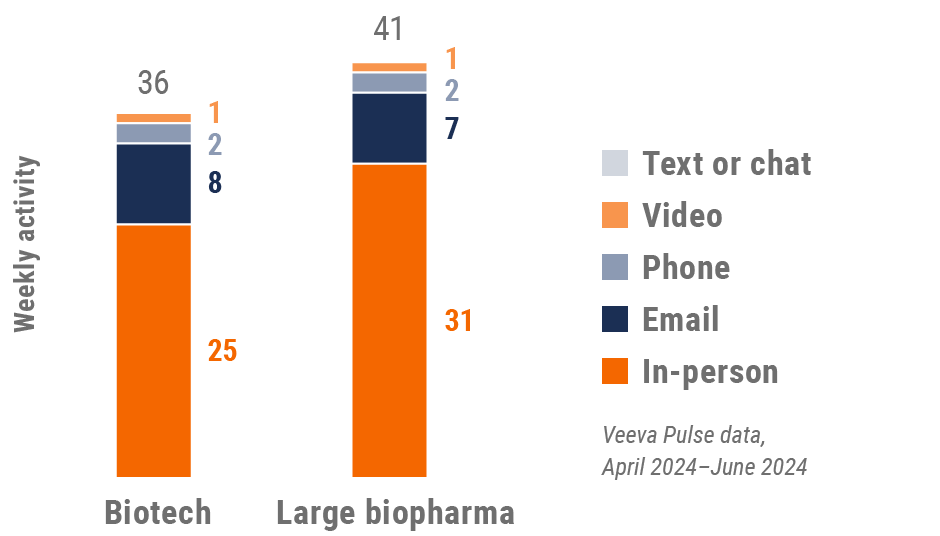

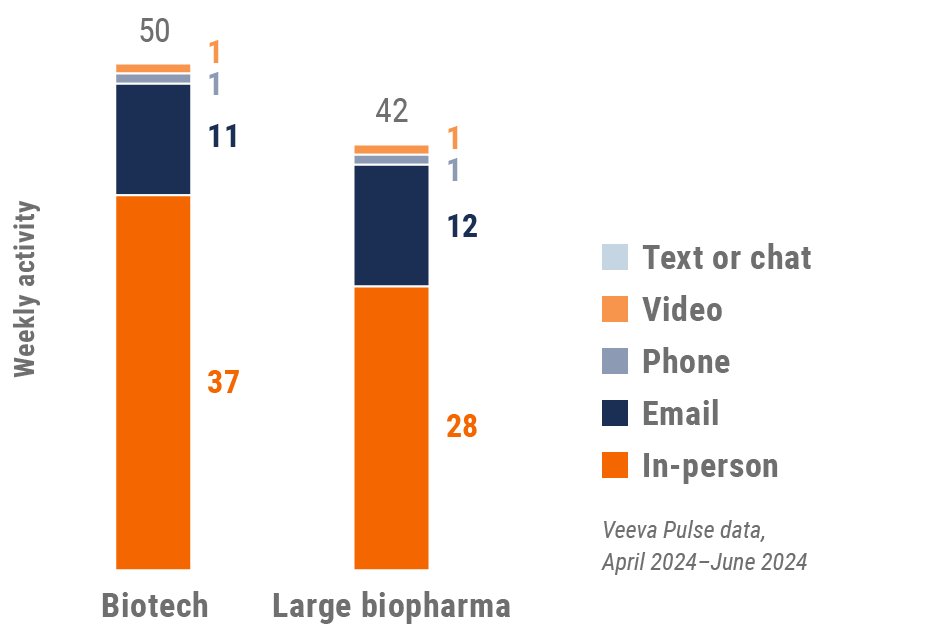

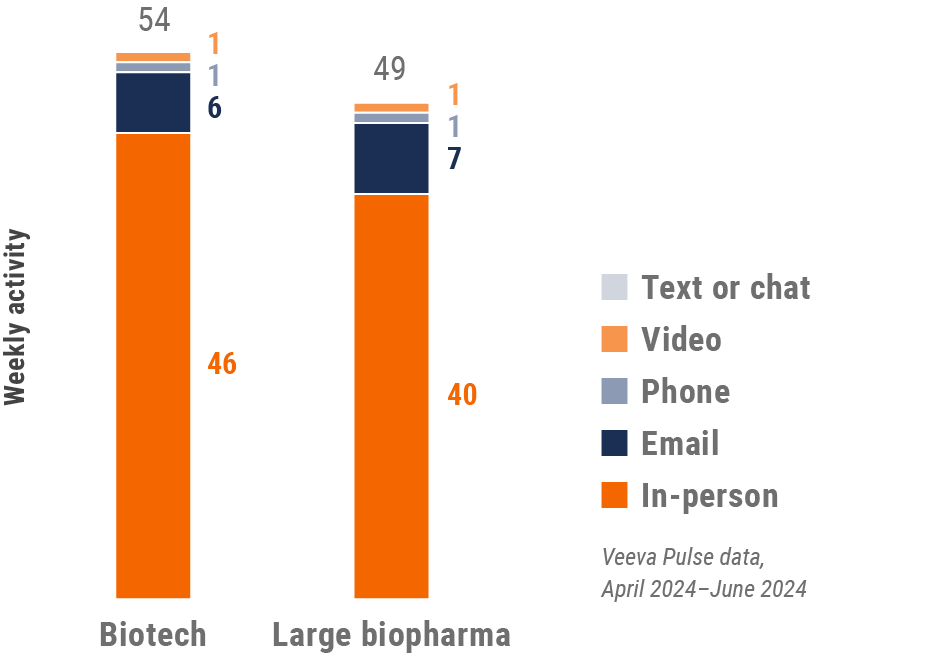

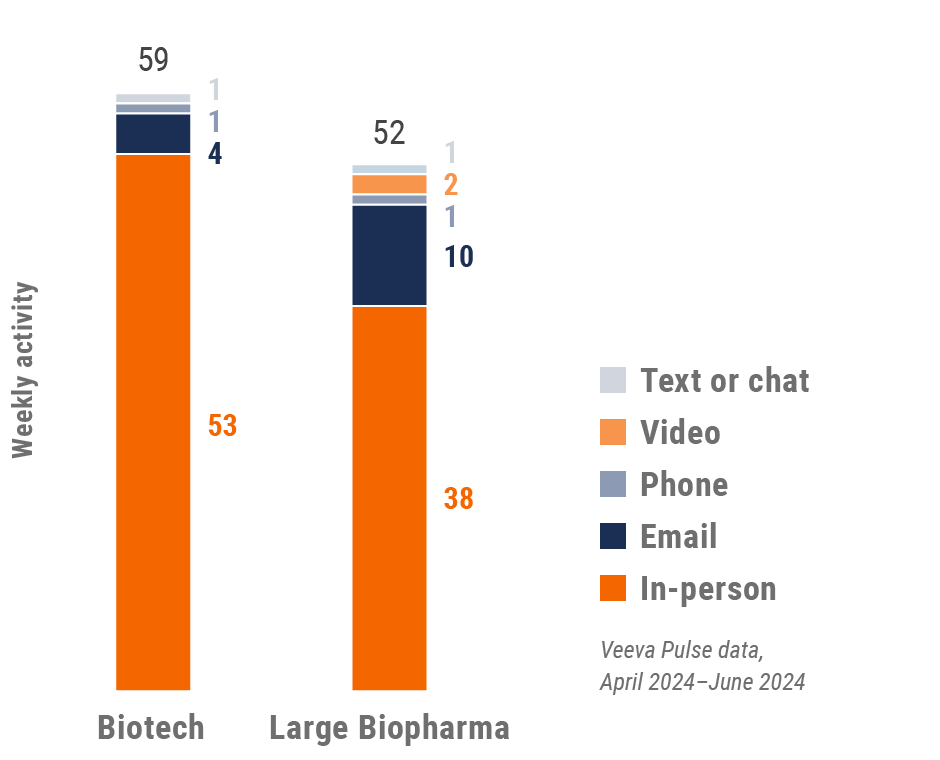

Figure 5: Activity by company size, global

Global engagement quality

Consolidation of key quality metrics

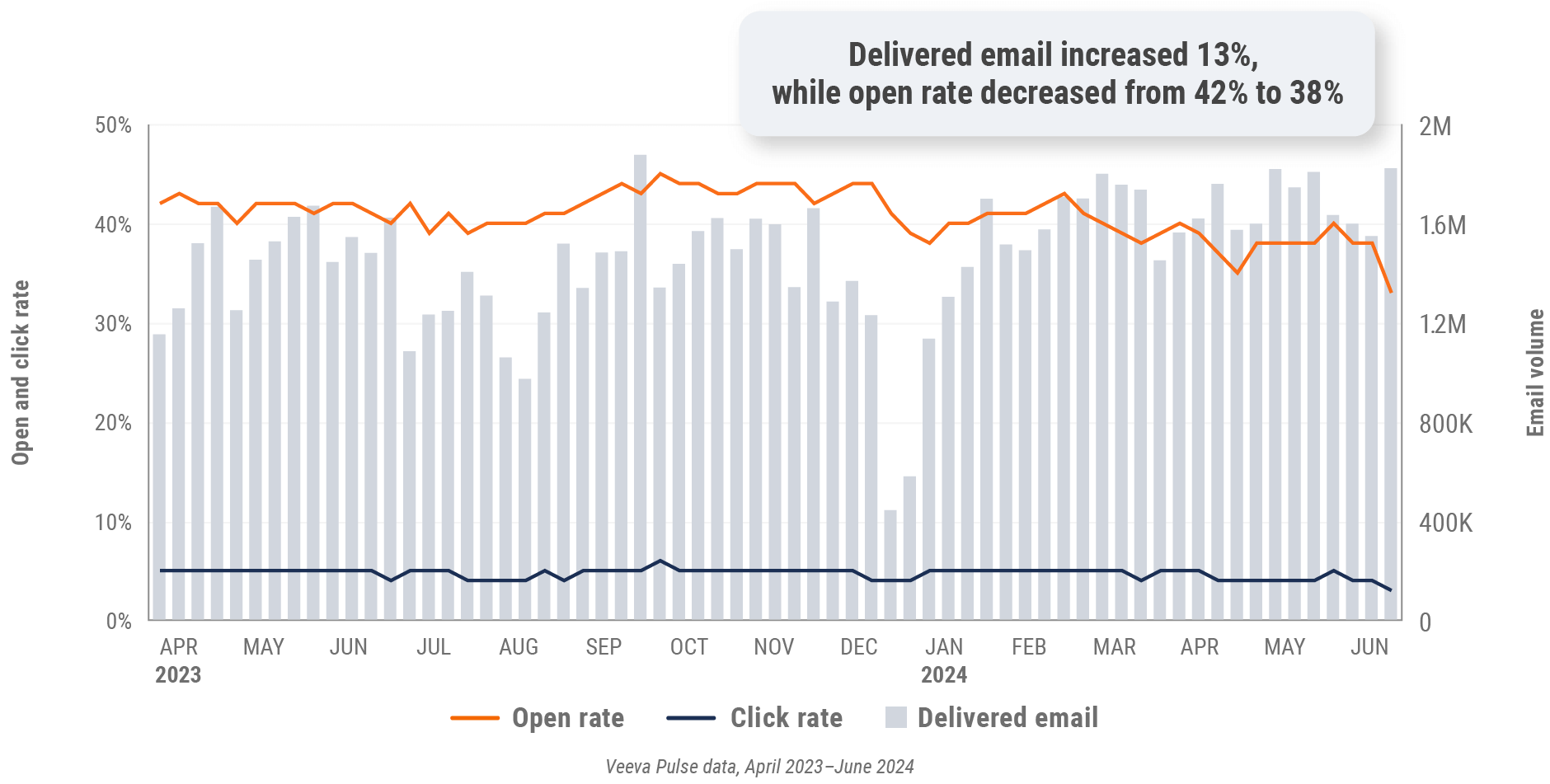

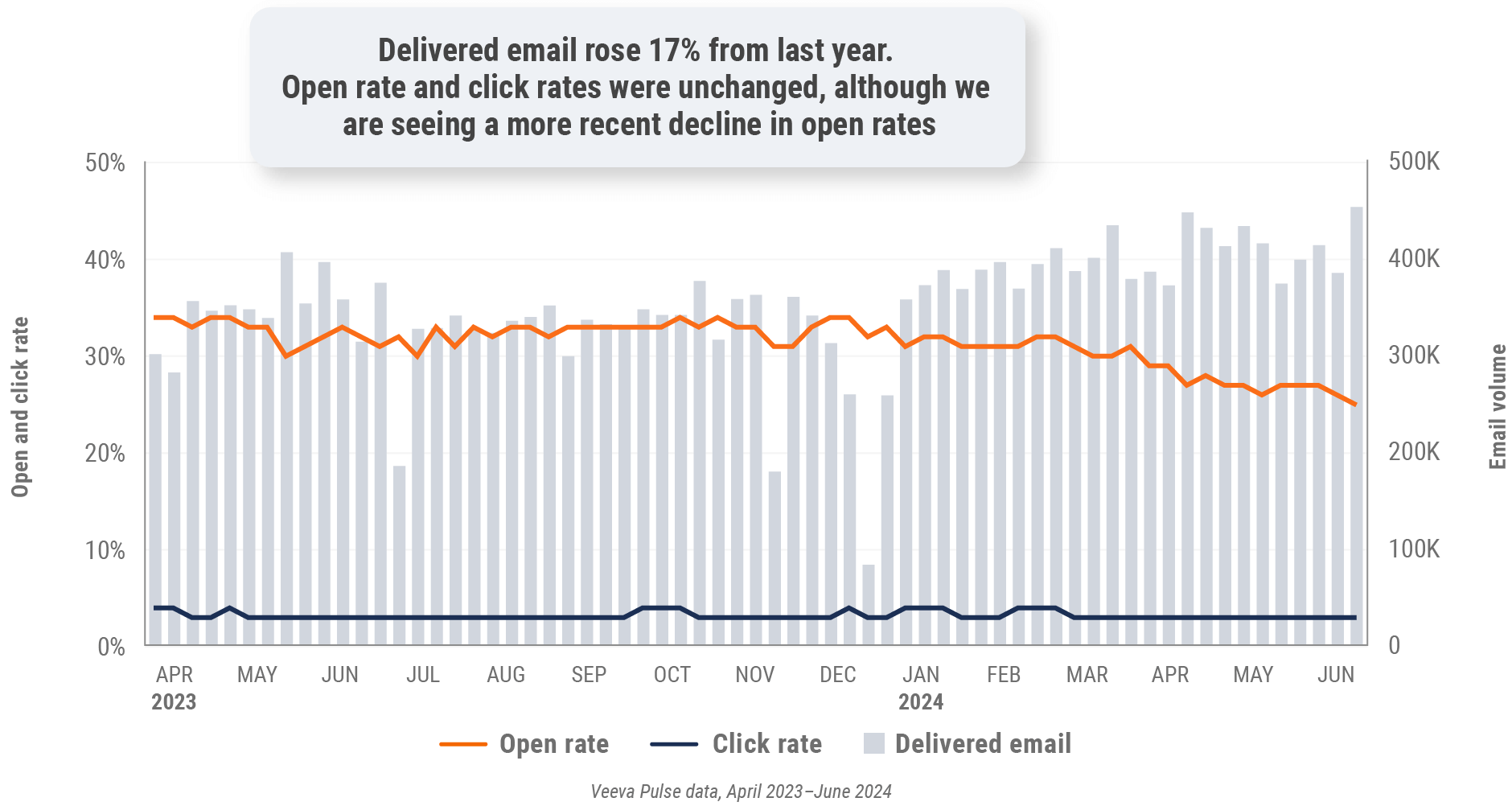

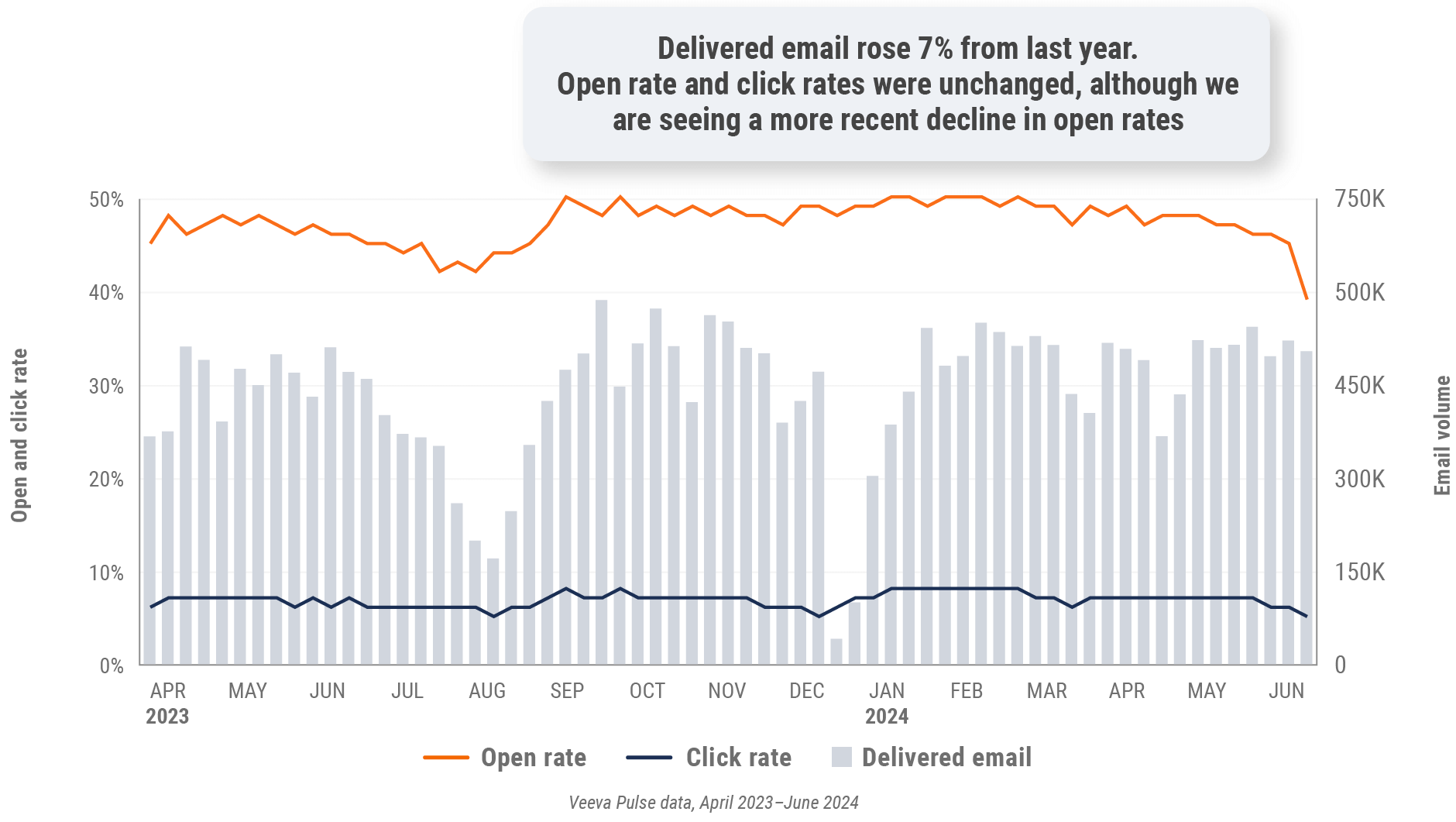

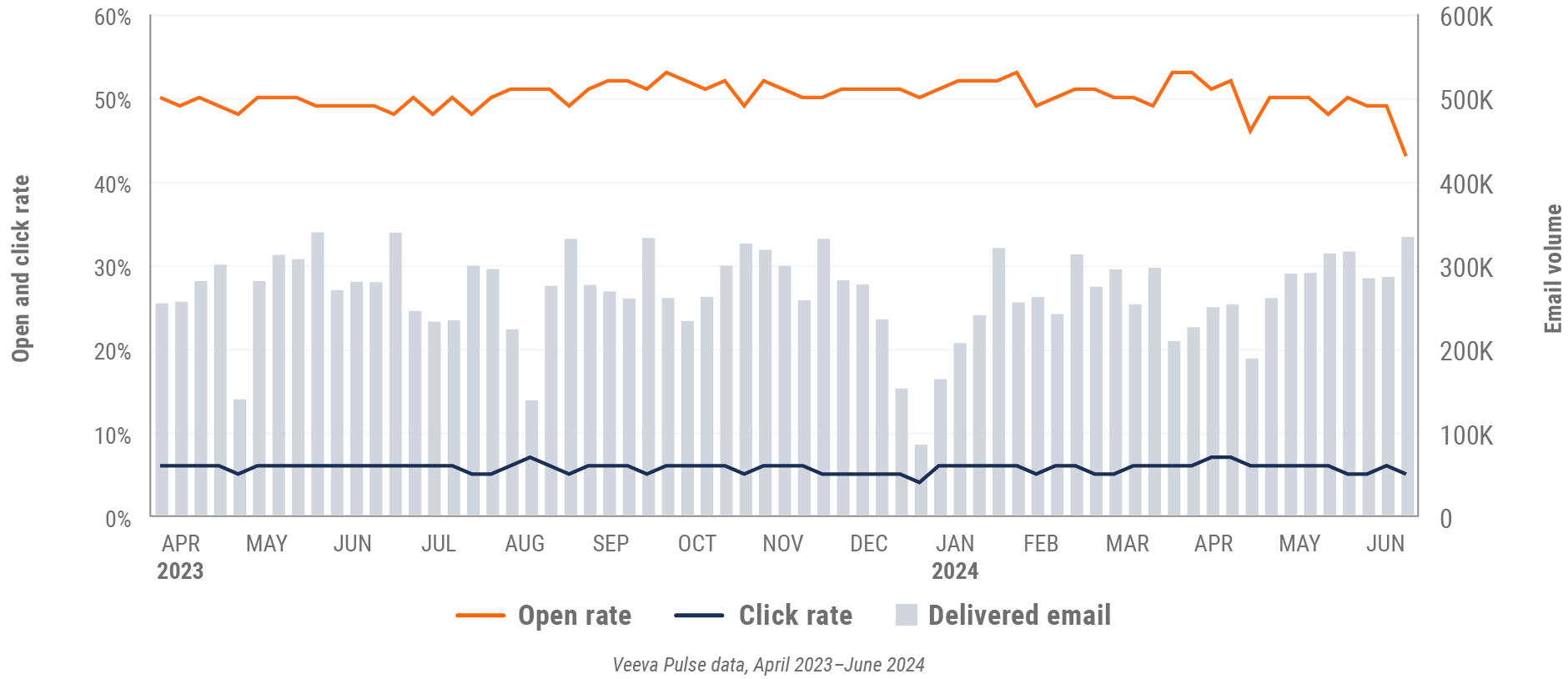

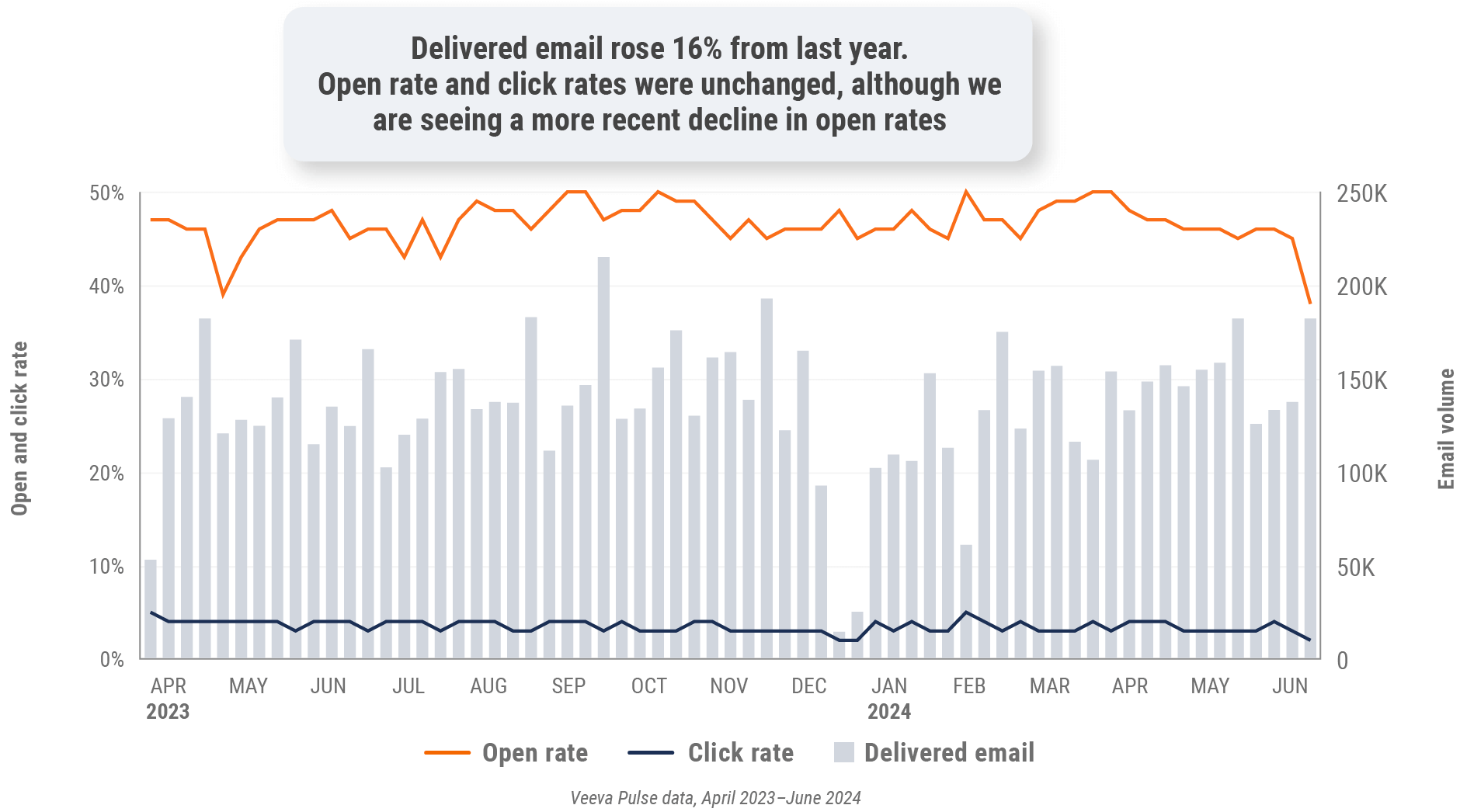

Figure 6: Approved email volume, global

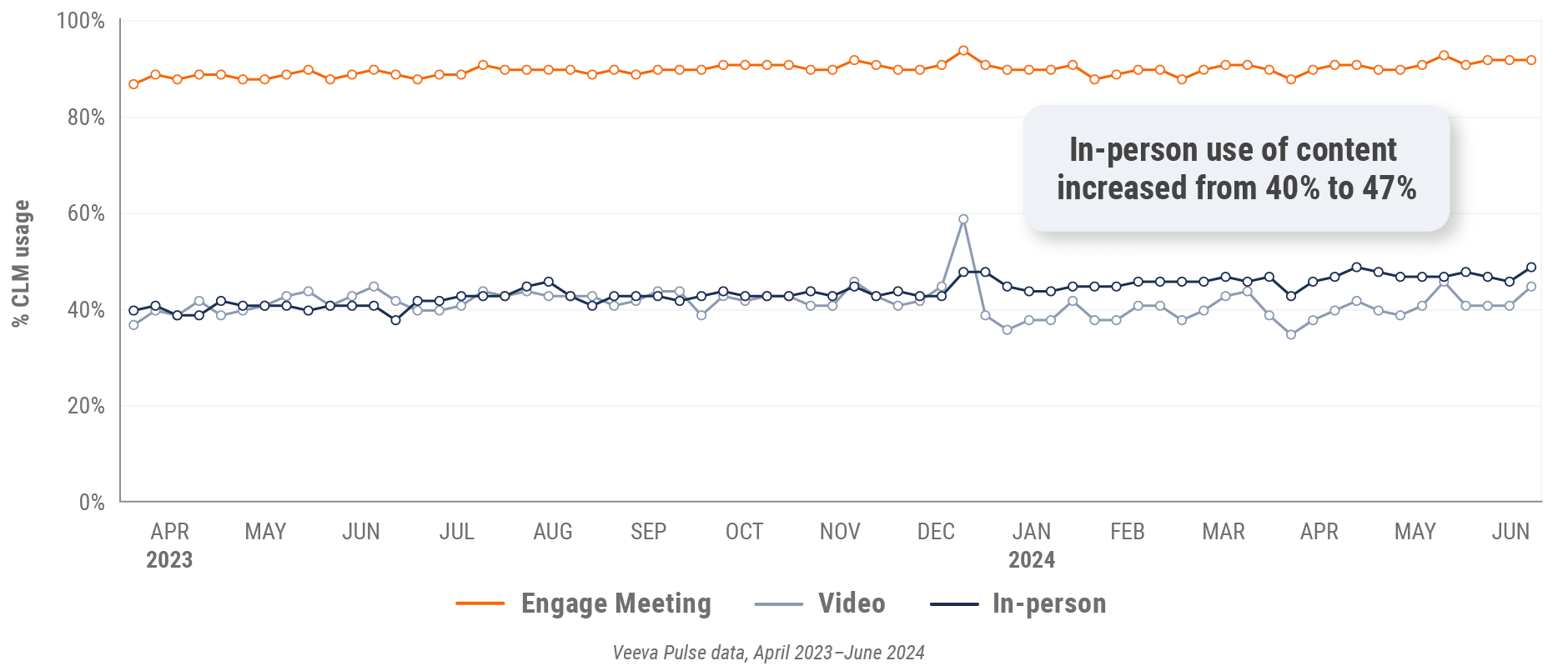

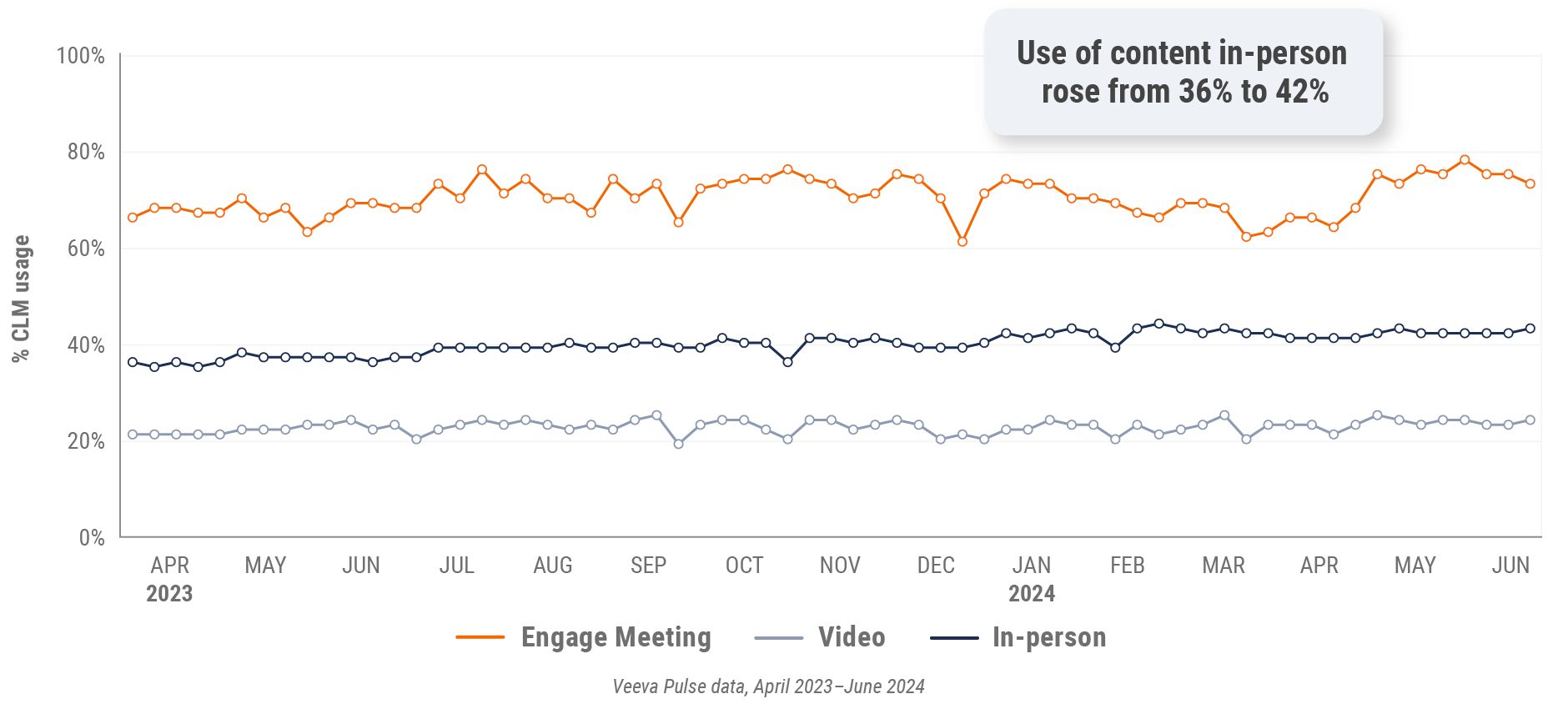

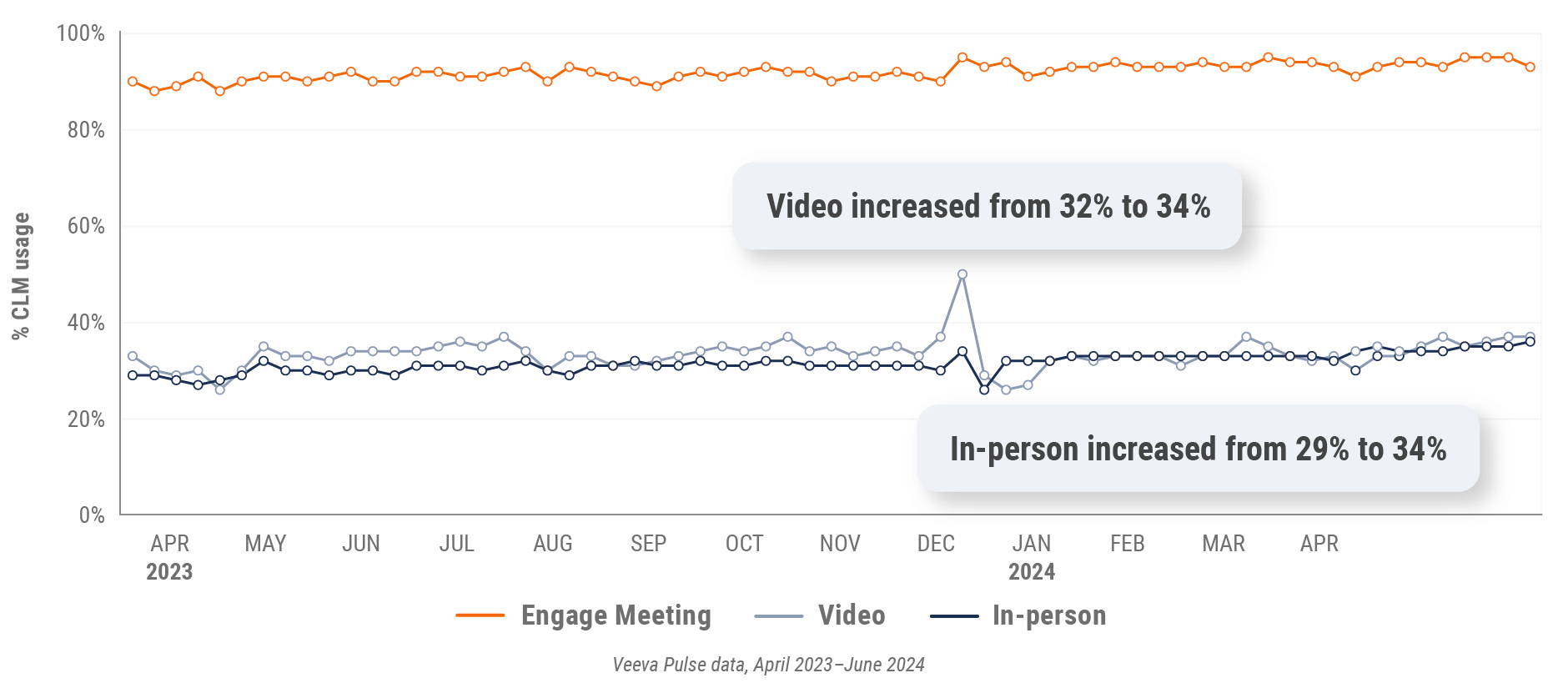

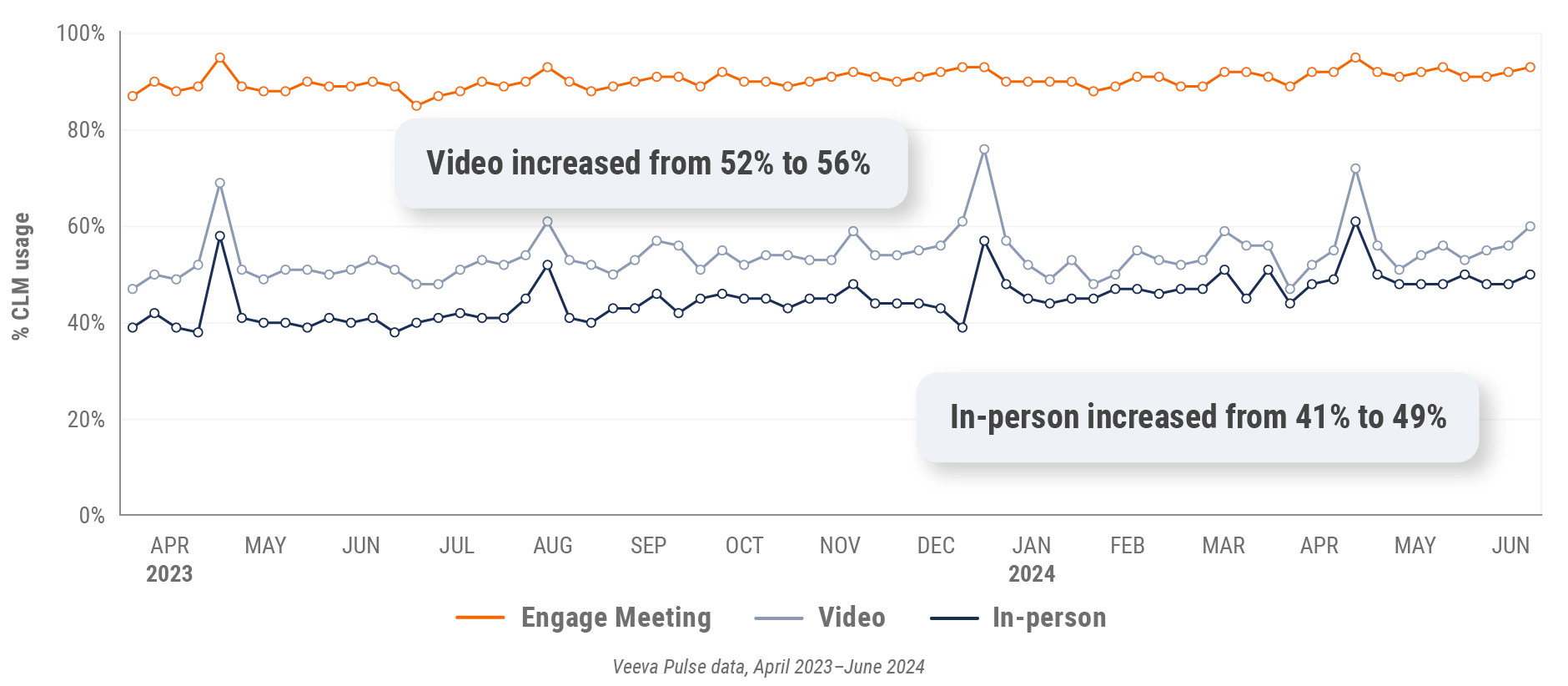

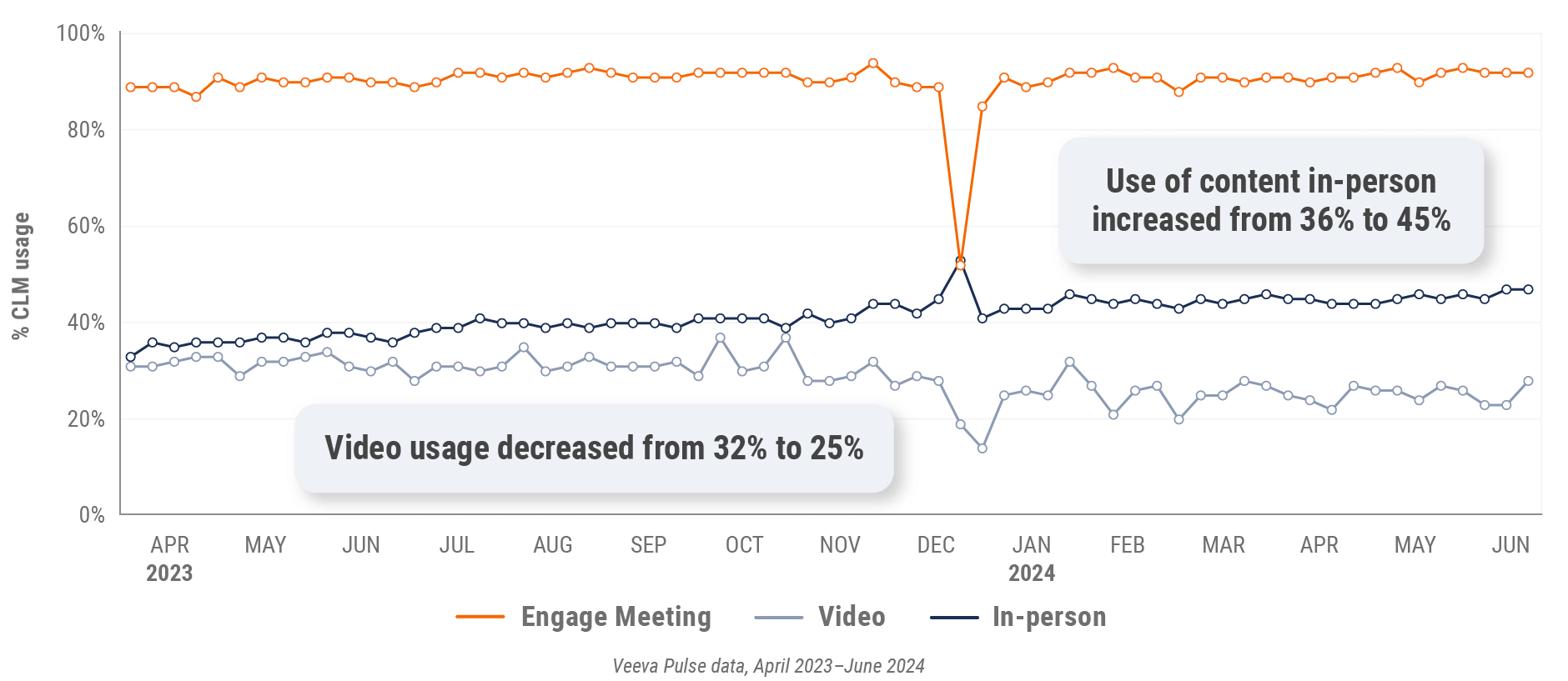

Figure 7: Content usage by channel, global

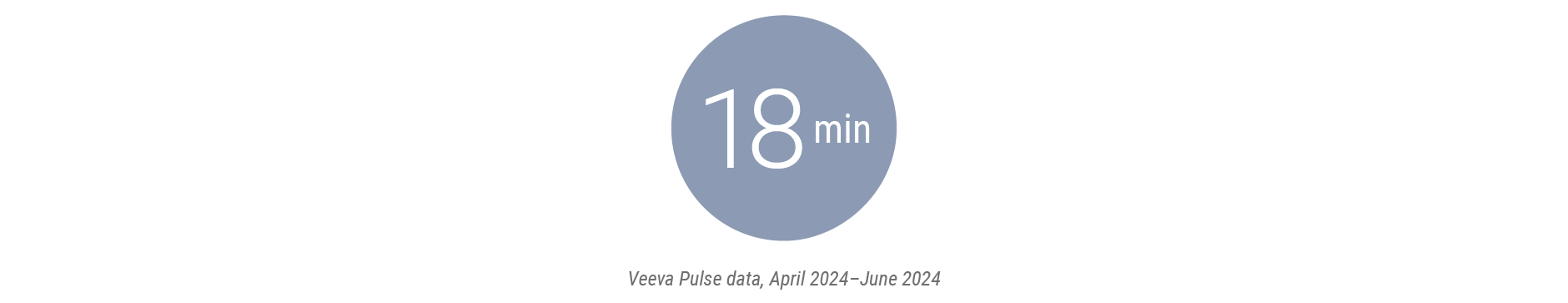

Figure 8: Veeva CRM Engage meeting duration, global

*This quarter’s global trends report omits data from China.

U.S. market trends

Figure 9: Channel mix evolution, U.S.

Figure 10: Channel mix, U.S.

U.S. field team activity

Weekly activity per user by engagement channel

Figure 11: Activity, U.S.

Figure 12: Activity by user type, U.S.

Figure 13: Activity by company size, U.S.

U.S. engagement quality

Consolidation of key quality metrics

Figure 14: Approved email volume, U.S.

Figure 15: Content usage by channel, U.S.

Figure 16: Veeva CRM Engage meeting duration, U.S.

Europe market trends

Figure 17: Channel mix evolution, Europe

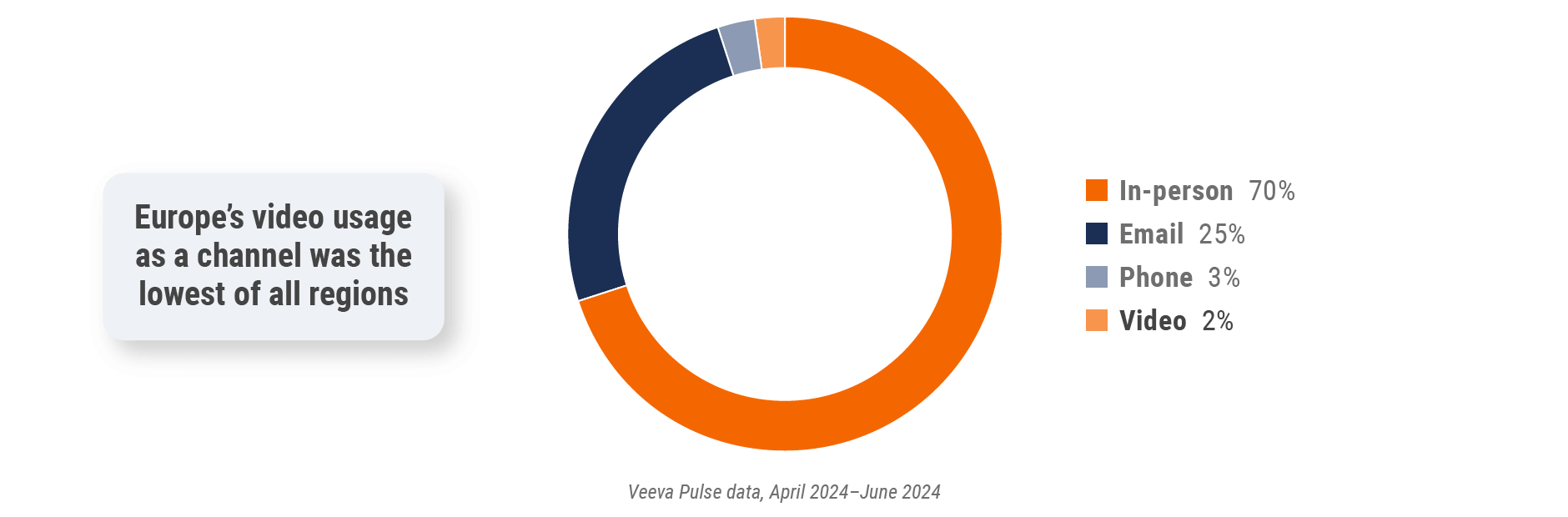

Figure 18: Channel mix, Europe

Europe field team activity

Weekly activity per user by engagement channel

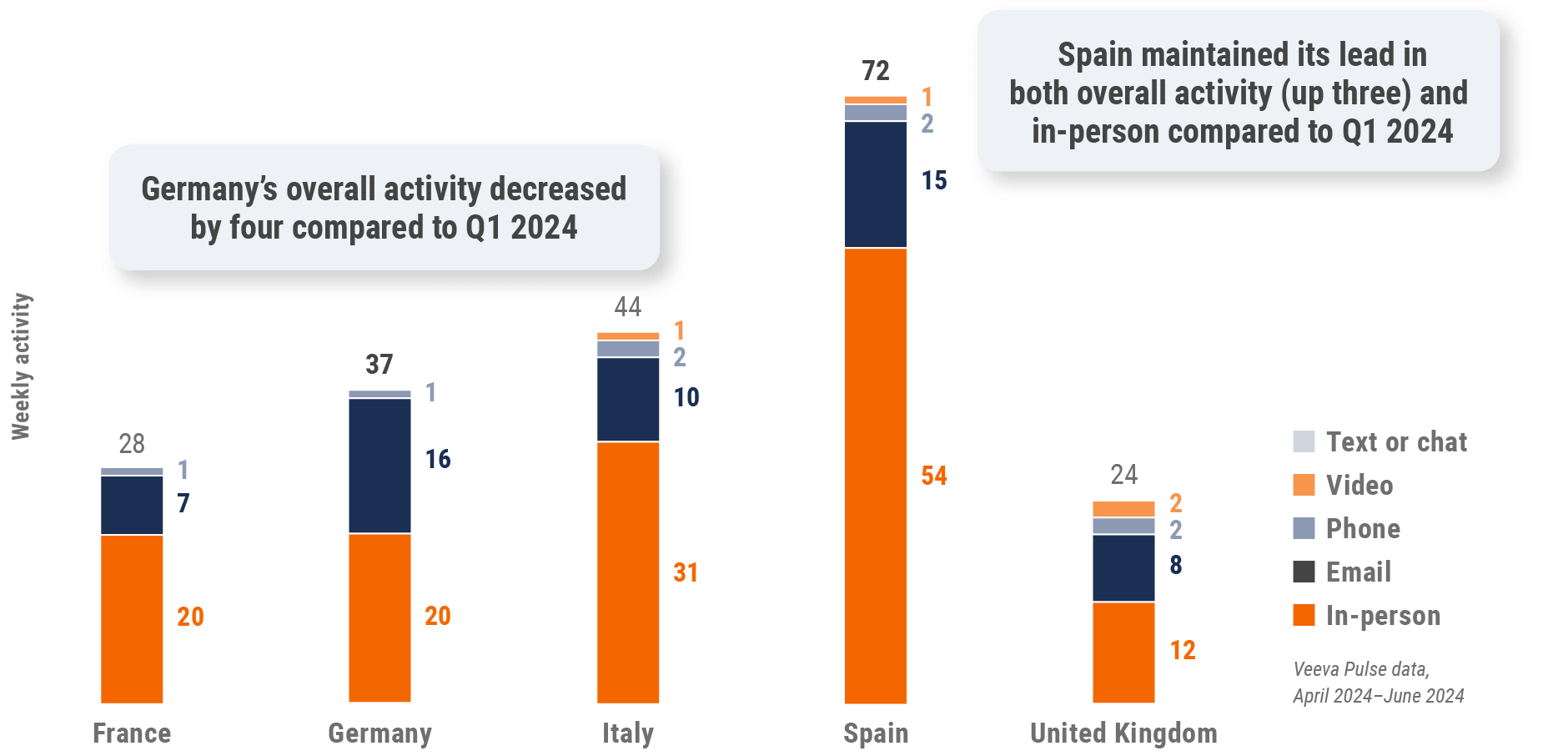

Figure 19: Activity by country, EU5

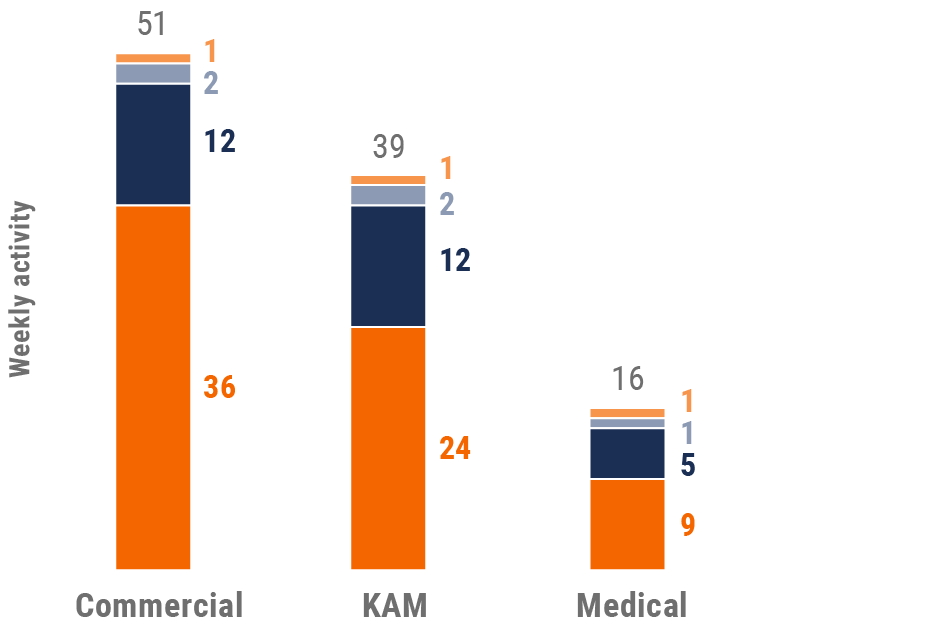

Figure 20: Activity by user type, Europe

Figure 21: Activity by company size, Europe

Europe engagement quality

Consolidation of key quality metrics

Figure 22: Approved email volume, Europe

Figure 23: Content usage by channel, Europe

Figure 24: Veeva CRM Engage meeting duration, Europe

Asia market trends

Figure 25: Channel mix evolution, Asia

Figure 26: Channel mix, Asia

Asia field team activity

Weekly activity per user by engagement channel

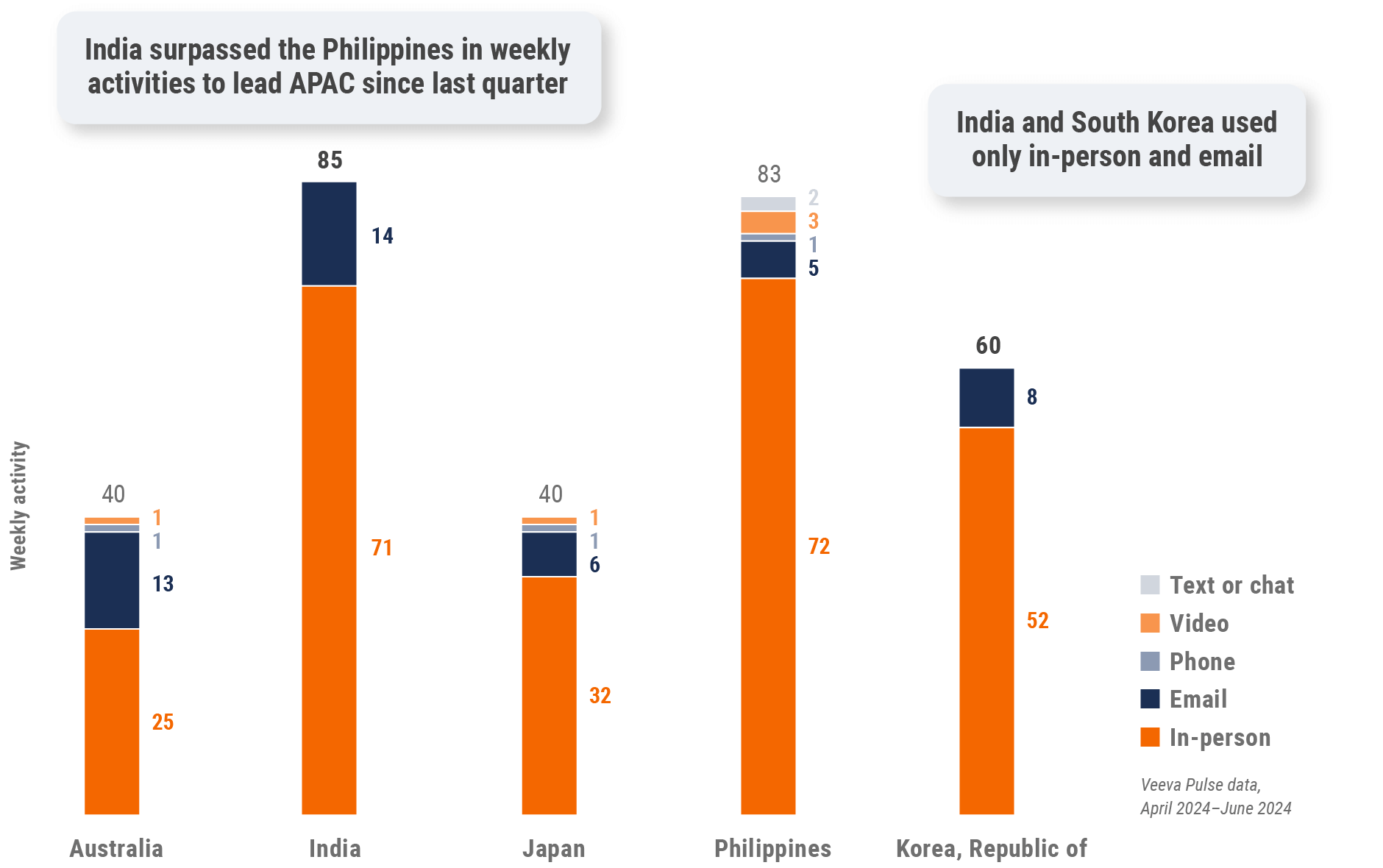

Figure 27: Activity by country, Asia

Figure 28: Activity by user type, Asia

Figure 29: Activity by company size, Asia

Asia engagement quality

Consolidation of key quality metrics

Figure 30: Approved email volume, Asia

Figure 31: Content usage by channel, Asia

Figure 32: Veeva CRM Engage meeting duration, Asia

Latin America market trends*

Figure 33: Channel mix evolution, Latin America

Figure 34: Channel mix, Latin America

Latin America field team activity

Weekly activity per user by engagement channel

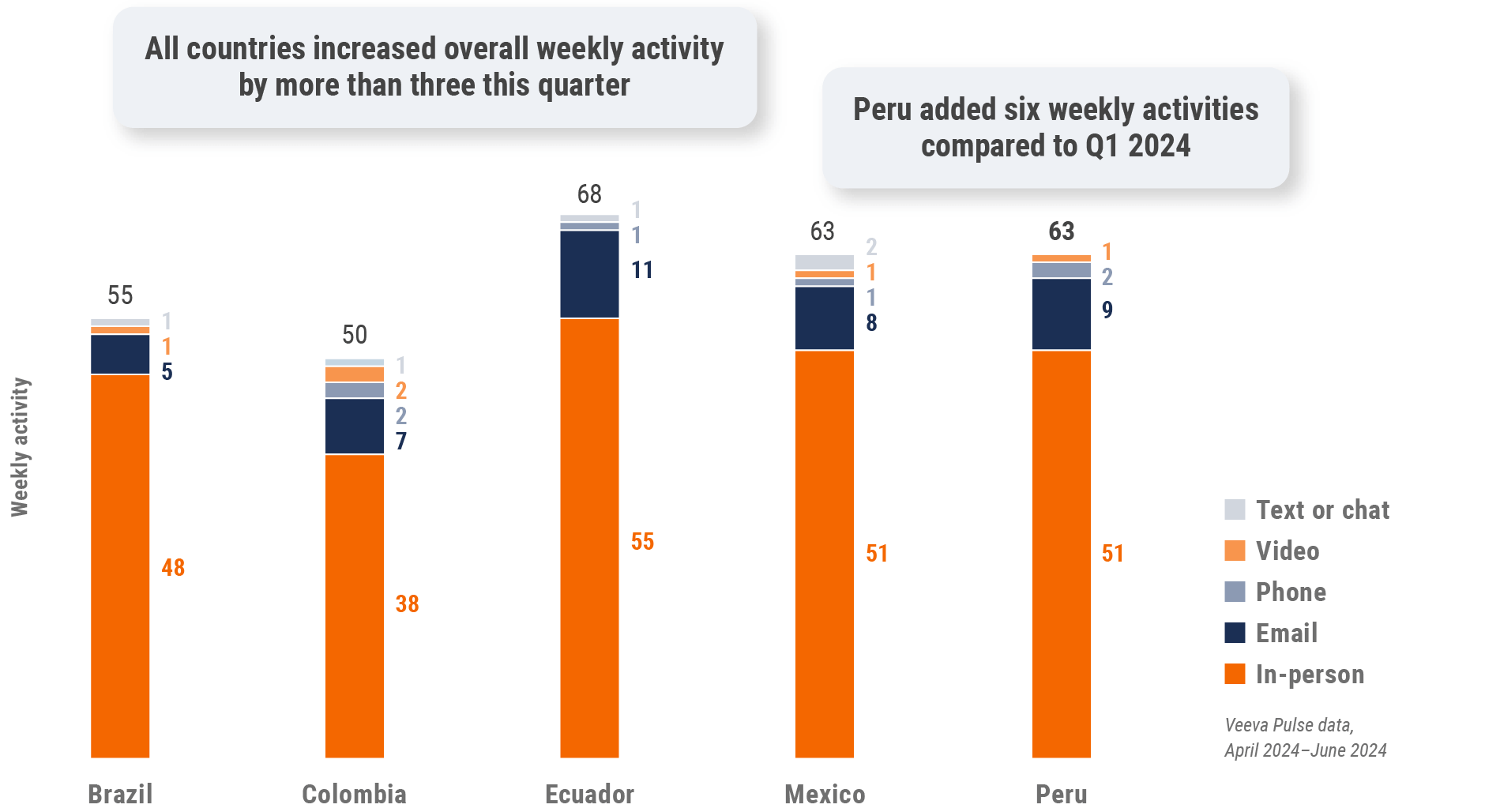

Figure 35: Activity by country, Latin America

Figure 36: Activity by user type, Latin America

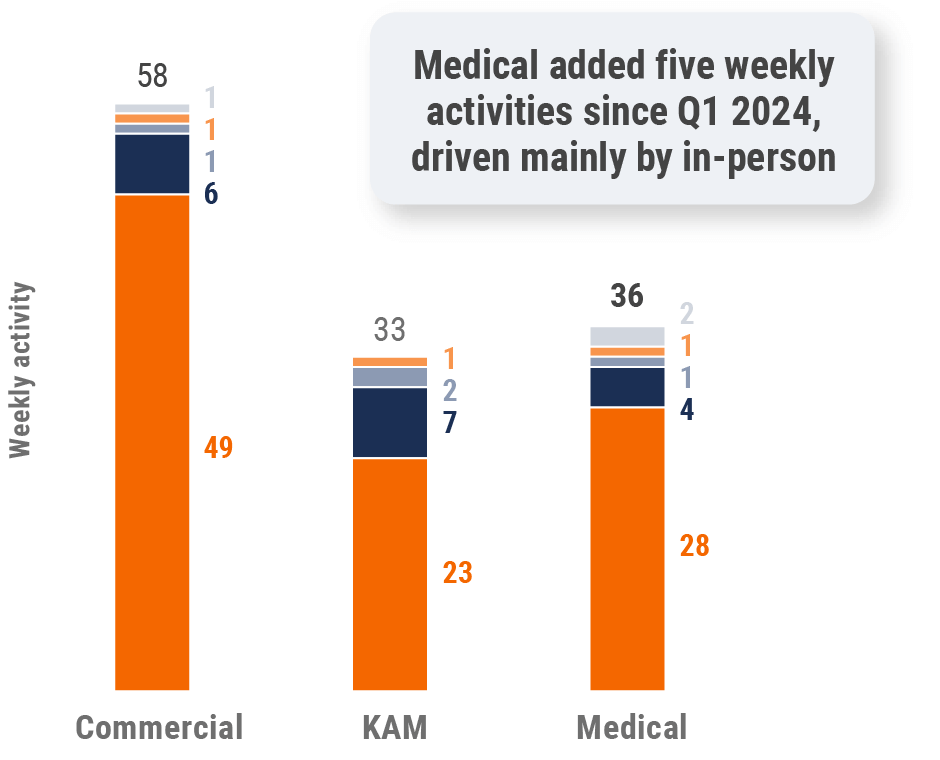

Figure 37: Activity by company size, Latin America

Latin America engagement quality

Consolidation of key quality metrics

Figure 38: Approved email volume, Latin America

Figure 39: Content usage by channel, Latin America

Figure 40: Veeva CRM Engage meeting duration, Latin America

*Multiple new LATAM pharma companies were added, increasing weekly activity volume.

Appendix: Data dictionary

Metric definitions

- Channel mix evolution over time: Weekly Veeva CRM activity volume broken down by the channel of engagement (in-person, phone, video, email, chat, or text)

- Channel mix: Total Veeva CRM activity volume broken down by engagement channel percentage

- Weekly activities per user: The average weekly number of Veeva CRM activities submitted per number of users active in Veeva CRM

- Approved email volume: Volume of approved emails sent via Veeva CRM

- Email open rate: Percentage of approved emails opened at least once out of all approved emails sent via Veeva CRM

- Email click rate: Percentage of approved emails clicked at least once out of all approved emails sent via Veeva CRM

- In-person % CLM usage: Percentage of in-person engagements that leveraged content in Veeva CRM

- Video % CLM usage: Percentage of video engagements that leveraged content in Veeva CRM

- Veeva CRM Engage meeting % CLM usage: Percentage of Veeva CRM Engage meetings that leveraged content in Veeva CRM

- Veeva CRM Engage meeting duration: The average duration of Veeva CRM Engage meetings in minutes

Engagement channel definitions

- In-person: Submitted calls with a CRM Standard Metrics call channel value of ‘in-person’

- Phone: Submitted calls with a CRM Standard Metrics call channel value of ‘phone’

- Video: Veeva CRM Engage calls and video calls via other platforms that are then recorded as calls in Veeva CRM with a Standard Metrics call channel value of ‘video’

- Email: Approved emails and emails sent via other platforms that are then recorded as calls in Veeva CRM with a Standard Metrics call channel value of ‘email’

- Chat or text: Submitted calls with a CRM Standard Metrics call channel value of ‘chat or text’

User type definitions

- Sales: Users that have been classified with the ‘sales’ value in the CRM Standard Metrics user type field

- Key account manager: Users that have been classified with the ‘key account manager’ value in the CRM Standard Metrics user type field

- Medical: Users that have been classified with the ‘medical’ value in the CRM Standard Metrics user type field

- Top global biopharma: Top 17 global biopharma companies by revenue

- Rest of industry: All other biopharmas

Region definitions

- Global: All markets globally. This quarter’s global trends report omits data from China.

- Europe: Albania, Andorra, Armenia, Aruba, Austria, Azerbaijan, Belarus, Belgium, Bermuda, Bosnia and Herzegovina,

Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, French Polynesia, Georgia, Germany,

Greece, Greenland, Guadeloupe, Guernsey, Hungary, Ireland, Italy, Jersey, Latvia, Lithuania, Luxembourg, Macedonia,

Malta, Martinique, Republic of Moldova, Monaco, Montenegro, Netherlands, New Caledonia, Norway, Poland, Portugal,

Romania, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Ukraine, United Kingdom - Asia: Australia, Bangladesh, Bhutan, Brunei Darussalam, Cambodia, Cocos (Keeling) Islands, Indonesia, Japan,

Kazakhstan, Republic of Korea, Kyrgyzstan, Malaysia, Mongolia, Myanmar, Nauru, Nepal, New Zealand, Philippines,

Samoa, Singapore, Solomon Islands, Sri Lanka, Taiwan, Tajikistan, Thailand, Turkmenistan, Uzbekistan, Vietnam - Latin America: Antigua and Barbuda, Argentina, Bahamas, Barbados, Belize, Bolivia, Brazil, Chile, Colombia, Costa Rica, Cuba, Dominican Republic, Ecuador, El Salvador, Guatemala, Guyana, Haiti, Honduras, Jamaica, Mexico, Nicaragua, Panama, Paraguay, Peru, Trinidad and Tobago, Uruguay, Venezuela. Multiple new LATAM pharma companies were added, increasing weekly activity volume.

Methodology

The Veeva Pulse Field Trends Report is a quarterly industry benchmark for global and regional healthcare professional

(HCP) engagement across the life sciences industry. The report is based on approximately 600 million annual global

field activities captured in Veeva CRM and Veeva CRM Engage, along with more than three million curated profiles from

Veeva Link Key People and global reference data of HCPs and HCOs in 65+ countries from Veeva OpenData. In addition, this study utilized anonymous patient longitudinal claims data from Veeva Compass

Patient covering dispensed prescriptions, procedures, and diagnoses from more than 300 million patients.

The Veeva Pulse Field Trends Report delivers insights that inform the industry and help field teams align their strategy to

key market trends for improved commercial success. The global Veeva Business Consulting team also helps customers

inform their strategies using industry benchmarking with Veeva Pulse data.

*All trending chart insights (except Figure 7) are calculated using an average weekly percent change during the specified time period.